What Is Form 2439 Used For

Note that some rics and reits do not have calendar fiscal years it is best to consult the website of the investment or your tax advisor for specific guidance in this area.

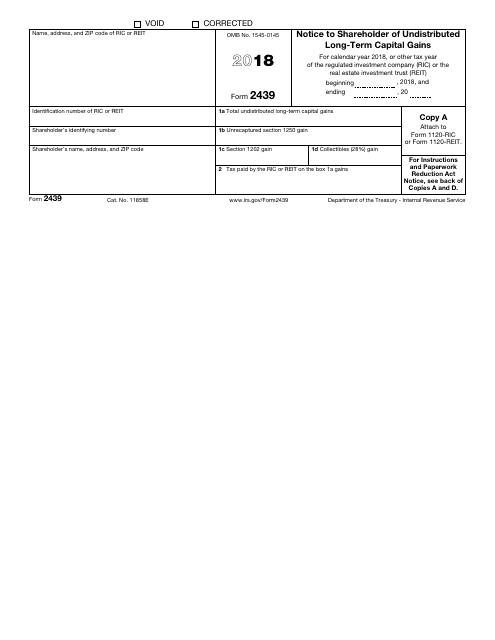

What is form 2439 used for. The tax paid by ric will flow to line 70 of the 1040. Report these capital gains even though you don t actually. Notice to shareholders of undistributed long term capital gains. It lists the dollar amount of taxes that the ric or reit paid on behalf of the taxpayer via the undistributed profit flowing from the investment.

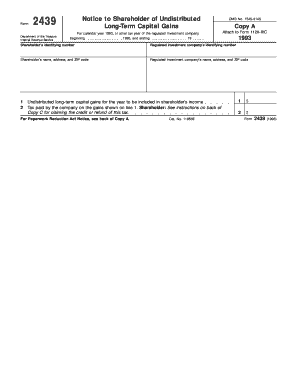

A form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Information about form 2439 notice to shareholder of undistributed long term capital gains including recent updates related forms and instructions on how to file. This is the amount the eligible taxpayer may claim as a line 71 credit. Line 4 form 2439 notice to shareholder of undistributed long term capital gains enter an amount.

Irs form 2439 is a notice to share holder of undistributed long term capital gains. The above information will flow to. Internal revenue service irs for use by rics and reits to inform shareholders of long term. Box 2 of form 2439 is most critical for tax purposes.

A separate form 2439 will be issued for each investment. When this happens the mutual fund company will send you a form 2439. The mutual fund company reports these gains on form 1099 div. Form 2439 notice to shareholder of undistributed long term capital gains is the form required to be issued by regulated investment companies rics and real estate investment trusts reits when there have been undistributed long term capital gains.

Copy a is to be completed and attached to irs form 1120 ric or 1120 riet. Shareholders also receive copies of form 2439. The total undistributed long term capital gains entered in box 1a. This form consists of four copies.

Complete copies a b c and d of form 2439 for each owner. However a mutual fund might keep some of its capital gains and pay a tax on them. The amounts entered in boxes 1b 1c and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. Use this form to provide shareholders of a regulated investment company ric or a real estate investment trust reit the amount of undistributed long term capital gains.

Copy b and c are to be furnished to the shareholder. Notice to shareholder of undistributed long term capital gains is produced by the u s. Form 2439 redirected from forms 2439 form 2439.