What Is Form 4972

Using irs form 4972 tax on lump sum distributions allows eligible taxpayers to decrease their tax burden when taking a lump sum distribution from a qualifying plan such as a pension plan or profit sharing plan.

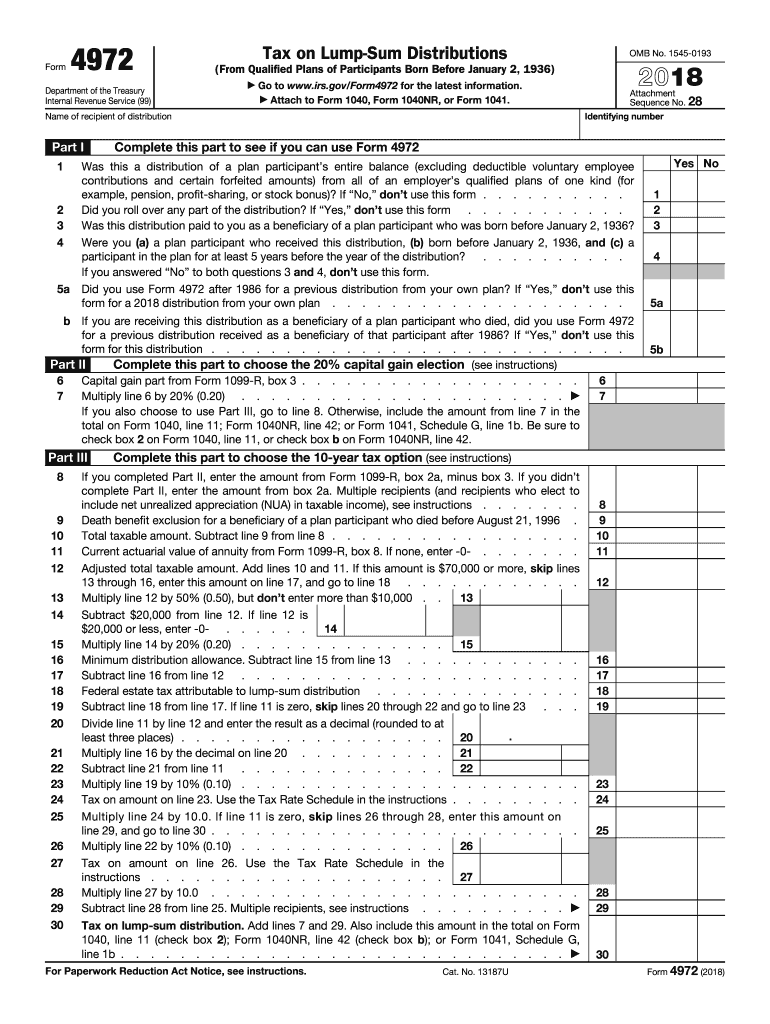

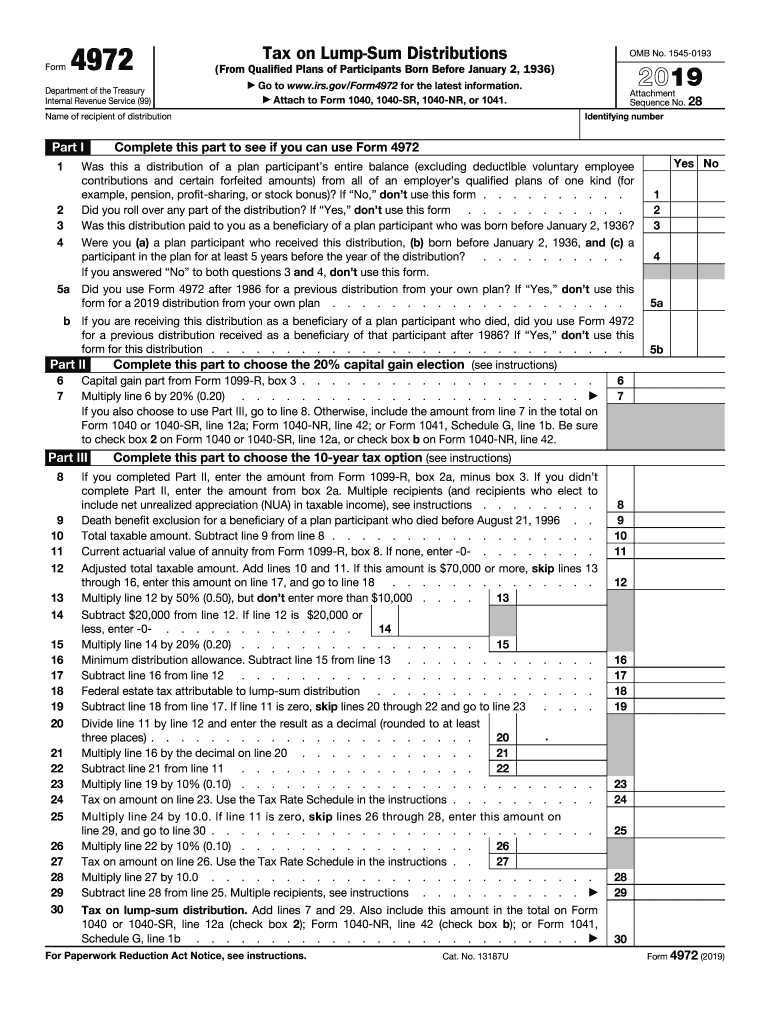

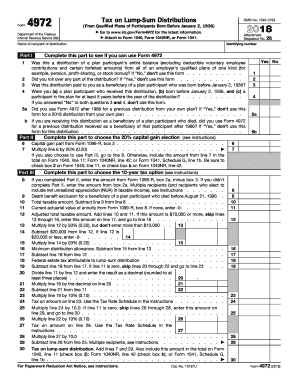

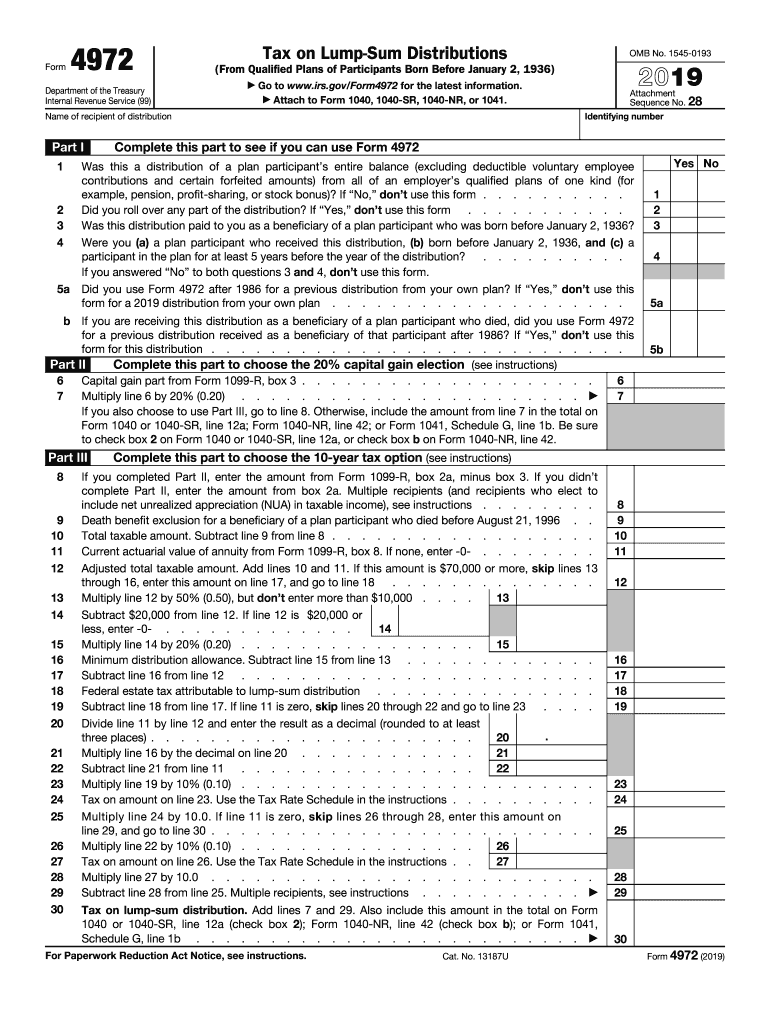

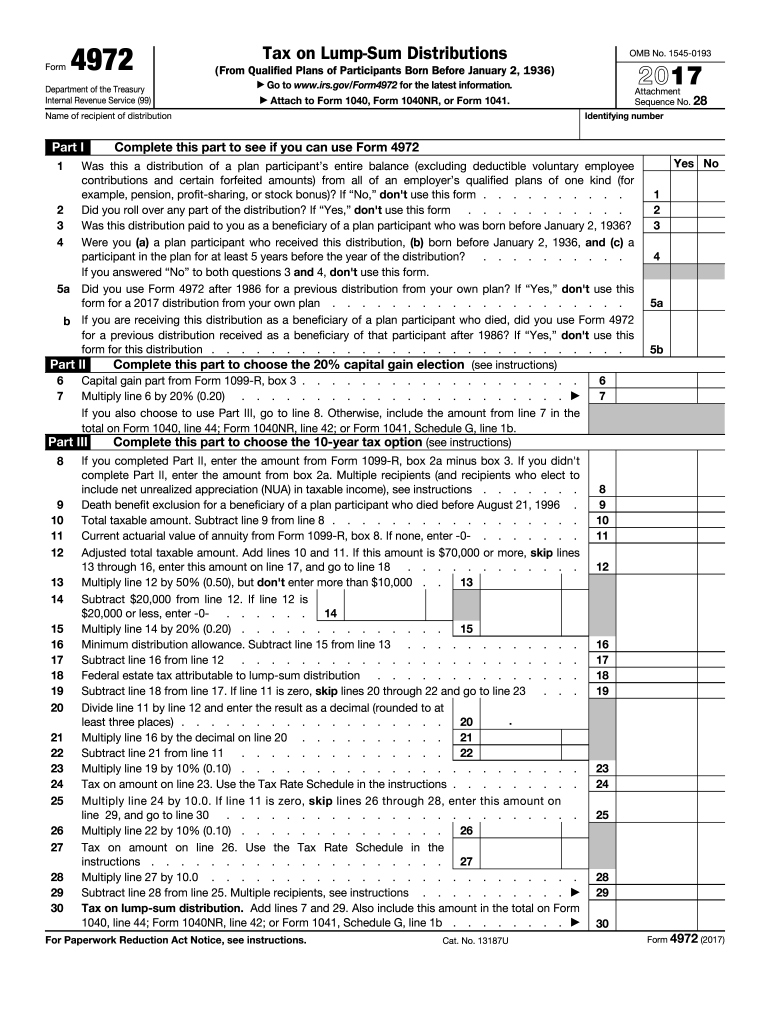

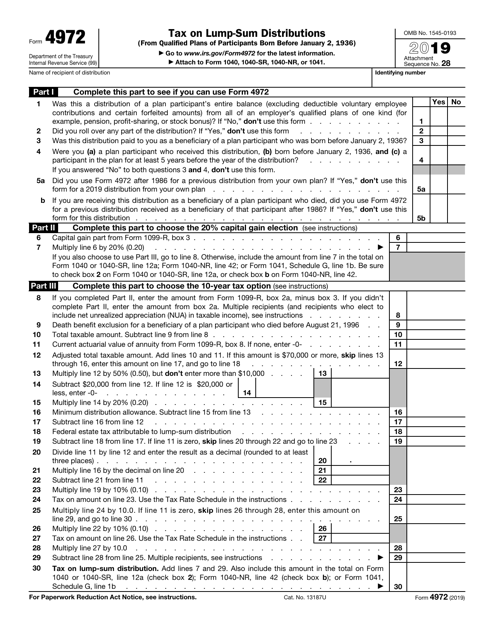

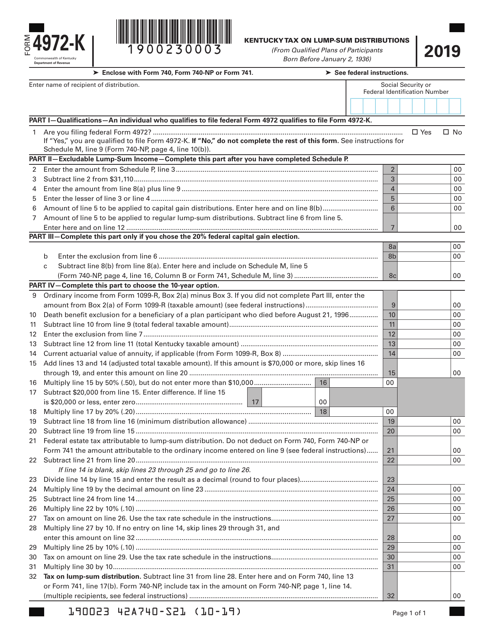

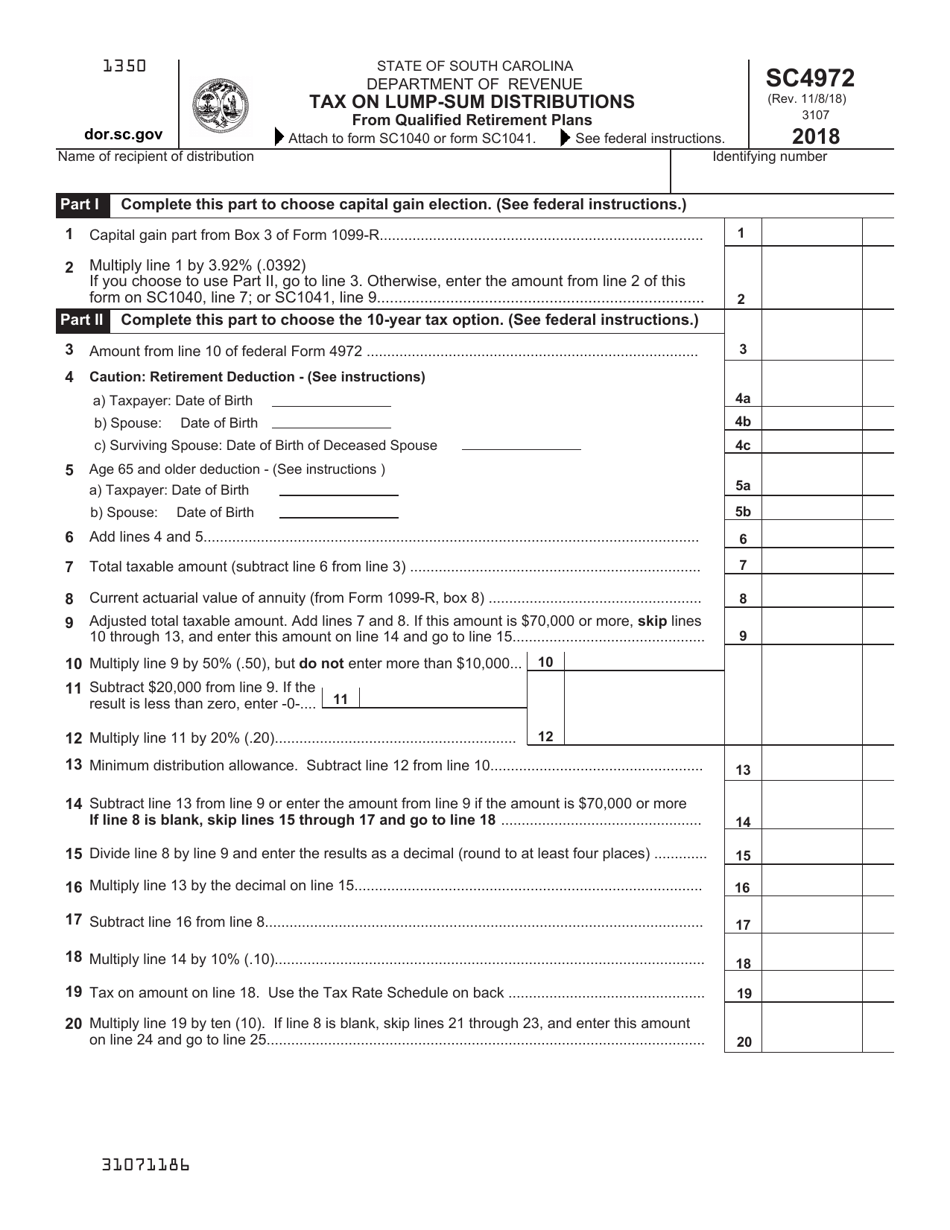

What is form 4972. The buzzle article below explains the purpose of form 4972 and the instructions to fill it. Available for pc ios and android. Use this form to figure the tax on a qualified lump sum distribution using the 20 capital gain election the 10 year tax option or both. Start a free trial now to save yourself time and money.

Assuming you qualify the irs allows you to elect one of five methods of taxation for lump sum distributions. If the browser you are using doesn t allow you to type directly into the w 9 then save the form to your desktop and reopen using form 4972 4420036 what is a schedule 2 tax form form 4972 4420036 what is a schedule 2 tax form reader general purposethe general purpose of form w 9 is to provide your correct taxpayer identification number tin to an individual or entity typically a company. Information about form 4972 tax on lump sum distributions including recent updates related forms and instructions on how to file. To qualify the entire account must be payed out to the beneficiary in one tax year the plan must be an employer plan and the beneficiary must be have been born before january 2 1936.

The payer should have given you a form 1099 r or other statement that shows the amounts needed to complete form 4972. Report part of your withdrawal as a capital gain with the remainder being ordinary income. Capital gain and 10 year methods. If you were born before january 2 1936 you may be able to use irs form 4972 to reduce the taxes on a lump sum distribution.

Form 4972 instructions offer two filing options. If you can use form 4972 attach it to form 1040 or 1040 sr individuals form 1040 nr nonresident aliens or form 1041 estates or trusts. Tax form 4972 is used to reduce the tax load for lump sum distribution of a qualified retirement account. Page 3 form 4972 2019 when to file form 4972 you can file form 4972 with either an original or amended return.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill out securely sign print or email your form 4972 2018 2020 instantly with signnow. For an amended return you generally must file within 3 years after the date the original return was filed or within 2 years after the date the tax was paid whichever is later to use any part of form 4972. The following choices are available.