What Is Form 24q In Income Tax

Statement for tax deducted at source from salaries.

What is form 24q in income tax. Each one has a different purpose but connected with income tax. Issue of duplicate tds certificate. Statement for tax deduction on income received from interest dividends or any other sum payable to non residents. In other words the taxable salary figure cannot be negative.

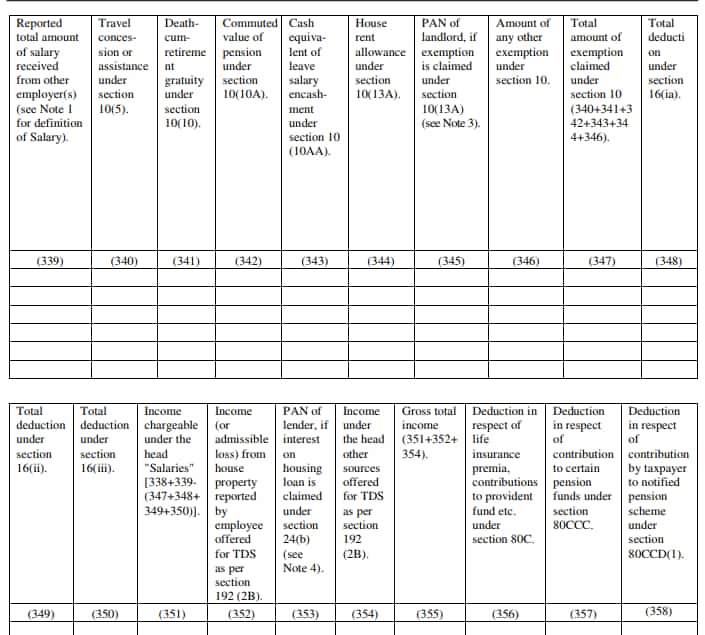

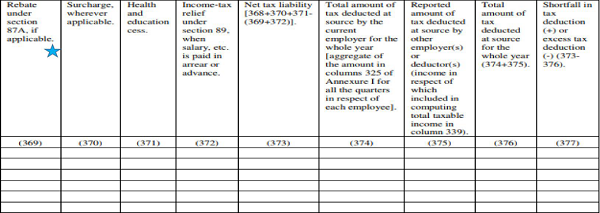

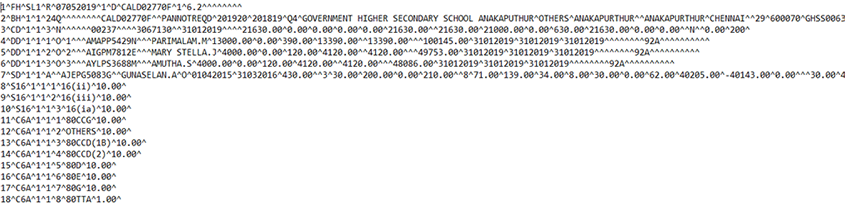

Forms 24q 26q 27q 27eq 27d are all income tax return forms to declare tax deducted at source tds and have to be submitted to the income tax department. Therefore if the total amount deductible under chapter via exceeds gross total income the total taxable income should be mentioned as zero. It specifies the format of part b of form 16 tds statement in form no. We have often been asked by our income tax lawyers or colleagues to fill in.

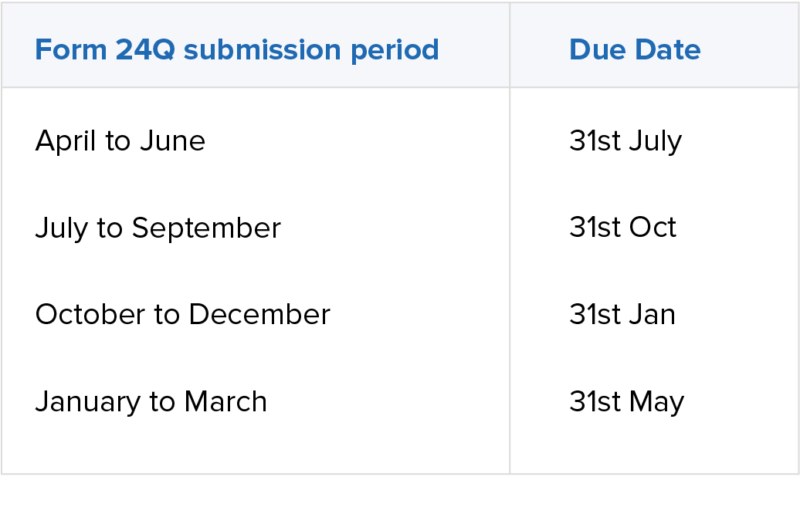

These provisions require a deduction of a prescribed percentage for all coverage. The salary tds return is filed in form 24q by the employer and is submitted on a quarterly basis. Statement for tax deducted at source on all payments other than salaries. 24q comprises of 2 annexures.

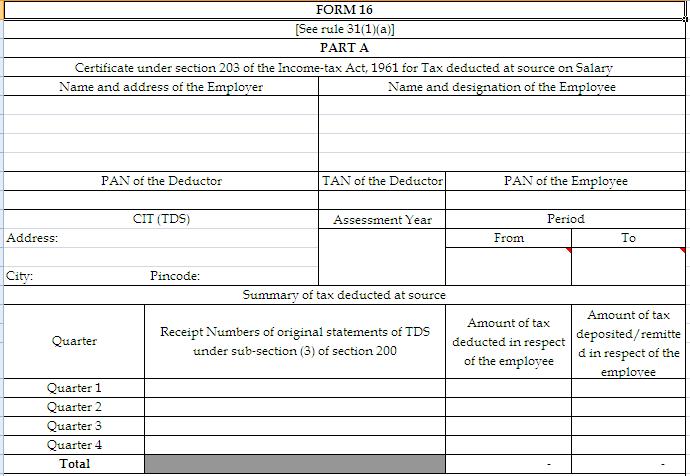

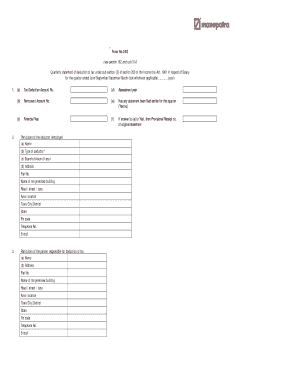

It specifies issuance of certificate for tds in form 16. 36 2019 by the income tax department had substantially modified the format of part b of form 16 salary tds certificate given to employees with effect from fy 18 19. Cbdts income tax notification 36 2019 dated 12th april 2019. Form 24q tds on salary.

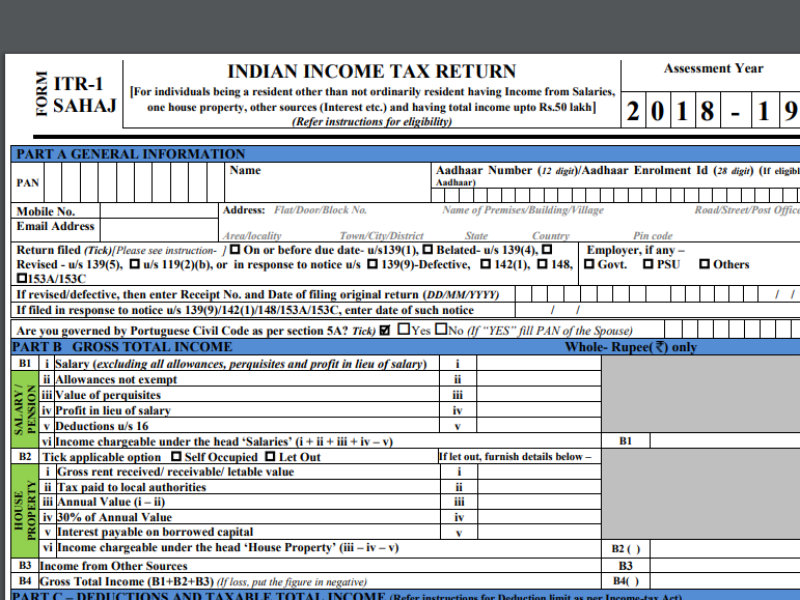

What is form 24q. 24q see section 192 and rule 31a quarterly statement of deduction of tax under sub section 3 of section 200 of the income tax act 1961 in respect of salary. Tds form 24q is to be filled by the employer for tds deduction and submitted to the income tax department on a quarterly basis. At the time of paying salary to an employee an employer deducts tds tax deducted at source under section 192.

Tax deducted at source is the collection of income tax for indians the collection and process of the tax is governed under the indian income tax act of 1961. Form 24q for the fourth quarter. An employer deducts tds under section 192 of the income tax act 1961 at the time of paying salary to an employee. Correspondingly the information to be provided by the employer in annexure ii of form 24q q4 salary details providing tax computation of each employee had also been changed.

Form 24q tds return on salary payment. Statement of collection of tax at source. Last year vide its notification no.