What Is Letter Of Undertaking

Mostly the lou is used when the person imports anything from a person in another country.

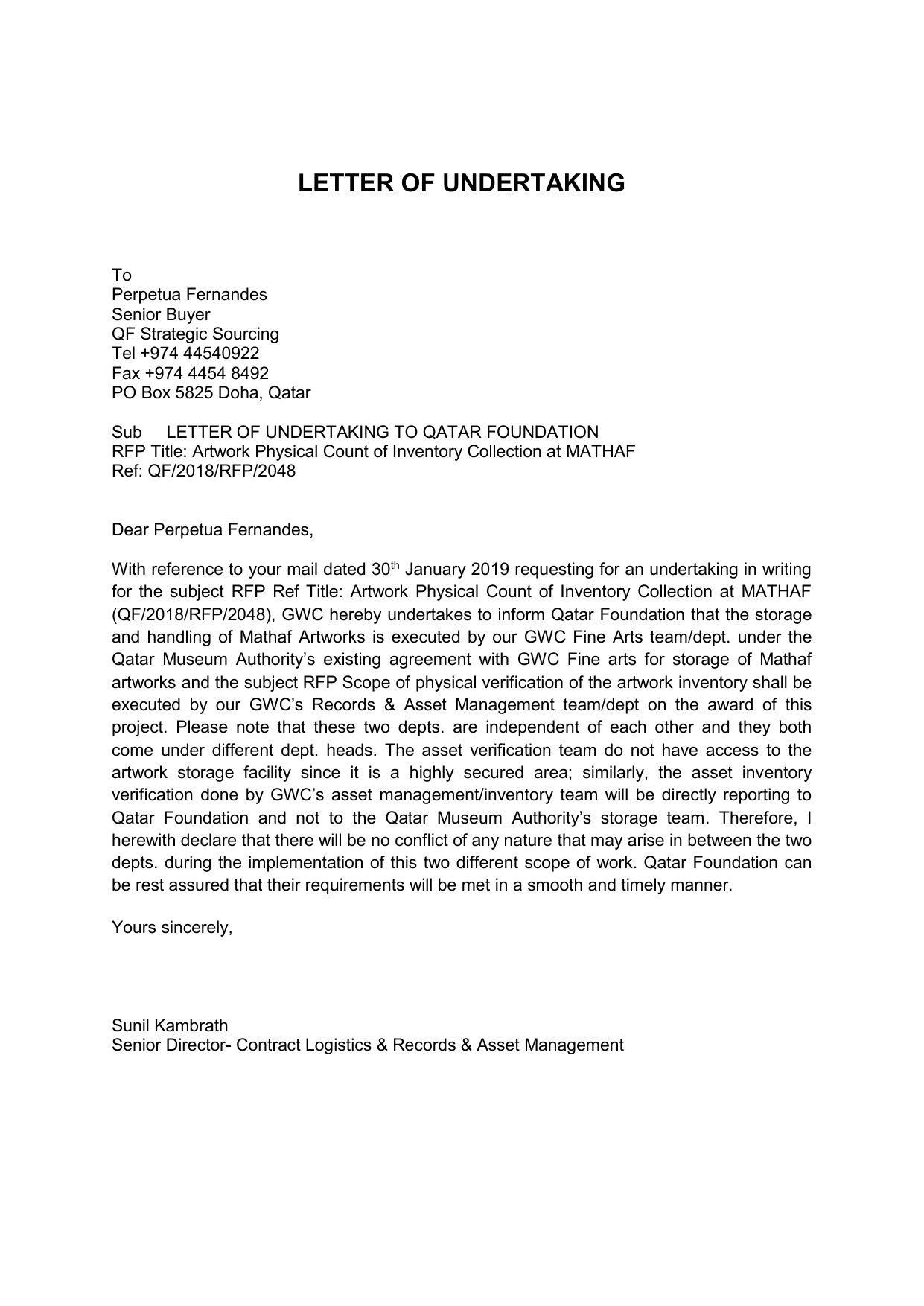

What is letter of undertaking. This lou is generally used for international transactions and is issued keeping in mind the credit history of the party concerned. This type of letter is often used when the agreement has only been spoken about but there is no written contract according to howtowritealetter. For example if one party wishes to complete some work for a business and get paid for it the individual would issue a letter of undertaking to the business stating their. The party can then avail buyer.

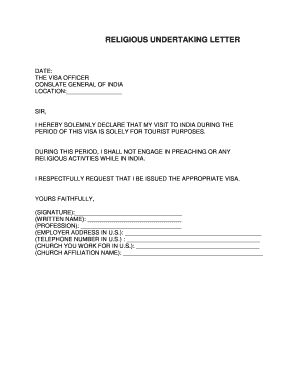

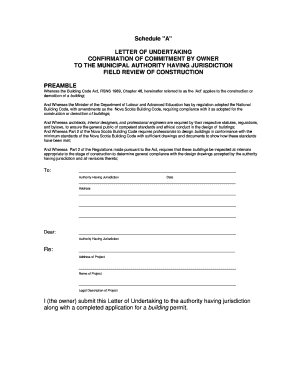

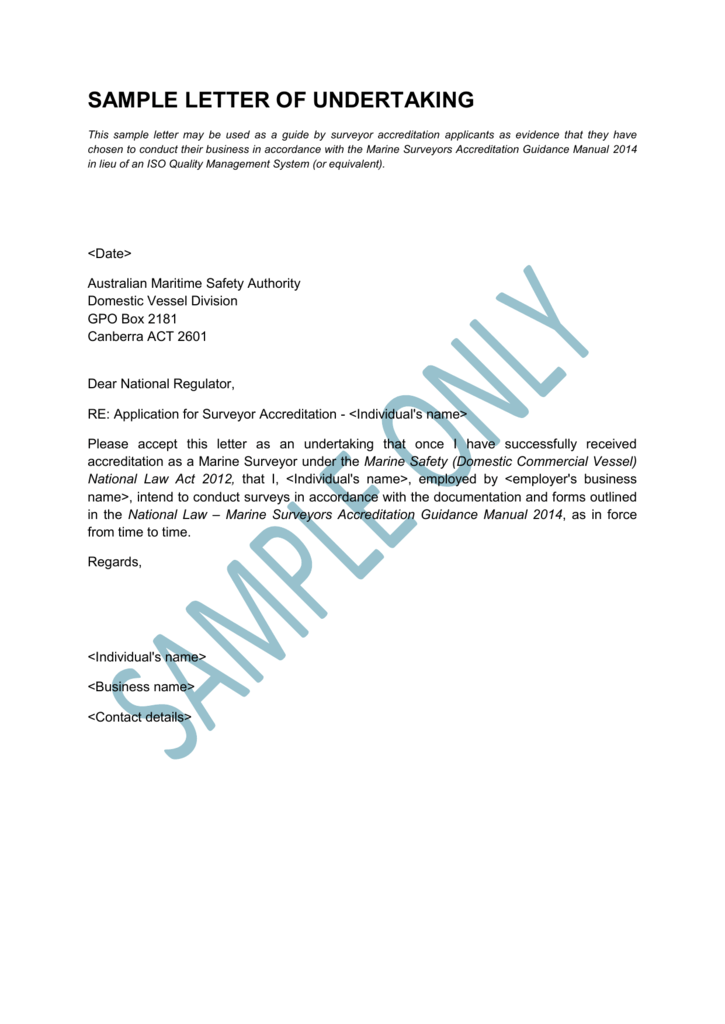

The letter of undertaking under gst is an agreement between the applicant of letter of undertaking and the government of india. A letter of undertaking or lou is a document issued by a bank to a person or a firm. The letter is written by the person who is contracted to perform the work. A letter of undertaking can be a legally binding form that makes both parties obligated to fulfill the terms of an arrangement that was previously agreed upon.

With the lou you are not required to file the form ir21 for the employee. Please obtain a letter of undertaking lou 28kb doc from the employee stating that he will not leave singapore permanently. A letter of undertaking is a written agreement of terms between two parties. A letter of undertaking lou is a bank guarantee given by one bank to another bank on behalf of the customer for repayment of the loan.

Letter of undertaking is a form of a guarantee issued by a banking entity to a person concerned for availing short term credit from the overseas branch of an indian bank. Singapore permanent residents spr who are not leaving singapore permanently after ceasing employment with you. A letter of undertaking is an assurance by one party to another party that they will fulfill the obligation that had been previously agreed on but not written into a contract. It is a business agreement and can be legally binding so it s.

It is mostly used from a business perspective to fulfill some deeds or work for a business and in return getting paid for it. Thus it is a joint agreement wherein the government allows a supplier to export the goods or services without payment of integrated tax igst.