What Is Form 2441 For Taxes

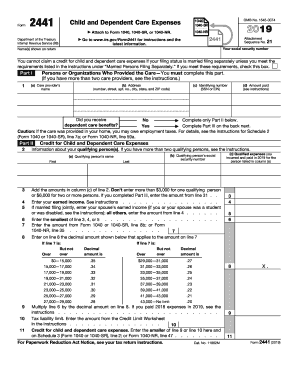

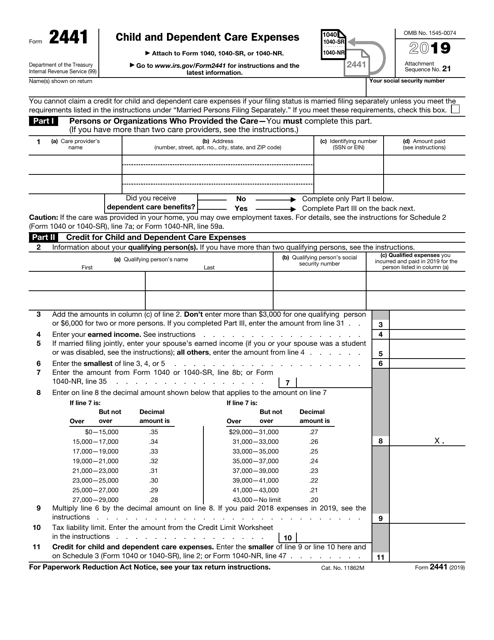

Form 2441 child and dependent care expenses is an internal revenue service irs form used to report child and dependent care expenses on your tax return in order to claim a tax credit for those.

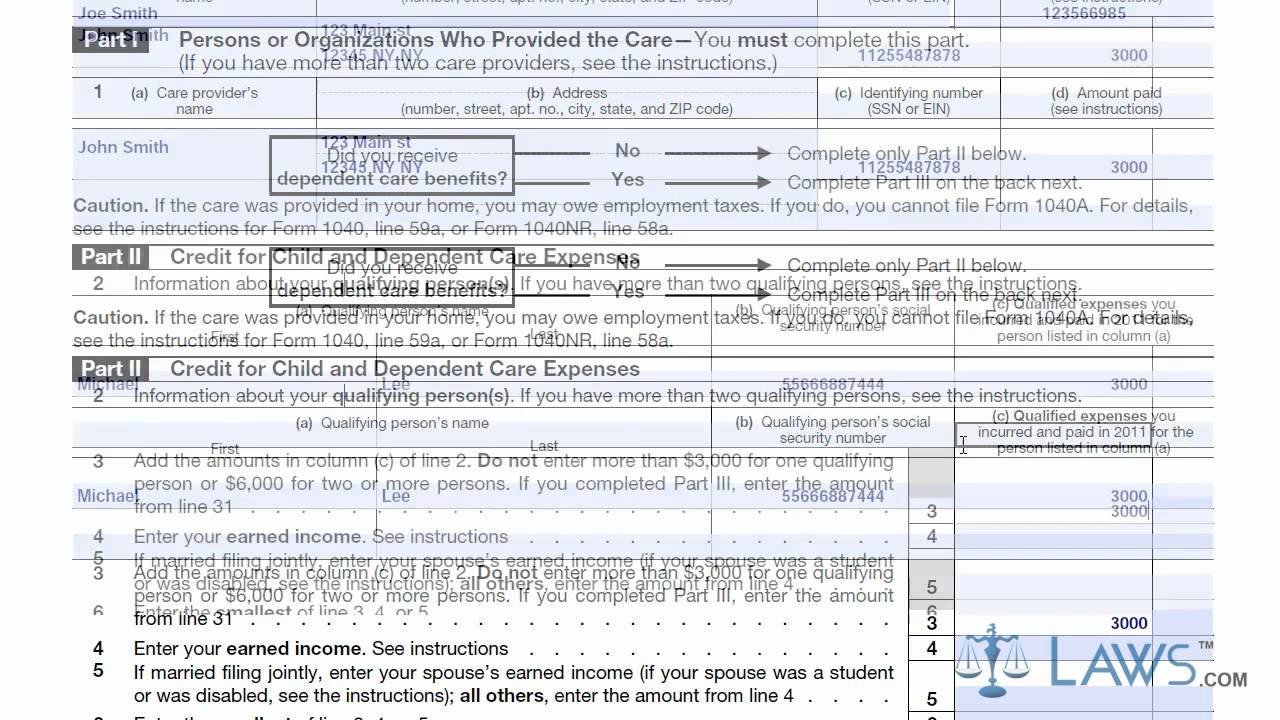

What is form 2441 for taxes. The irs also requires their addresses social security or employer identification numbers and all payments they receive from you. The iris form 2441 is titled as the child and dependent care expenses which is issued by the department of the treasury internal revenue service of united states of america. Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. In part i of form 2441 report the names of all individuals and organizations you make payments to during the year for care provider services.

Should you need help filing your taxes this year you may want to consider both turbo tax and h r block. This form is used to calculate whether an individual or family can take credit for child and dependent care expenses. On lines 15 26 you will adjust your benefits according to the instruction on your form 2441. For the latest information about developments related to form 2441 and its instructions such as legislation enacted after they were published go to irs gov form2441.

Their free online tax software can make your tax nightmares disappear. The rest of form 2441 pertains to special circumstances and credits for previous years with the exception of line 10. Irs form 2441 child and dependent care expenses is a two page tax form that will take some time and concentration to fill out correctly the resulting credit likely won t pay you back for all your care expenses either since it s capped at 3 000 for the care of one person and 6 000 for the care of two or more people. Form 2441 care providers.

Child and dependent care expenses. Purpose of form if you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work in 2019 you may be able to take the credit for child and dependent.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)