What Is Gst Malaysia

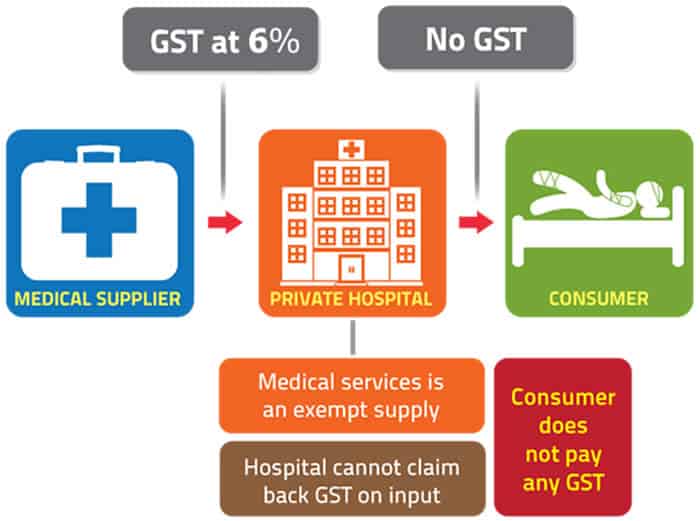

Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette.

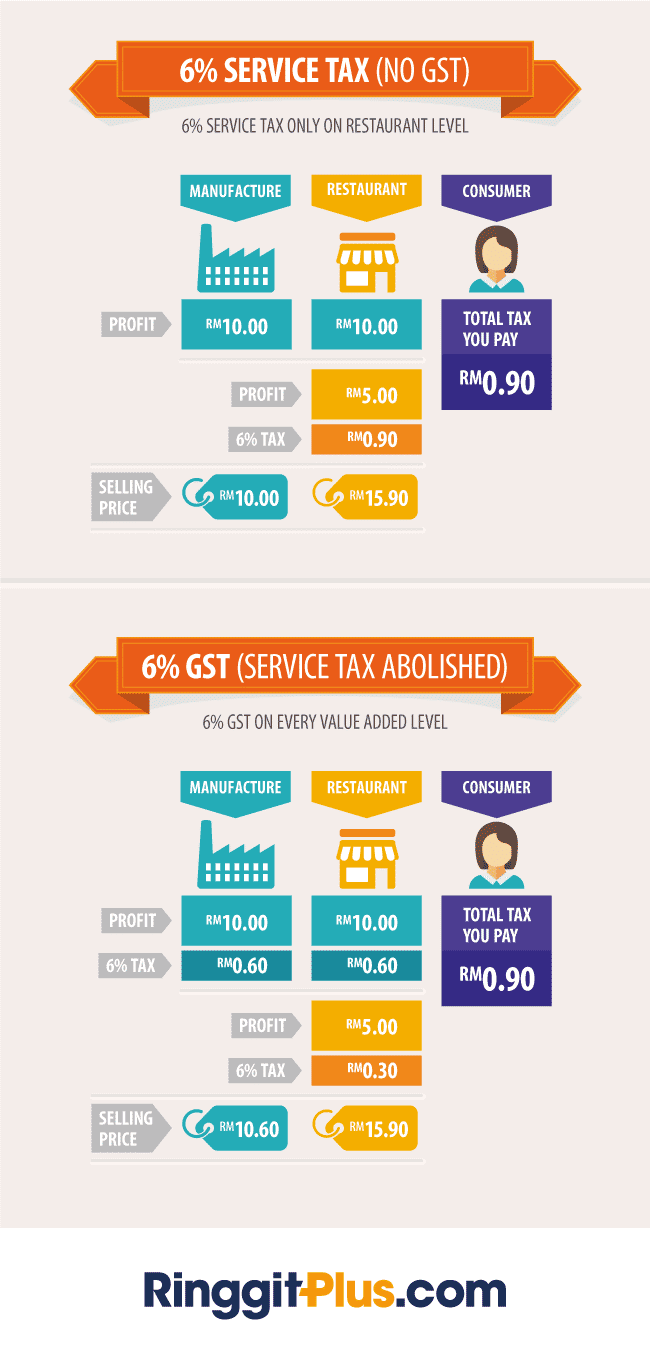

What is gst malaysia. For exports of goods gst is charged at 0 zero rate. Any taxable supply of goods and services made in the course or furtherance of any business by a taxable person in malaysia the importation of goods into malaysia except goods prescribed as zero rated and exempt and all imported services acquired for the purpose of business except exempt supplies of services. The goods and services tax gst is an abolished value added tax in malaysia. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

The existing standard rate for gst effective from 1 april 2015 is 6. Gst will be charged on. However gst is charged at 0 instead of 7. Gst will be a part of the government s tax reform programme to enhance the capability effectiveness and transparency of tax administration and management.

Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. Under the current tax system the government depends too much on direct taxes both from individual and corporate taxpayers. The malaysian gst system has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books. Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette.

Gst exceptions in malaysia exports of goods and the supply of international services are zero rated. Zero rated supplies are considered taxable supplies. Current gst rate in malaysia is 6 for goods and services. Gst is also charged at 0 zero rate for the provision of international services.

Malaysia will impose a tax of between 5 per cent and 10 per cent on the sale of goods while services will attract a 6 per cent levy when a new tax regime comes into effect on. The goods and services tax gst is a value added tax in malaysia. Provision of international services. Responsibilities of registered person.