What Is Authorised Share Capital Of Limited Company

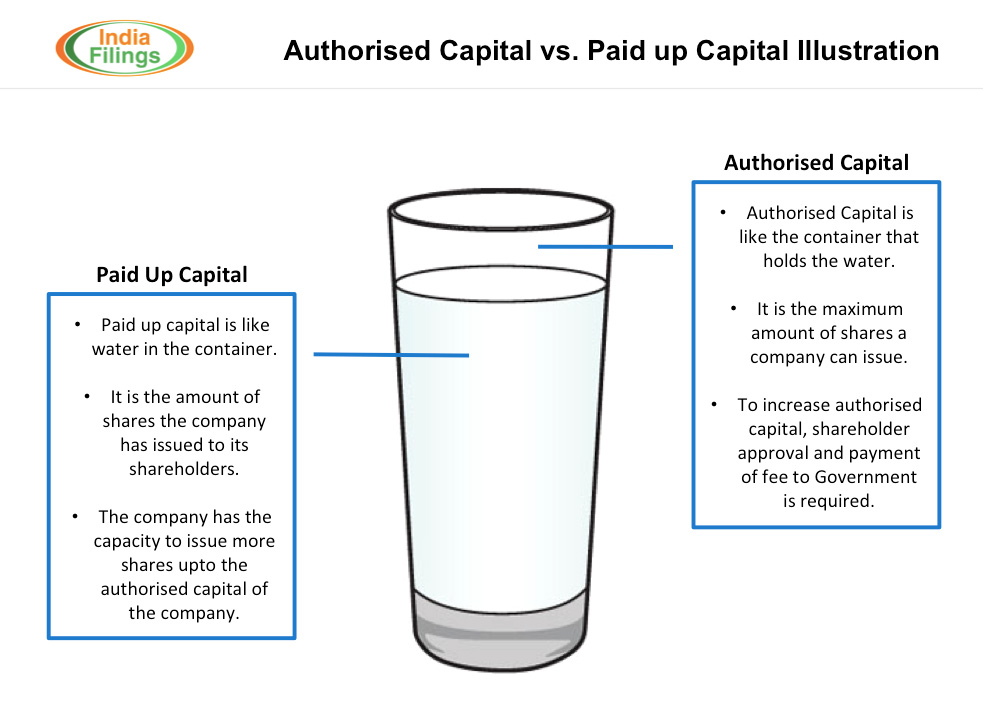

The authorized capital is different from the paid up capital and the authorized capital will always be more than the paid up capital.

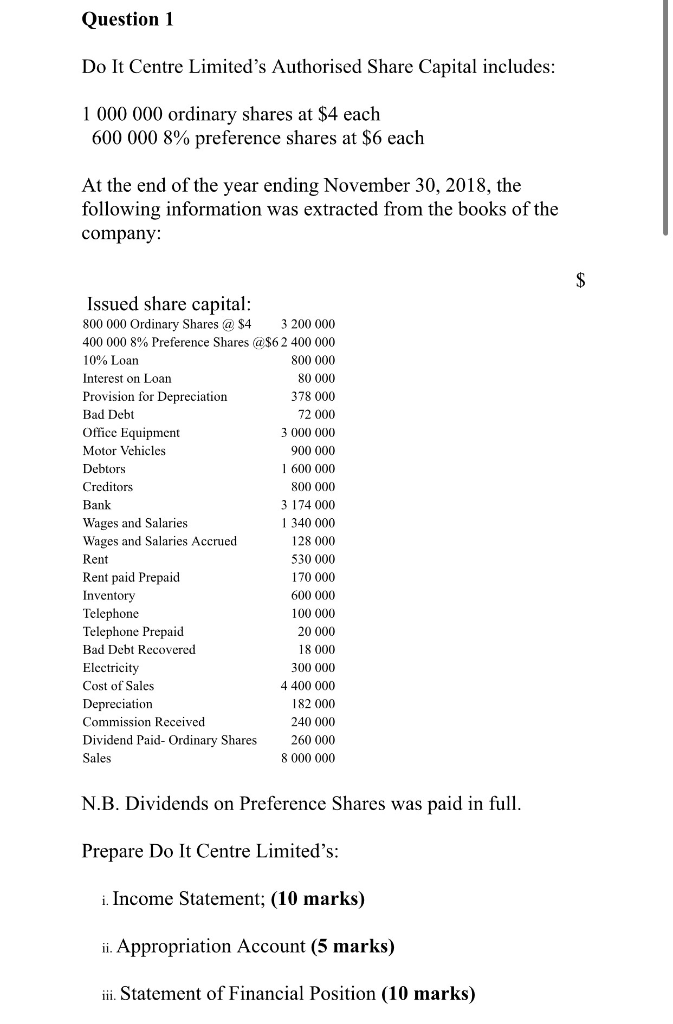

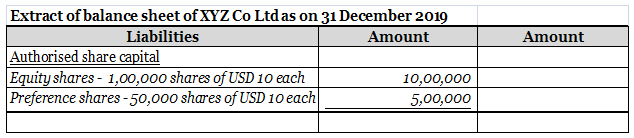

What is authorised share capital of limited company. Authorised capital had to be stated as a sum of money divided into shares of a fixed amount e g. It is the maximum value of shares that a company can allot to its shareholders. Authorized capital of a company during incorporation is the maximum amount of share capital that a company can issue to shareholders and this is the money founders or co founders during the registration of the startup must authorize. A private limited company after its incorporation decides the amount of authorized capital for the company and the value of shares that they will receive in return for their investment in the company.

In most cases a portion of the company s authorised share capital will remain unissued. The authorised share capital often referred to as the nominal share capital is the maximum amount of share capital a company can issue to its shareholders according to the company s constitution. Authorized share capital is. A private limited company may need to expand its authorised capital before issuing new value shares and expanding paid up capital.

Charges for authorized capital. Authorized share capital is the maximum value of share capital face value that can be raised by a company by issue of shares as specified by the its charter documents. The higher the capital the higher was the duty payable. Authorised share capital related content a former requirement of the now repealed section 2 5 a of the companies act 1985 under which before 1 october 2009 a company with share capital was required to state in its memorandum the amount of capital that the company was authorised by its shareholders to issue together with the number and nominal value of the shares into which it was divided.

The company s share capital is 50 000 divided into 50 000 shares of 1 each the authorised capital provisions in the 1985 act were a hangover from the days when stamp duty was paid on registration of a company s memorandum. The company s charter documents include its memorandum and articles of association. The authorised share capital of the company is rs. 10 rupees ten each sample shareholders resolution to be passed in the general meeting.

When you look at the minimum amount of authorized capital for private limited companies and opcs is inr 1 lakh.