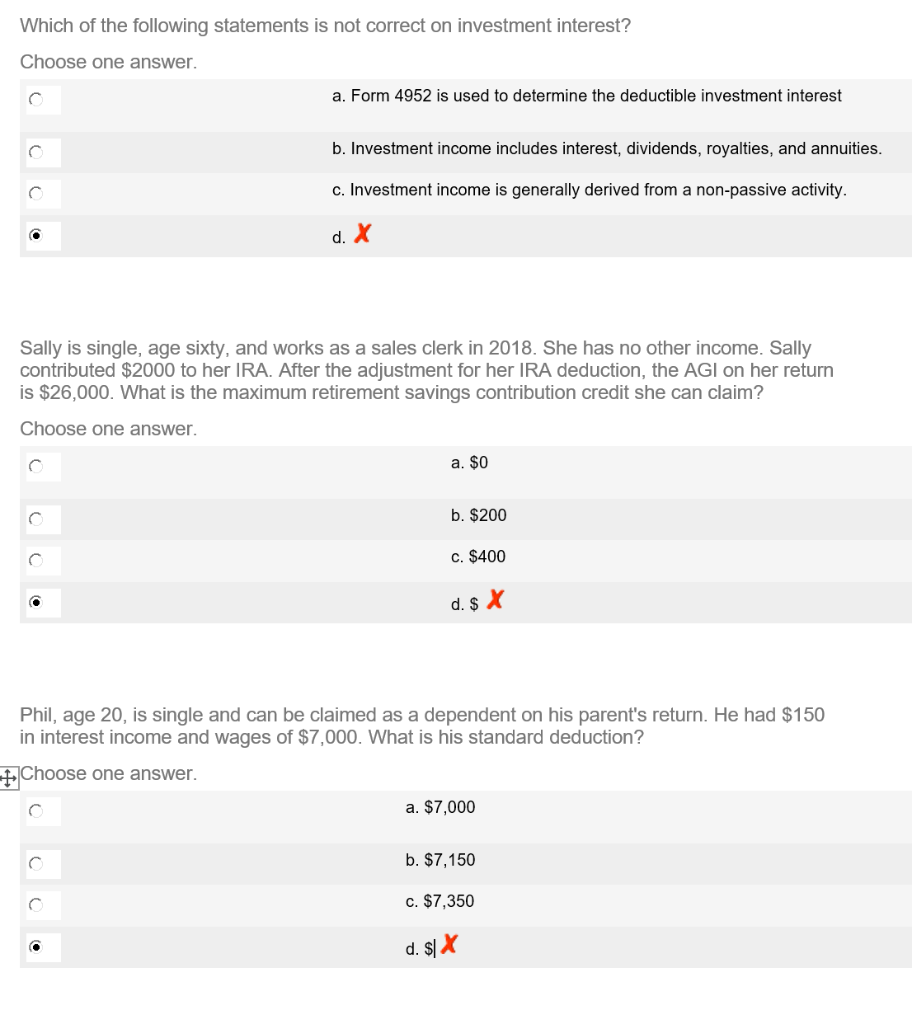

What Is Form 4952 Used For

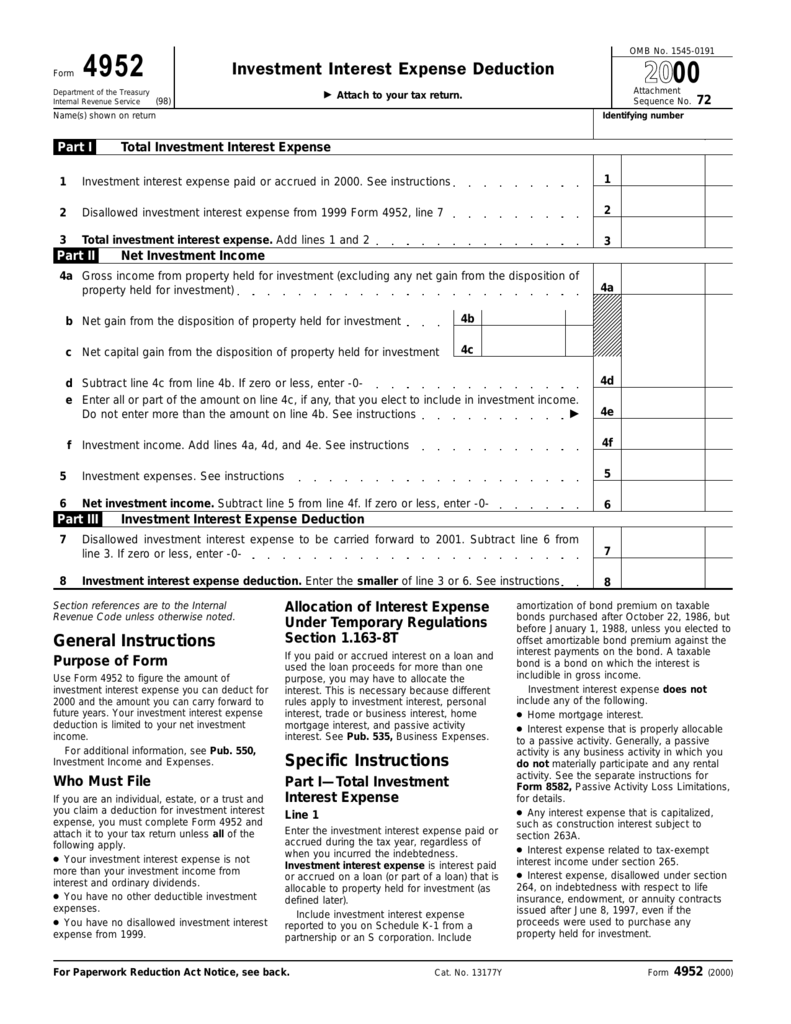

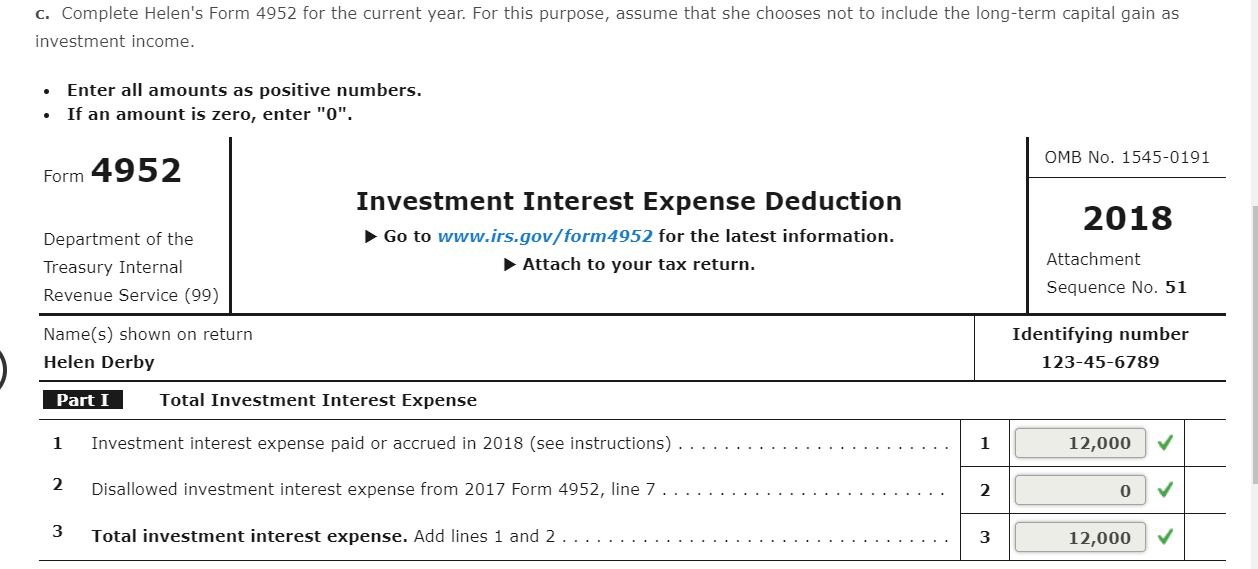

Purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years.

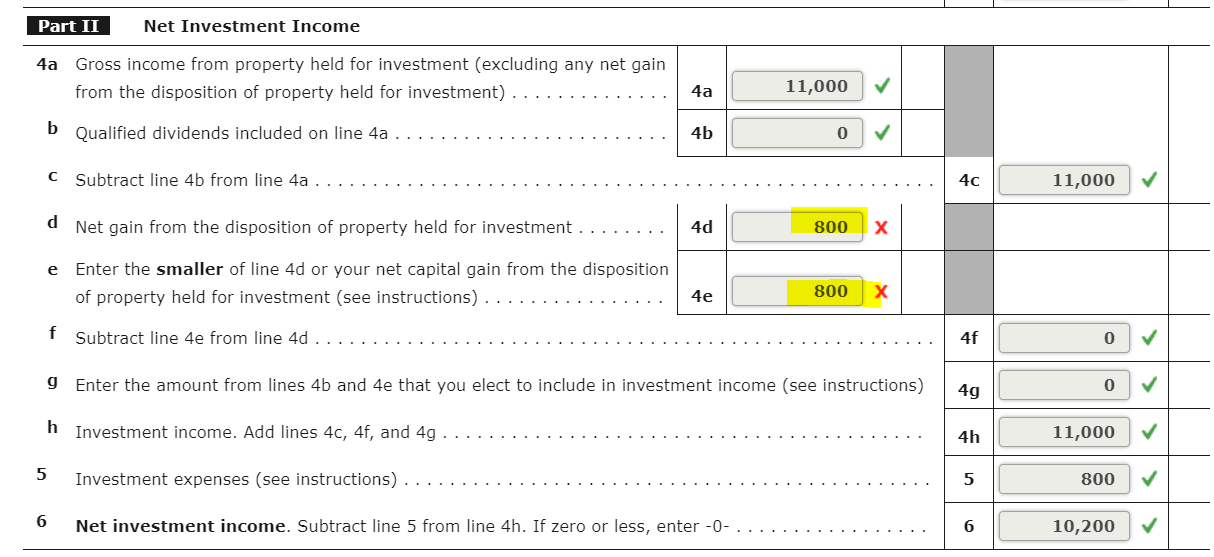

What is form 4952 used for. Investment interest expense deduction is a tax form distributed by the internal revenue service irs used to determine the amount of investment interest expense that can be deducted. In line 116 investment income you have 10 000. Form 4952 can help you lower your tax bill. Where does the number come from on line 4a form 4952 line 4a gross income from property held for investment includes income unless derived in the ordinary course of a trade or business from interest ordinary dividends except alaska permanent fund dividends annuities and royalties.

The amount flowing to form 4952 line 4a is 10 000 and the statement behind form 4952 will show a negative adjustment for the difference 1 000. Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Ultimately whichever of your form 4952s shows the higher tax is the one you will have to file with the irs. I have accumulated a large investment interest expense carryover and am at a very low tax rate after deductions i have a short term capital loss carryover and long term gains but with max 3000 capital loss on line 13.

Investment interest expense deduction is an internal revenue service irs tax form determining the investment interest expense that may be either deducted or carried forward to a. If you choose to include any amount of your net capital gain in investment income you must reduce your net capital gain by the same amount. Let me know if you have any question. Specifically i cannot figure out how to calculate the amounts being requested in.

You make this choice by completing form 4952 line 4g according to its instructions. I am not a cpa and a trying to find an example a completed form 4952 to try to figure it out. Information about form 4952 investment interest expense deduction including recent updates related forms and instructions on how to file. However if we enter an amount in the investment income line this will change.

The instructions for form 4952 investment interest expense deduction and form 6251 alternative minimum tax individuals instruct taxpayers on how to compute the correct taxes under both systems. Your investment interest expense deduction is limited to your net investment income. Brad hagen flickr if you re an investor with interest expenses rejoice you may be able to deduct them from your income using irs form 4952.

/GettyImages-155152969-576ab8495f9b58587519065a.jpg)

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)