What Is Form 49a And 49aa

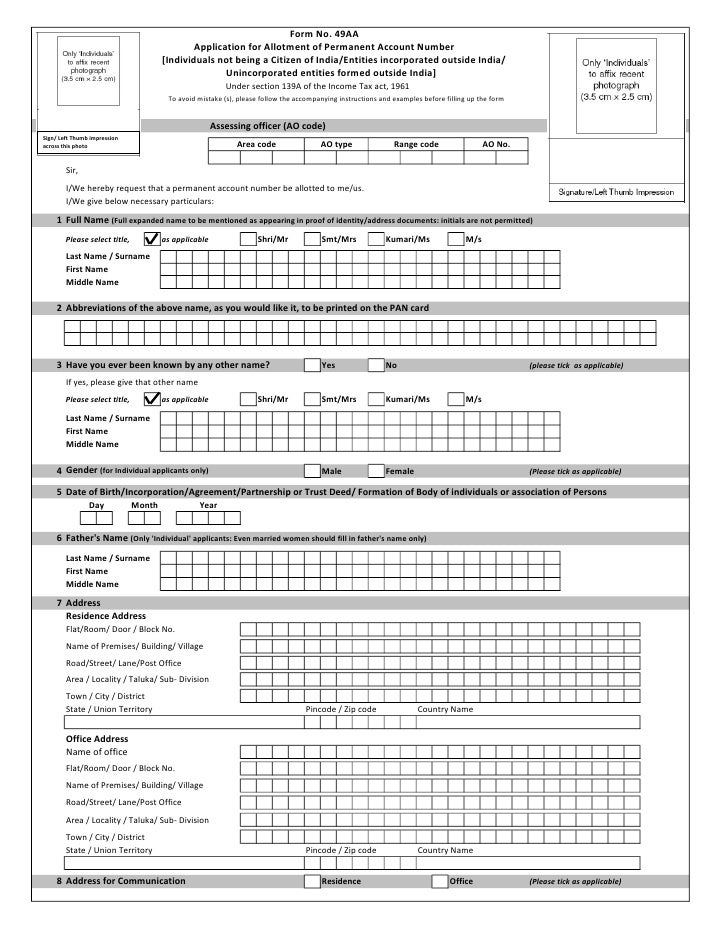

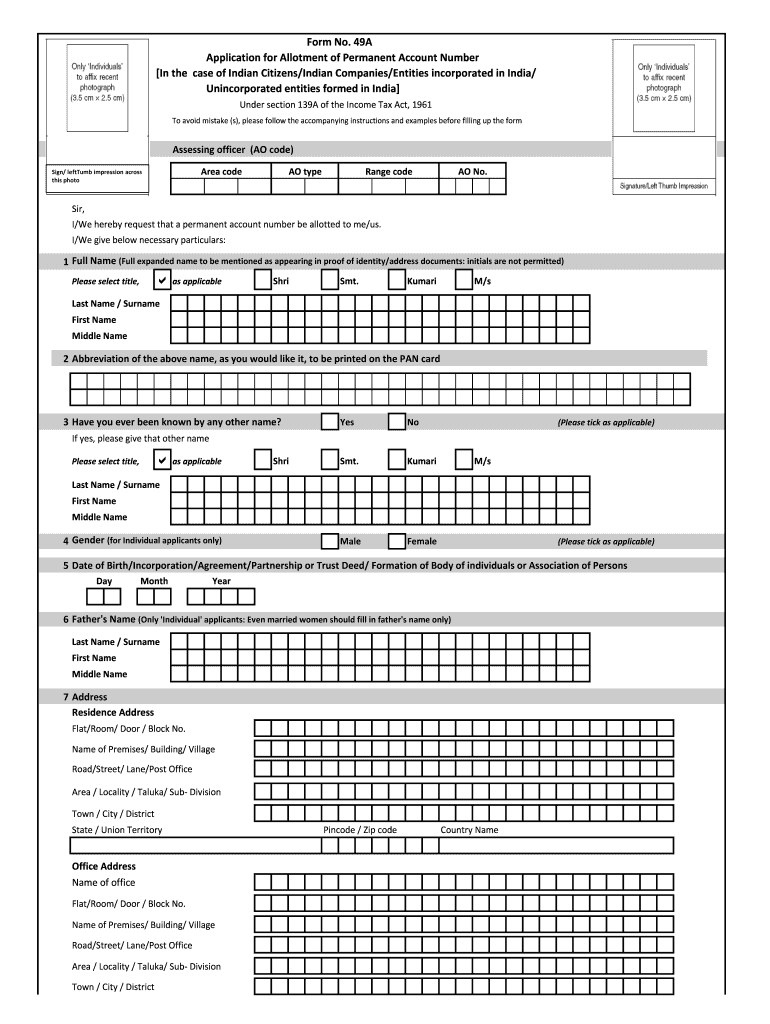

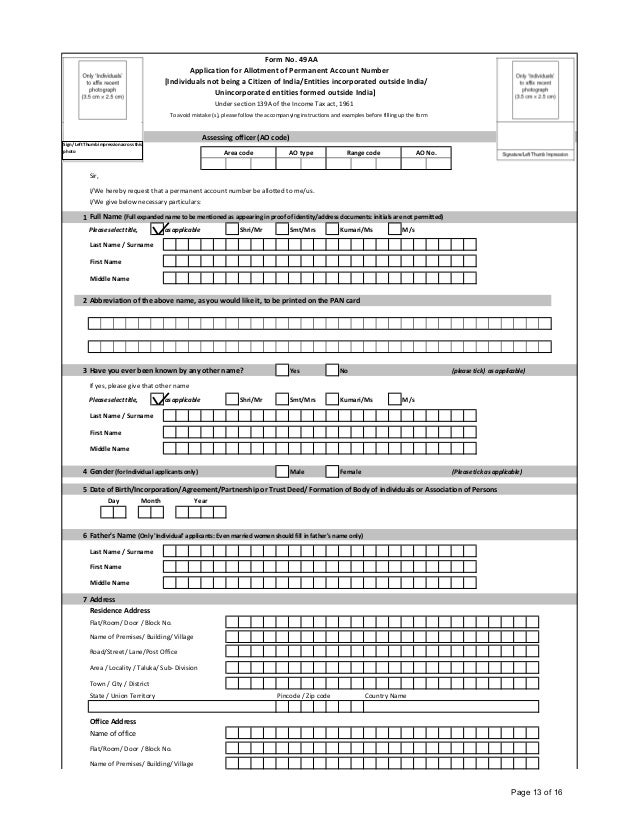

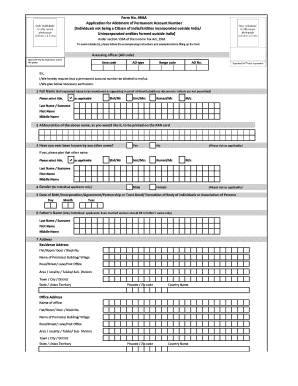

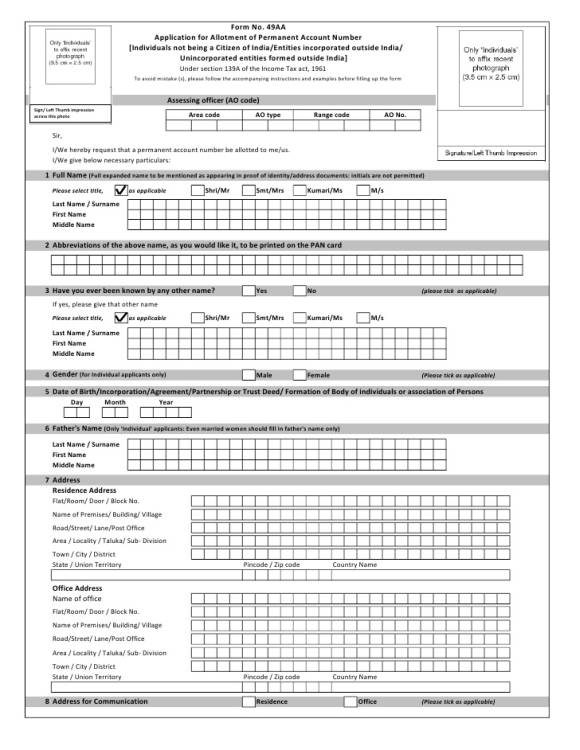

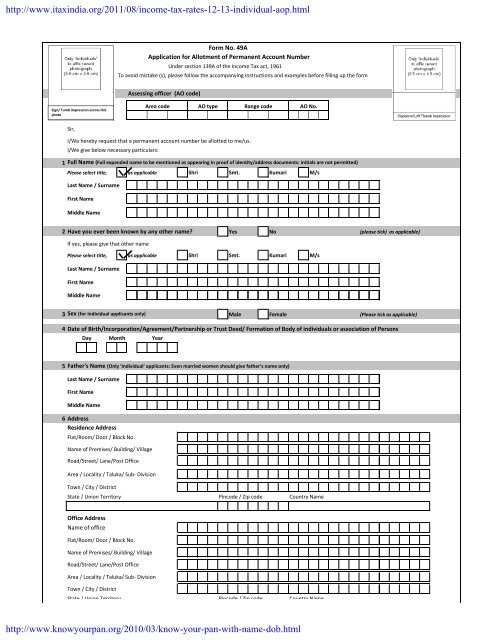

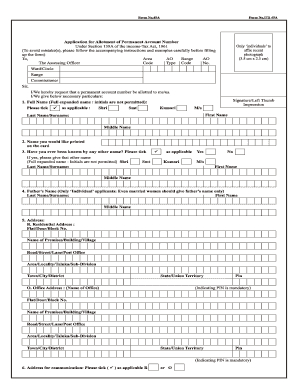

You can use form 49aa 49a which are legal forms required when applying for a permanent account number.

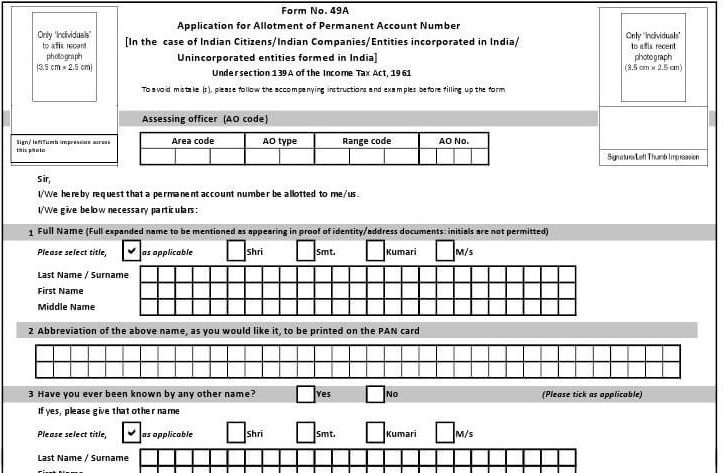

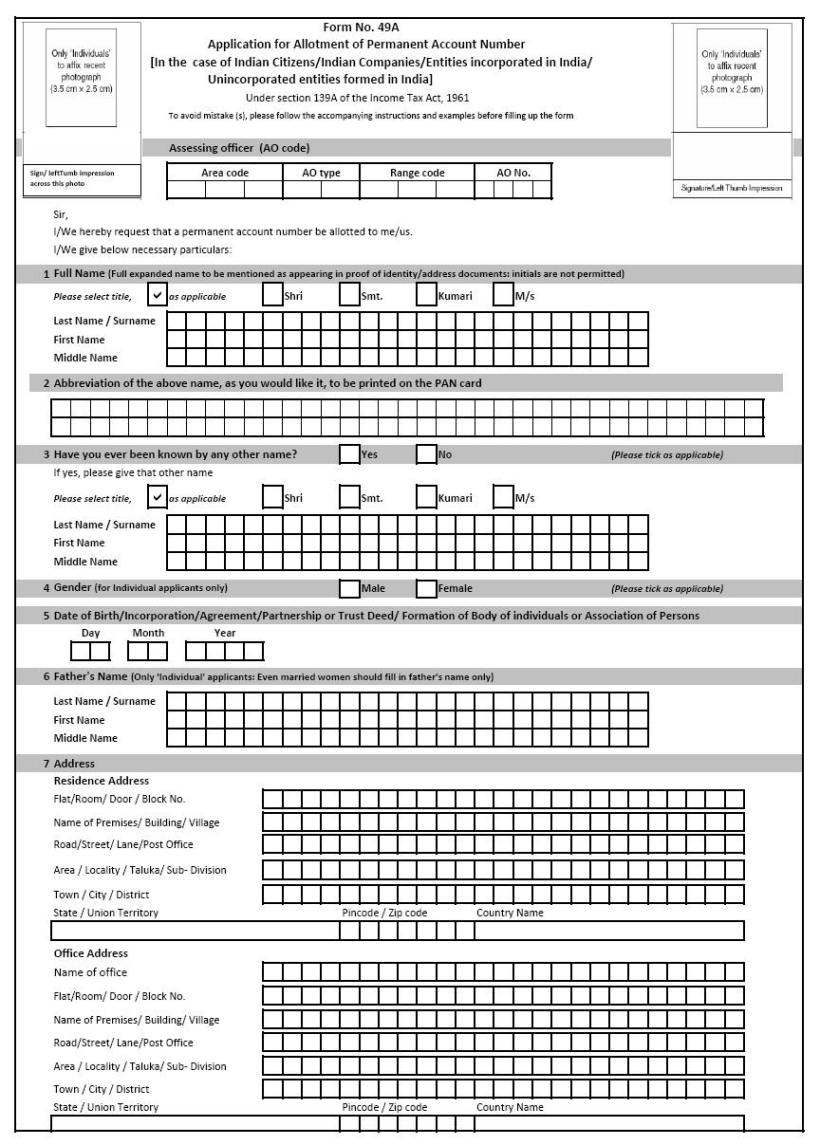

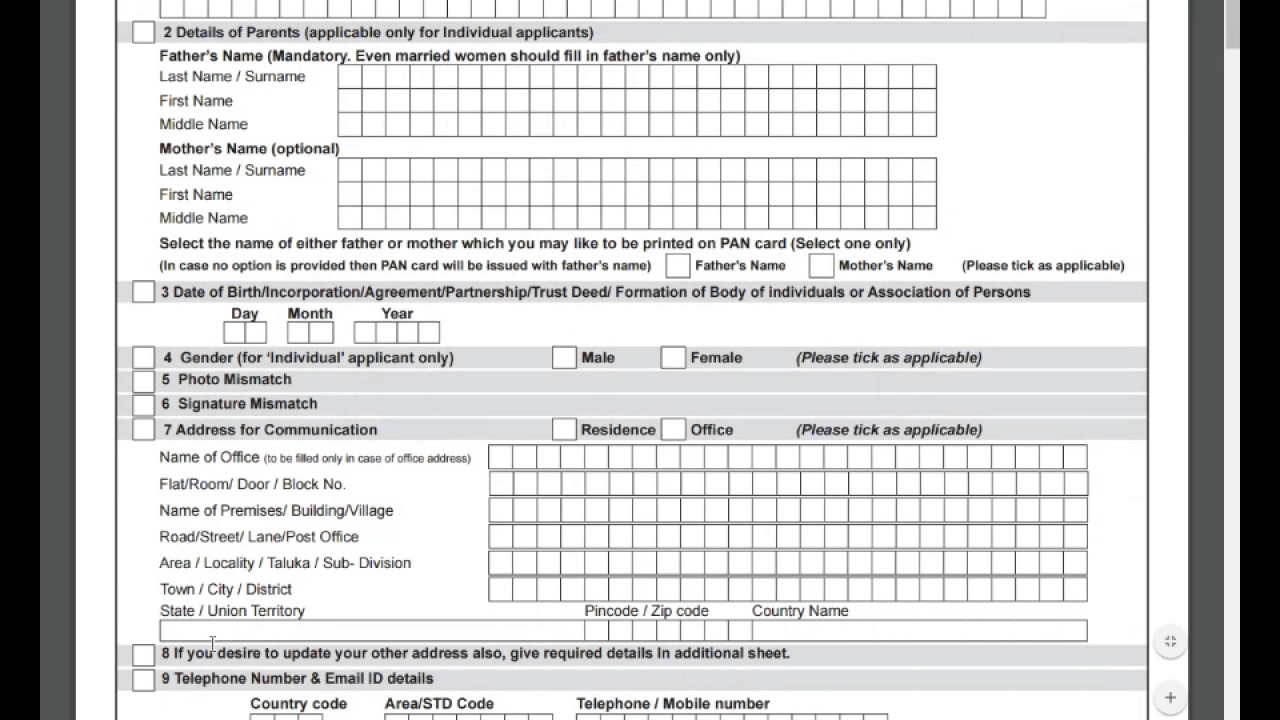

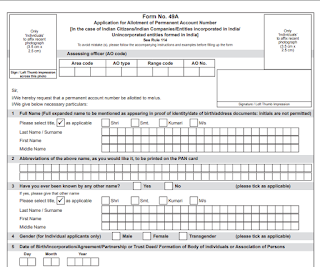

What is form 49a and 49aa. Form 49aa for submitting application for allotment of pan. Find below appended notification from income tax department and download new format of form 49a page 7 form 49aa page 13 along with annexure a b c form form 49a and annesxure 1 for form 49aa. Individuals filling form 49aa only need to provide their basic details as required for kyc process of the applicant. B each box.

You will have to submit documents pertaining to proof of identity poi and proof of address poa. For your information form 49a is pan application form to be filed by indian resident. An applicant will fill form 49aa online and submit the form. What are the documents that i need to submit when applying for a pan using a form 49aa.

It is important even for non taxpaying residents to citizens to obtain a pan card as it would be required for various transactions. Non citizens of india should only use this form i e. New pan application form 49a and 49aa wef 01 11 11. If the applicant cannot sign then the left hand thumb impression of the applicant should be affixed at the place meant for signatures and should be attested by a magistrate or a notary public or a gazetted officer under official seal and stamp.

The form 49a is available for download on the government nsdl site or on the utiitsl website. The form needs to be filled in english. It s best to fill the pan form online and download and print. However a qualified foreign investor qfi has to apply for pan in form 49aa through a depository participant only.

The details to be provided in the form are stated below. Pan card form form 49a form 49aa pan card is one of the most essential documents to be possessed by residents and citizens of india as it is a tool for identifying taxpayers. Form 49aa is identical to form 49a. Hence the applicant has to provide his her personal and basic details in order to complete the kyc process.

There is no such difference between the form 49aa and form 49a. The applicant has to provide signature at three places in form 49a 49aa. 49aa application for allotment of permanent account number individuals not being a citizen of india entities incorporated outside india unincorporated entities formed outside india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form. Form 49aa is for resident outside india.

New pan application form 49a and 49aa wef 01 11 11.