What Is Form 49

Convert to radical form 49 1 2 if is a positive integer that is greater than and is a real number or a factor then.

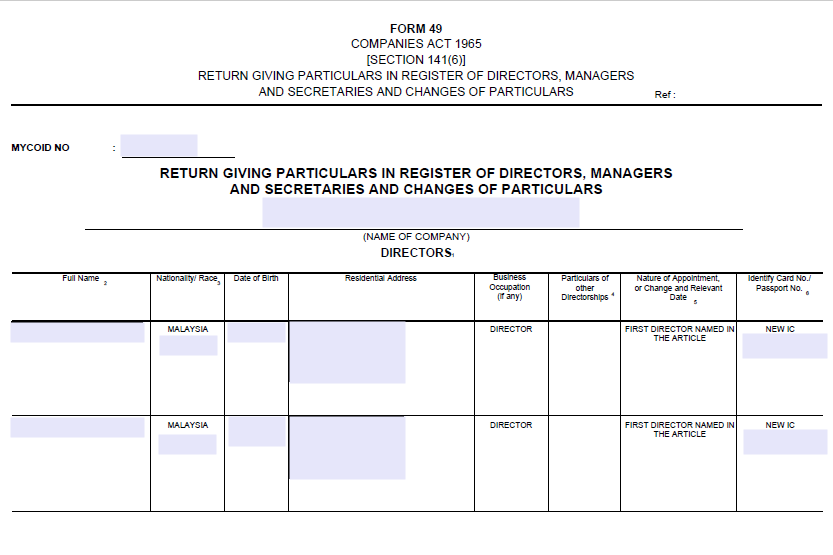

What is form 49. And form 49 a is use in apply for pan card. Changes of particulars are also made in form 49. Is this answer correct. Footnotes to form 49 where a director is also a manager or secretary his particulars are to be given under each of the headings directors and managers and secretaries insert full name and any former name of the officer concerned.

Use the rule to convert to a radical where and. Section 141 6 of the act provides that the company shall lodge with the registrar. 2 and form no 49 is used to make pan card. 1 what is form 49 aa.

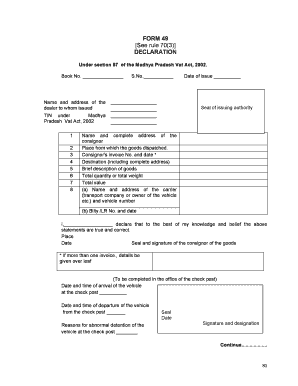

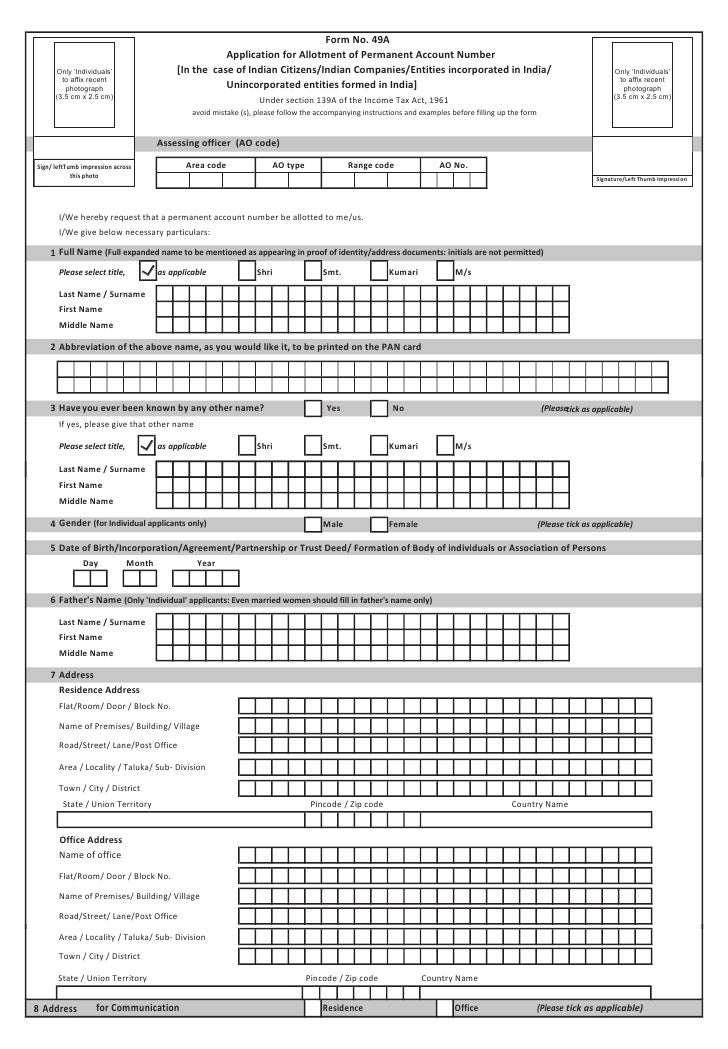

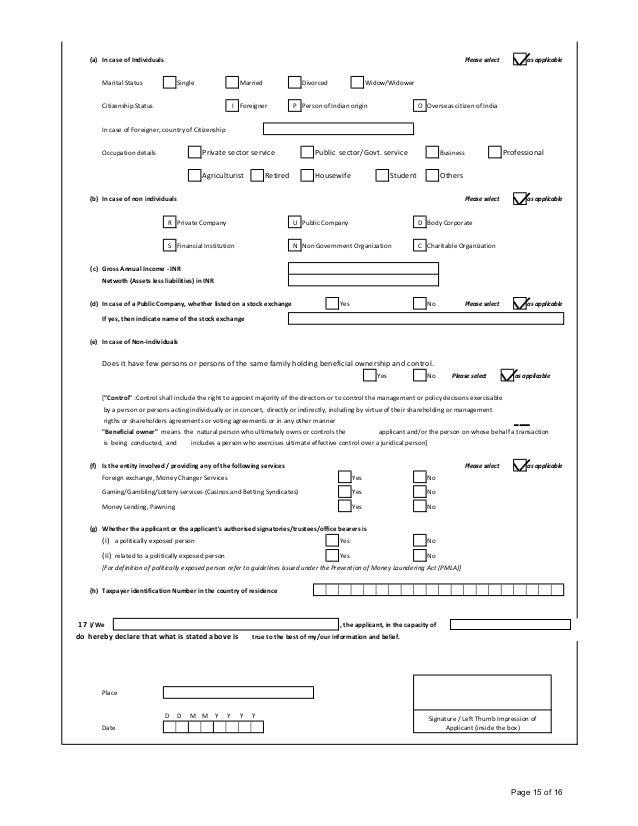

The registered dealer only issue form c to reduce the sales tax i e. Pan form 49 a is designed for the use of indian citizens entities incorporated in india unincorporated entities formed in india and indian companies. This form is mandatory for obtaining the 10 digit permanent account number pan. Elector deciding not to vote if an elector after his electoral roll number has been duly entered in the register of voters in form 17a and has put his signature or thumb impression thereon as required under sub rule 1 of rule 49l decided not to record his vote a remark to this effect shall be made against the said entry in form 17a by the presiding officer and the signature or.

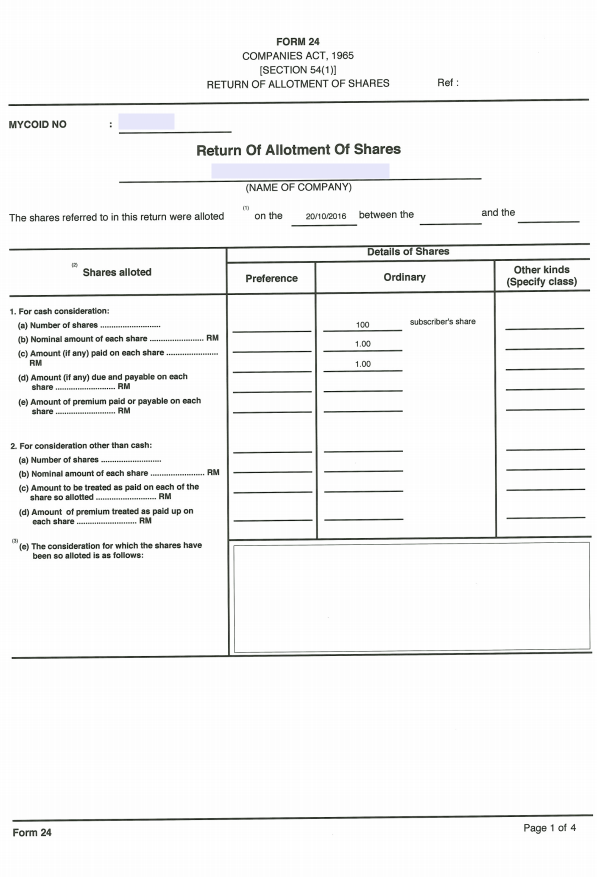

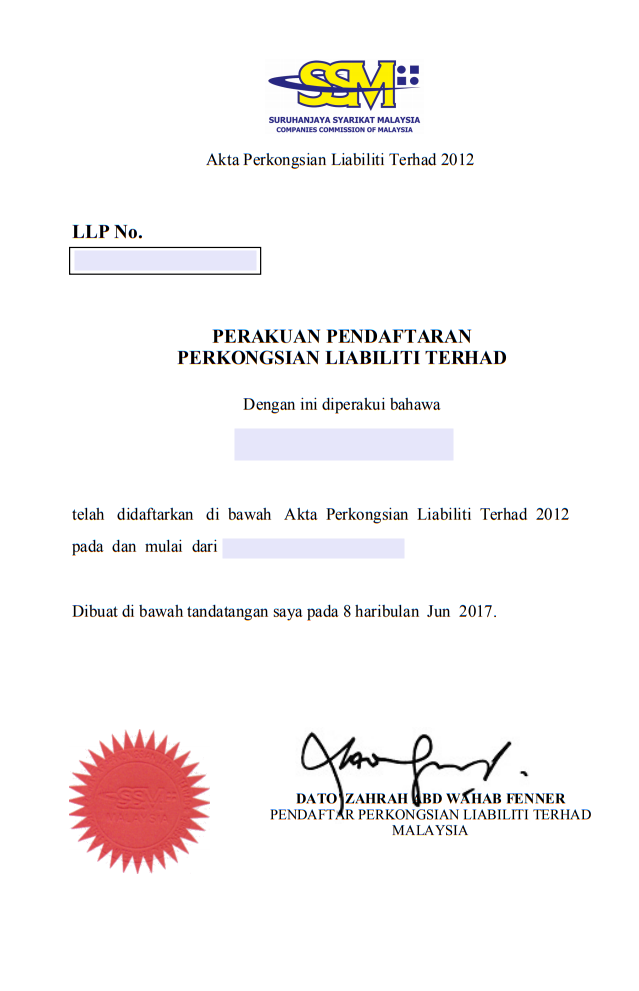

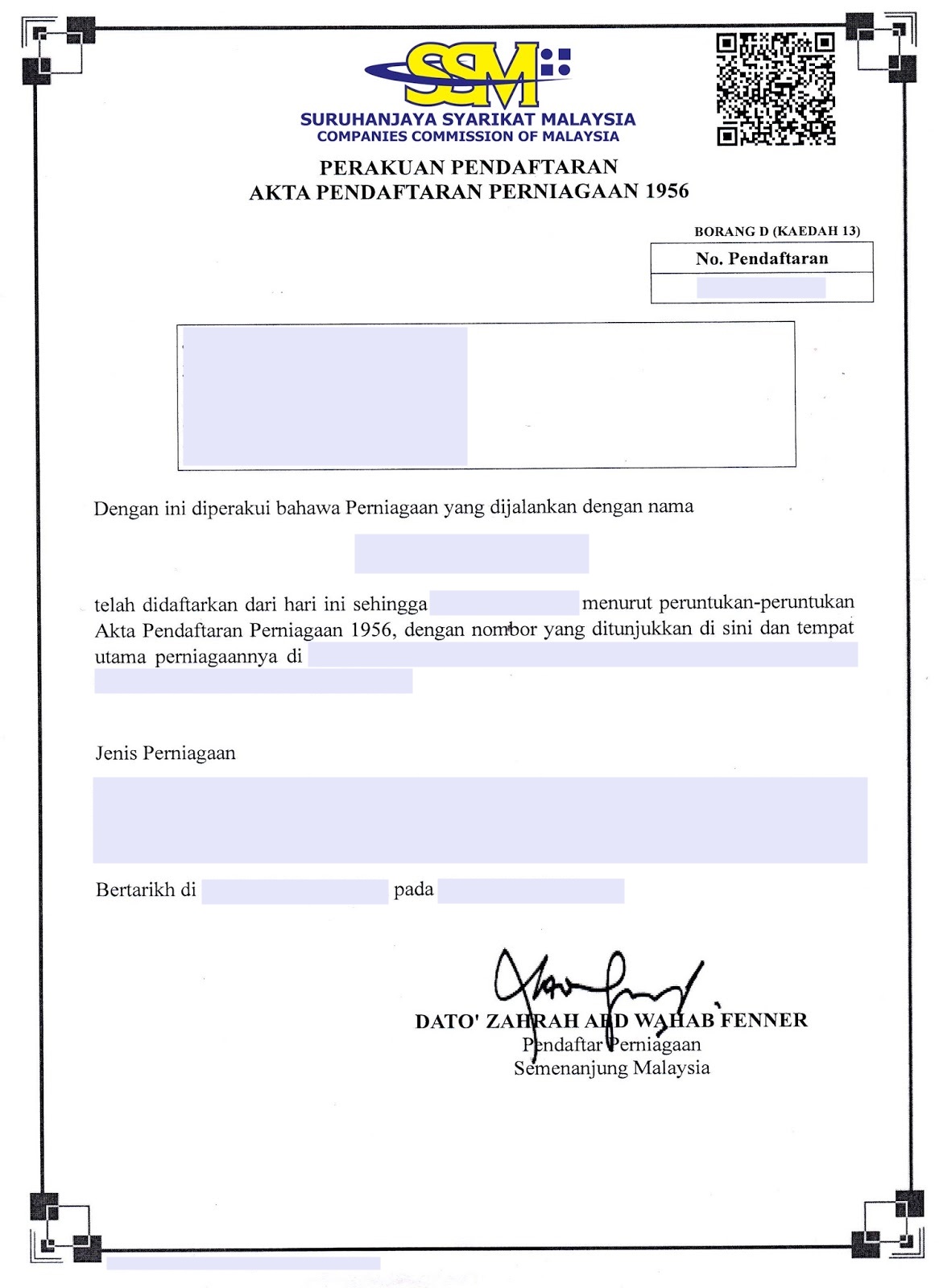

49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form. Our role is to provide a system of registration of title ownership to land which is comprehensive and readily accessible. Form 49aa is a application for allotment of permanent account number is case of individuals not being citizen of india entities incorporated outside india unincorporated entities formed outside of india. Form 49 return giving particulars in register of directors managers and secretaries and changes of particulars.

If the director is of the female gender insert f against her same. Income tax department issues pan card form 49a under section 139a of the income tax act 1961. Form 49 is used to giving the particulars of directors managers and secretaries. Rule 114 of the income tax rules 1962.

Why issue a c form to seller what is form no 49. Form is available both offline and online. Answer dhiraj singh. Pan application form 49 a governed under nbsp.

:max_bytes(150000):strip_icc()/Screenshot49-679bd4f55caa43dd9c4735f69581bfbc.png)