What Is Form 24q

Form 24q and 26q due dates.

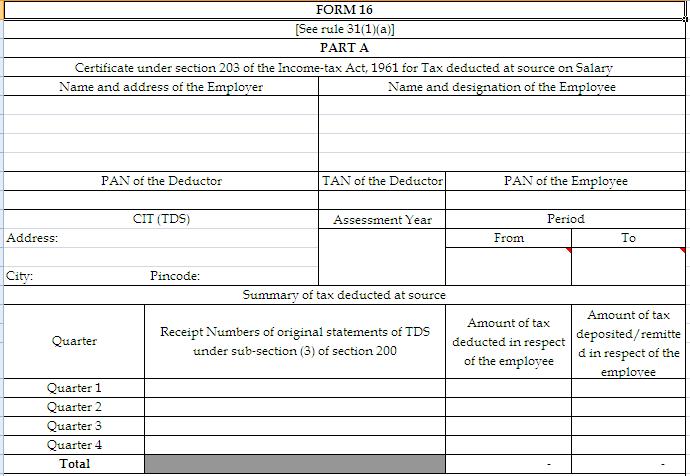

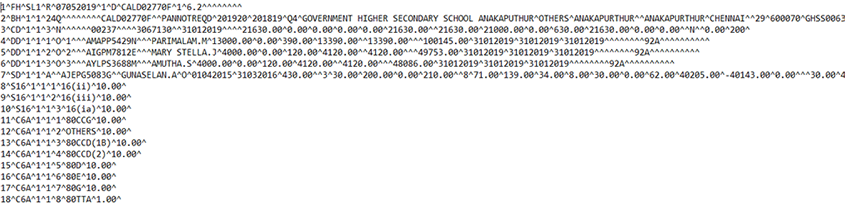

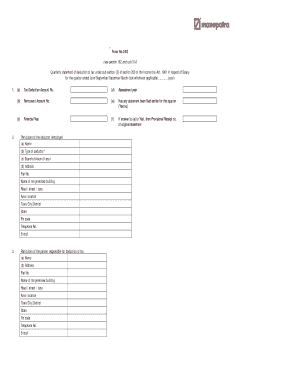

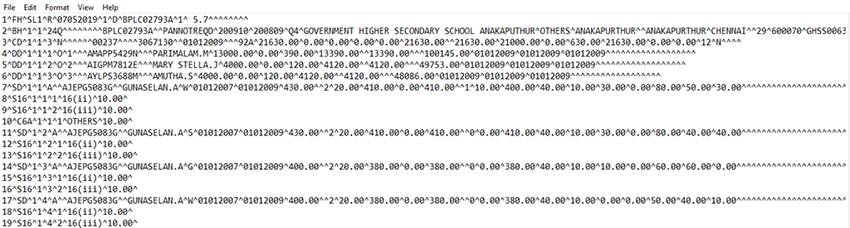

What is form 24q. Tax deducted at source is the collection of income tax for indians the collection and process of the tax is governed under the indian income tax act of 1961. Every employer deducts tds form 24q is to be filled and submitted to the income tax department on quarterly basis. Form 24q is a form for deduct tds under section 192 of the income tax act 1961. The employer considers all deductions and investments of the employee if proofs are submitted.

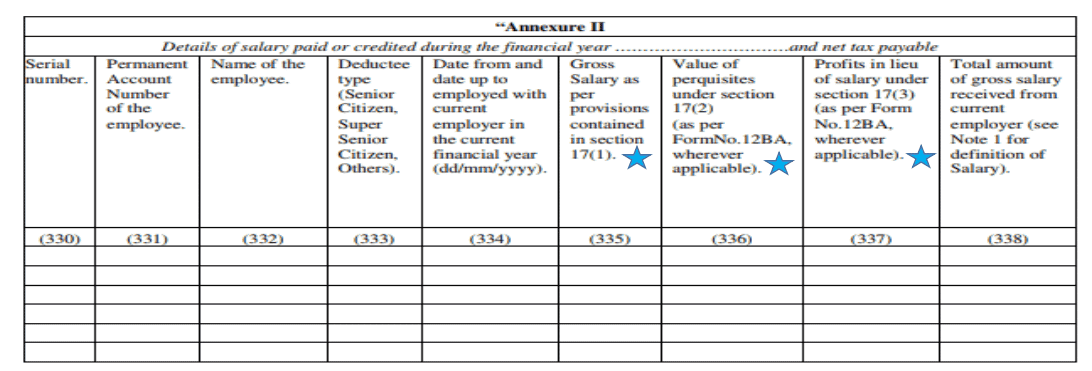

What is form 24q. In coloumn 327 of annexure ii of form no. Form 24q tds on salary. For the quarter ending 30th september the due date will be 31st october.

The employer companies and firms needs. Tds on salary is deducted as per the income tax slab rate. As per section 192 of the it act an employer will deduct tds at the time of paying salary to an employee. For the quarter ending 30th june the e tds return due date for both 24q and 26q will be july 31.

These provisions require a deduction of a prescribed percentage for all coverage.