Standard Depreciation Rate Malaysia

Following are the depreciation rates for different classes of assets.

Standard depreciation rate malaysia. The income tax act 1962 has made it mandatory to calculate depreciation. Carrying amount for the purpose of this standard is the amount at which an asset is recognized after deducting any accumulated depreciation and accumulated impairment losses. While annual allowance is a flat rate given every year based on the original cost of the asset. The chairman malaysian accounting standards board suites 5 01 5 03 5th floor wisma maran no.

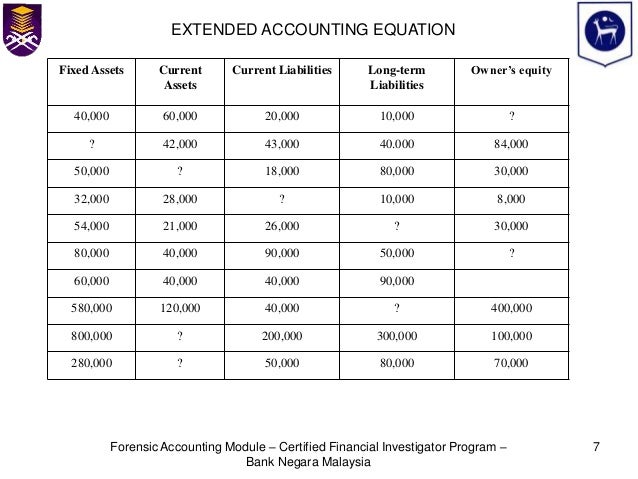

However if the expenditure is qualifying expenditure qe expenditure on plant and machinery a tax deduction is given in the form of capital allowance ca in determining the statutory income from a business source as provided under section 42 of the ita. Here s what you need to know about mfrs 16. Class of property plant and equipment means a grouping of assets of a similar nature or. Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

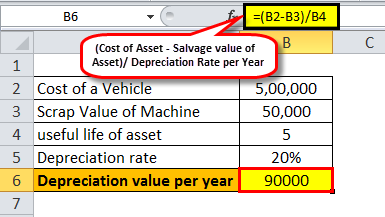

Depreciation value per year. 338 jalan tuanku abdul rahman 50100 kuala lumpur tel. The accounting standard for leases mfrs 16 is changing effective for annual periods beginning on or after 1 january 2019. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business.

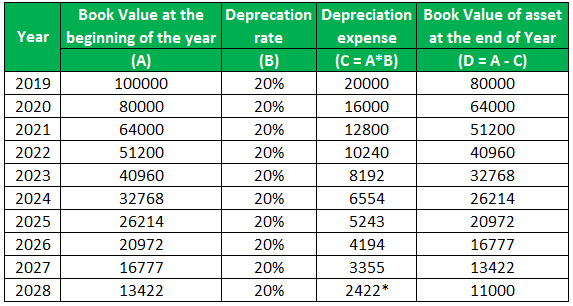

Depreciation rates as per income tax act for the financial years 2019 20 2020 21 are given below. Tanks have a useful life of 10 years and a scrap value of 11000. Therefore the depreciation charges in 20x7 20x8 and 20x9 will be 56 000 168 000 3 unless there are future changes in estimates. The following terms are used in this standard with the meanings specified.

A list of commonly used depreciation rates is given in a. A company purchases 40 units of storage tanks worth 1 00 000 per unit. Thus depreciation rate during the useful life of vehicles would be 20 per year. Lembaga piawaian perakaunan malaysia malaysian accounting standards board masb standard 15 property plant and equipment any correspondence regarding this standard should be addressed to.

Depreciation rates as per income tax act for the financial years 2019 20 2020 21 are given below. Given the reassessment of the ul and rv the depreciable amount at the end of 20x6 is 168 000 180 000 12 000 over three years. 2018 2019 malaysian tax booklet 23 an approved individual under the returning.