What Is Form 499r 2 W 2pr

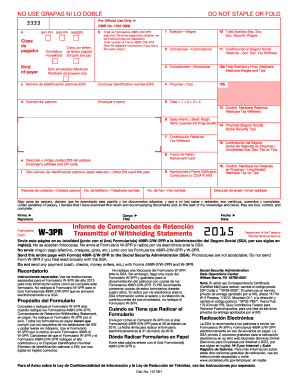

Employers with w 2 forms to submit using private programs that is any program other than our hacienda s web program.

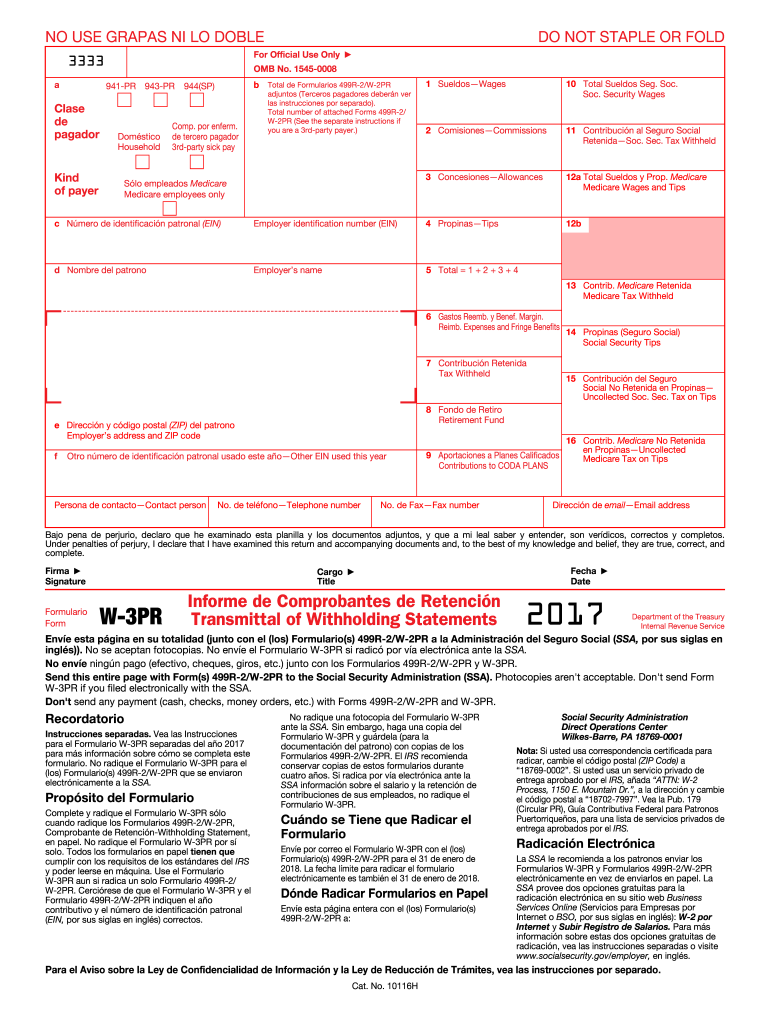

What is form 499r 2 w 2pr. Two new fields have been incorporated to the form to indicate if the remuneration includes payments to the employee for the following services. Any extension filed after january 31 2019 will be rejected. The number will consist of ten digits starting with a letter. Who must use these instructions.

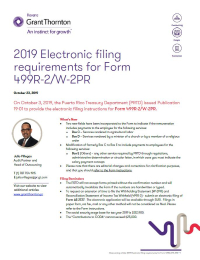

On october 3 2019 the puerto rico treasury department prtd issued publication 19 01 to provide the electronic filing instructions for form 499r 2 w 2pr. Instructions for filing form 499r 2 w 2pr copy a w 2 information to the department of the treasury through electronic transfer using the mmw2pr 1 format. Who must use these instructions. Instructions for filing form 499r 2 w 2pr copy a w 2 information to the department of the treasury through electronic transfer using the mmw2pr 1 format.

Verify each form 499r 2 w 2pr has a printed confirmation number. Control numbers the puerto rico treasury department has reserved the sequence between 900000000 and 999999999 for internal use. Extension using form as 2727 request for extension of time to file the withholding statement 499r 2 w 2pr and reconciliation statement of income tax withheld 499 r 3. Employers with w 2 forms to submit using private programs that is any program other than our hacienda s web program.

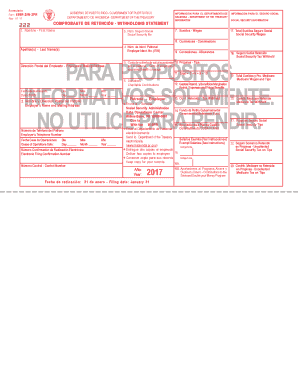

One 1 form per employee was used to report the total amount paid during the same tax period to each employee.