How To Submit Income Tax Return Fbr Pakistan Step By Step

A step by step guide.

How to submit income tax return fbr pakistan step by step. For individuals get registered online with fbr s e enrollment system. The first step of filing your income tax return is to register yourself with federal board of revenue fbr. Get your registration number and password through fbr s enrollment process. For income tax registration an individual can register online through iris.

The list is updated by fbr on weekly basis. Whereas the principal officer of aop and company needs to visit regional tax office rto. Tax filers who don t have an ntn can use their cnic numbers to start filing their tax returns without going through the additional step of getting an ntn first. The advantage of becoming the tax filer in pakistan is that you have to pay half of your total income tax.

Register for income tax. The list is upgraded after that income tax returns filed by taxpayers. You can check out the summary of your income chargeable tax rate refundable tax wealth summary etc. To complete an online income tax return a person must complete the return of income form and wealth statement form.

In the meantime when we re discussing filing tax returns the federal board of revenue fbr has extended the tax filing deadline for the year 2018 19 up to 31 october. Before we get to how to register online as a tax filer and submit your returns. Fbr provides you with. Step by step guide step 1.

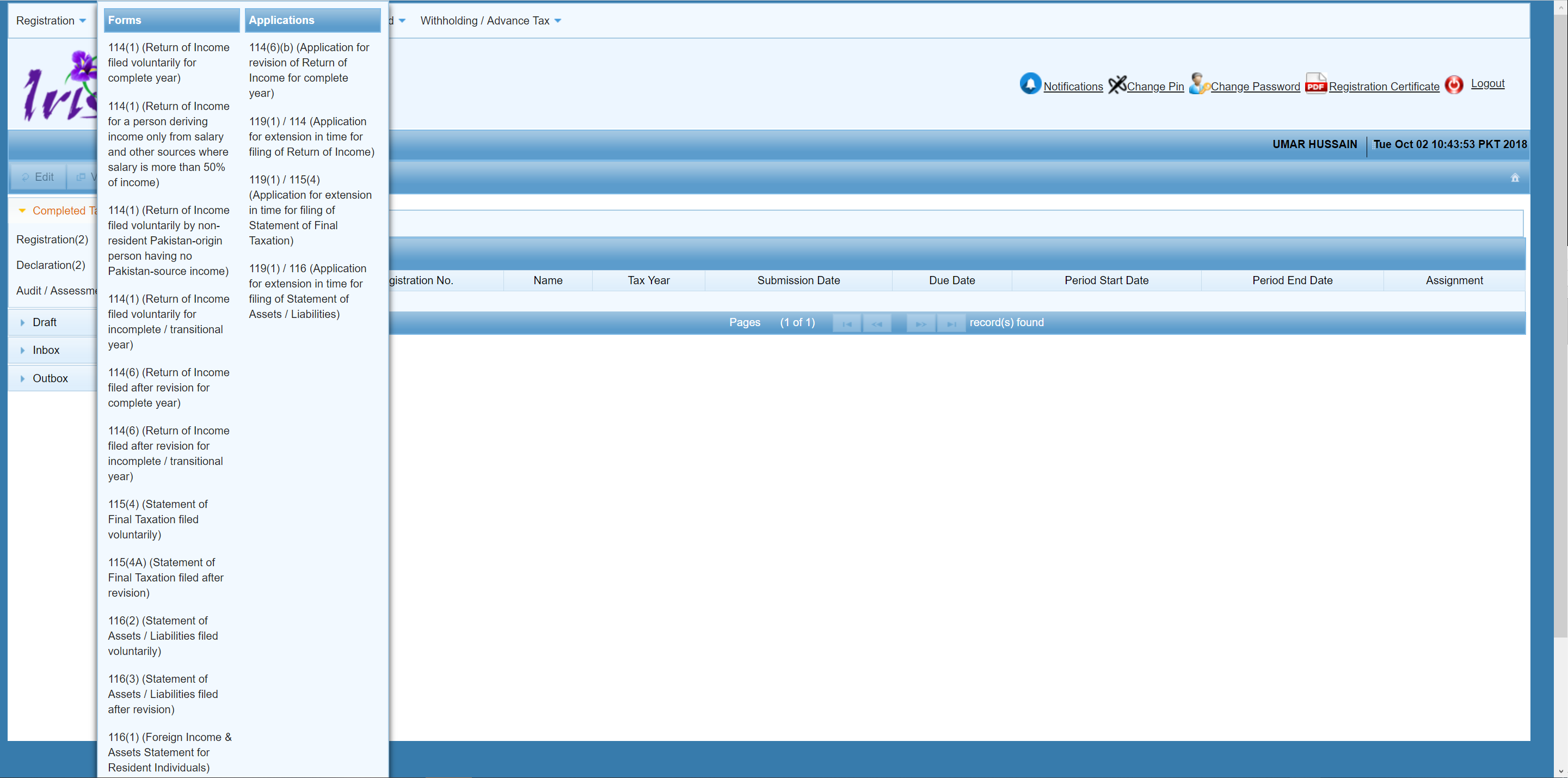

A salaried person would need to complete the declaration form 114 i in order to successfully submit their income tax return. For income tax registration individual can register online through iris portal. Those having obtained a national tax number ntn or registration number but do not have credentials to log into iris can get access by clicking on e enrollment for registered person. Also have a look at the tax slabs for the salaried person for tax year 2020 2021.

It is important to go through the fbr s recent instructions on how to file your tax return. After registration you can log into iris and file your income tax return.