Money Market Fund Malaysia Interest Rate

By contrast money market fund interest rates typically are determined by the performance of the investments that the fund owns.

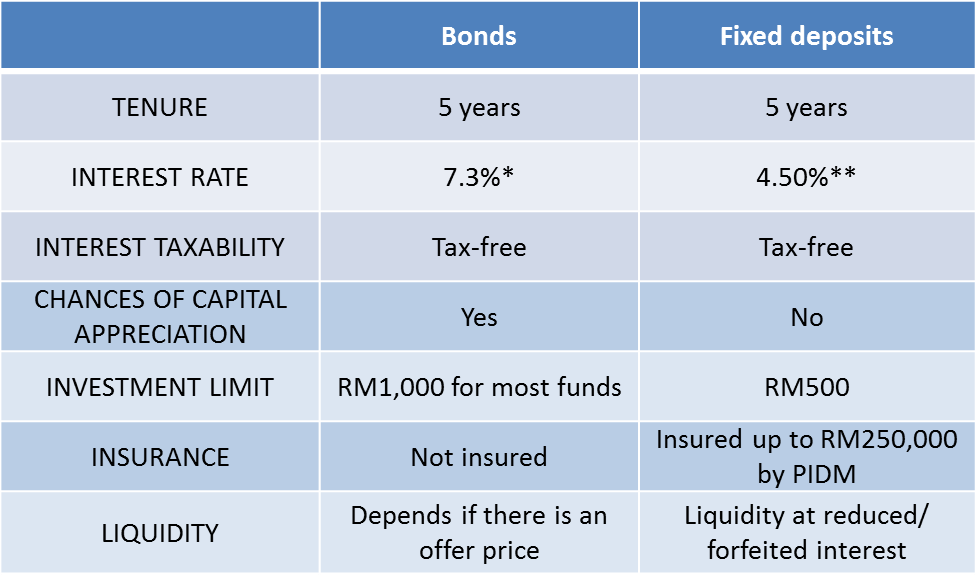

Money market fund malaysia interest rate. A money market mutual fund often referred to as a money market fund is a low risk investment with the goal of earning interest while still providing liquidity. Only short term money market deposit stmmd is protected by pidm up to rm250 000 for each depositor. A fixed deposit bears interest at an agreed rate based on a specific maturity date. Deposits and money market instruments i e.

The minimum placement is rm5 000 for 1 to 2 months and rm1 000 for 3 months or longer. The above stmmd rates apply for amounts of rm250 000 and above. Sipc protects money market mutual funds which are securities according to the sipc. The minimum placement is rm5 000 for 1 to 2 months and rm1 000 for 3 months or longer.

Our investors can get their money back on the same day if they sell their units before 10 30am. All rates quoted above are for indication purposes only and are subject to change without notice. A fixed deposit earns higher interest than a savings account and offers protection from interest rate fluctuations. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services.

A fixed deposit bears interest at an agreed rate based on a specific maturity date. Jalan dato onn 50480 kuala lumpur malaysia. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. For amounts less than rm250 000 the rate of 0 50 applies across the board.

Money market funds operate under a different set of regulations and are not protected by that insurance. 1300 88 5465 bnmtelelink 603 2698 8044 general line bnmtelelink bnm gov my. The tenor may vary from 1 to 60 months. Negotiable instruments of deposits with maturity periods of more than 365 days but no longer than 732 days.

Interest rates on money market accounts vary from bank to bank and fluctuate with the economy. Tan says a money market fund that only invests in short term bank deposits and fds such as the phillip master money market fund is more liquid and usually allows investors to sell their units and withdraw their money on the same day. Asset allocation of fund s nav deposits and or money market instruments that will mature within 365 days. As malaysia s central bank bank negara malaysia promotes monetary stability and financial stability conducive to the sustainable growth of the malaysian economy.