What Is Form 24q In Tds

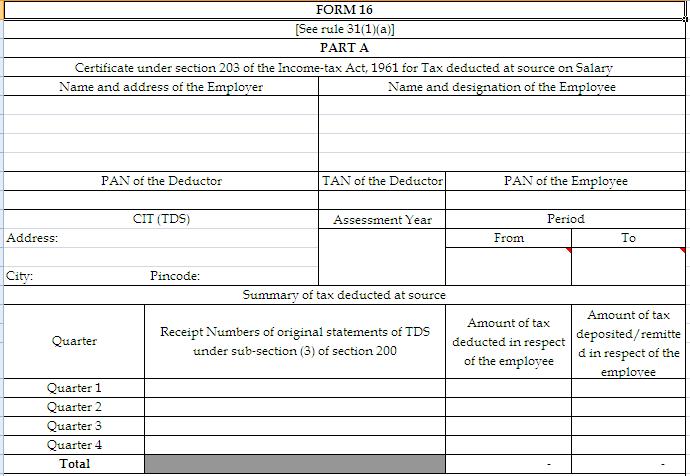

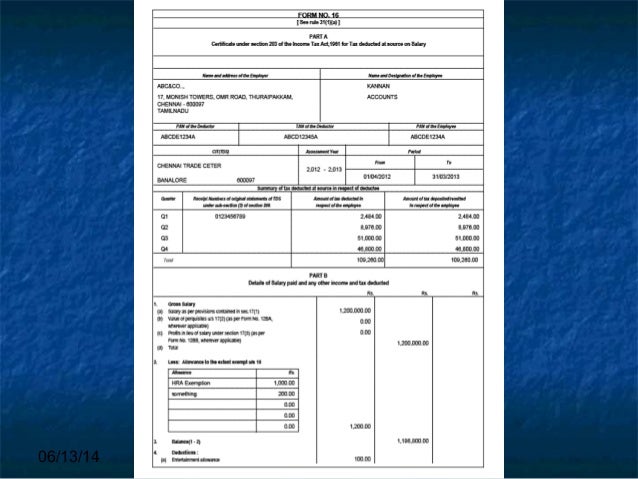

Annual tds certificate in form no.

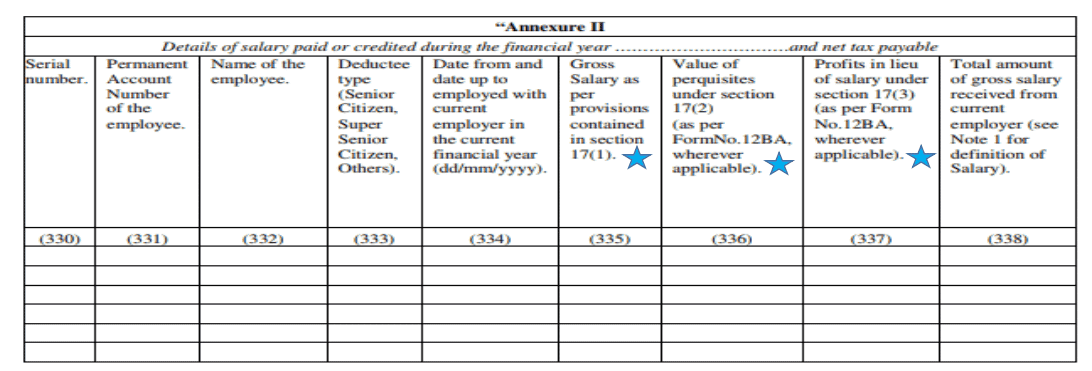

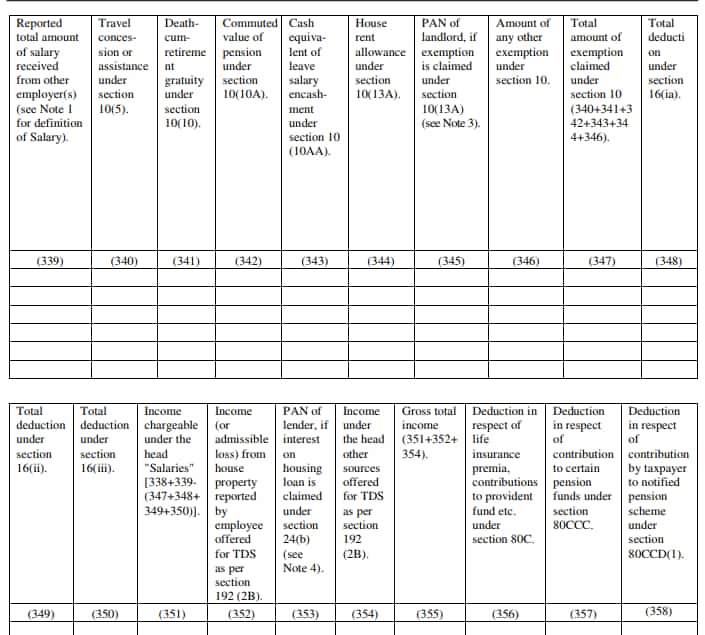

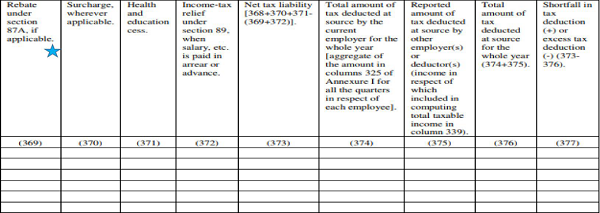

What is form 24q in tds. Form 24q and 26q due dates. 16 is required to be issued by the employer deductor to the employees as an acknowledgement of the fact that the tax has been deducted and has been deposited in the government treasury. It is used for preparing etds returns for the tds deducted on salary under section 192 of the income tax act 1961. 04 of main form 24q details of salary paid and tax deducted thereon from the employees bsr code of the branch where tax is deposited name of employer date on which tax deposited dd mm yyyy challan serial no.

24q comprises of 2 annexures. Form 24q is a statement for tds from salaries which must be filled and submitted by the deductor on a quarterly basis. What is form 24q. Tax deducted at source is the collection of income tax for indians the collection and process of the tax is governed under the indian income tax act of 1961.

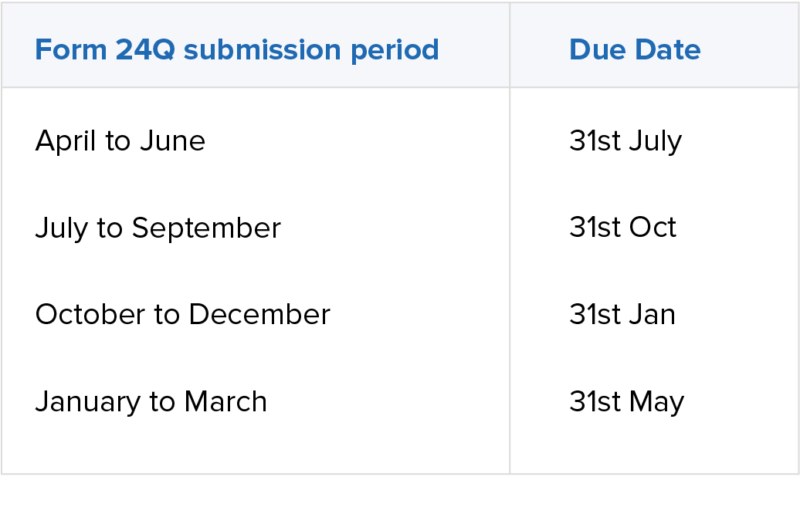

For the quarter ending 30th june the e tds return due date for both 24q and 26q will be july 31. Tds form 24q contains 2 annexures and they are annexure i and annexure ii. In case any additions or updates are to be made to the details of the regular statement accepted at the tin central system the same is done by furnishing a correction statement. No firm must refrain from abiding by the norms to file form 24q when required.

These provisions require a deduction of a prescribed percentage for all coverage. Annexure i deductee wise break up of tds please use separate annexure for each line item in the table at s no. 16 annual tds certificate. For the quarter ending 30th september the due date will be 31st october.

At the time of paying salary to an employee an employer deducts tds tax deducted at source under section 192. The firm would need to submit form 24q every quarter of the financial year to indicate tds for salary. It has to be submitted on a quarterly basis by the deductor. Form 24q and 26q are nearly the same except that the former is meant for declaration of tds from income from salary while the latter is used for declaration of tds from sources other than salary the tds sections covered in 24q include 192a salary paid to government staff besides union government employees 192b salary paid to non government staff and 192c salary paid to union.

Annexure i and annexure ii in form 24q. It should contain the details of the salary paid as well as the tds deducted. The salary tds return is filed in form 24q by the employer and is submitted on a quarterly basis. The deductor collector has to submit one regular tds tcs statement for a particular tan form financial year and quarter.

Let us study in detail the various types of tds return forms. Form 24q tds on salary.