Malaysia Corporate Tax Rate 2019

The effective tax rates may be significantly below the normal corporate tax rate of 24.

Malaysia corporate tax rate 2019. Reduction of corporate tax rate for small medium enterprises smes on chargeable income of up to rm 500 000 to 17 from 18 effective from ya 2019 discover more. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Data is also available for.

Sme the first rm500 000 chargeable income will be tax at 17 with effective from ya 2019. A company or corporate. Our malaysia corporate income tax guide. However in the case of a resident company the malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non resident entities.

Malaysia corporate income tax rate. Insights malaysia budget 2019 taxand s take. Where the recipient is resident in a country which has a double tax treaty with malaysia the tax rates for the specific sources of income may be reduced. Only services rendered in malaysia are liable to tax.

The corporate tax rate in malaysia stands at 24 percent. Malaysia adopts a territorial system of income taxation. Income attributable to a labuan business. The standard malaysia corporate tax rate is of 24 for the financial year of 2019 2020 this rate being applied to both resident companies and to non resident companies.

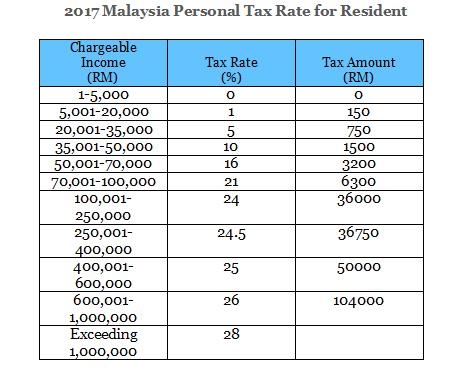

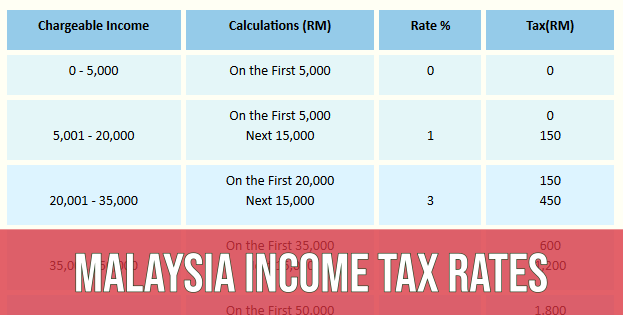

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Resident company with paid up capital of rm2 5 million and below at the beginning of the basis period sme note 1 on first rm500 000 chargeable income 17. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.