What Is Sst Malaysia 2018

Malaysia introduces sales and service tax sst.

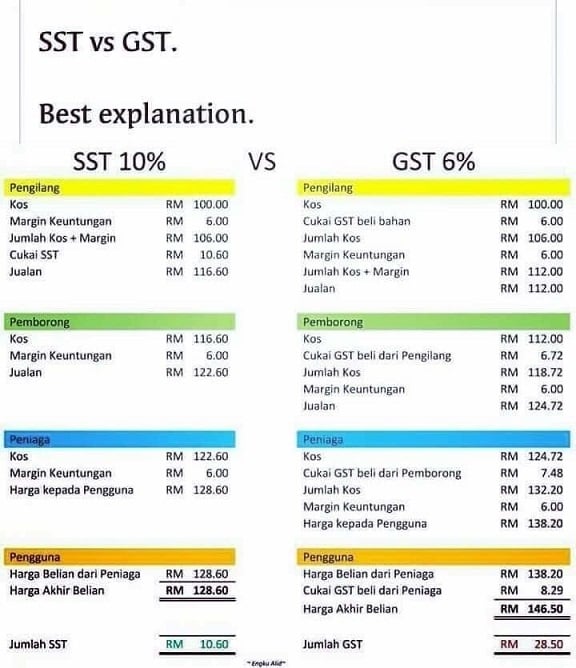

What is sst malaysia 2018. This comes after the tax holiday when the previous goods and services tax gst was zero rated for the last three months. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. Gst is charged at standard rate of 0 on the value of the removal of goods.

Here are the details on how the sst works the registration process returns and payment of the sst and the transitional measures to take after the abolishment of the gst. Malaysia sales tax 2018 following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence. The sst consists of 2 elements. However the payment of the goods only made on 6 september 2018.

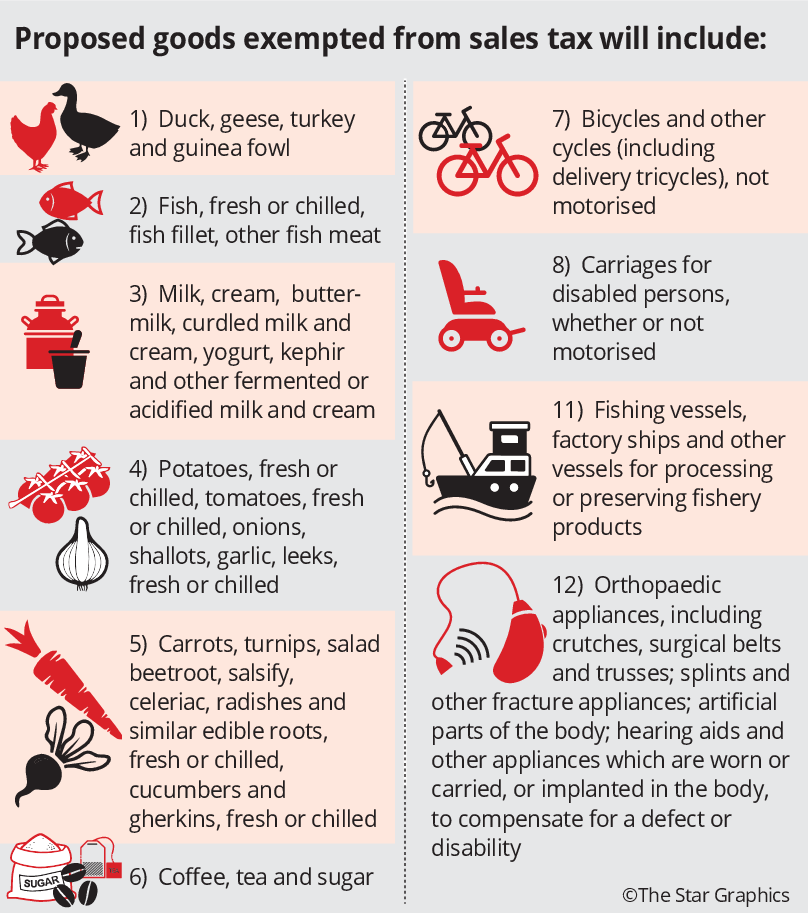

From 1 september 2018 the sales and services tax sst will replace the goods and services tax gst in malaysia. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Service tax a consumption tax levied and. Now that the implementation of sst has begun malaysians are curious to see how prices have changed since 1 september.

Apply to the sst regime. Goods removed and invoice issued to the buyer on 28 august 2018. What you need to know 05 december 2018 malaysia s new sales and service tax or sst officially came into effect on 1 september replacing the former goods and services tax gst system and requiring malaysian businesses to adjust to a new regime. September is here and malaysia has entered into the new period of the sales and services tax sst.

Implemented since september 2018 sales and service tax sst has replaced goods and services tax gst in malaysia. What is the tax treatment. I the sst will be a single stage tax where the sales ad. Vat in malaysia known as sales and service tax sst was introduced on september 1 2018 in order to replace gst goods and services tax.