What Is Authorised Share Capital In Private Limited Company

A private limited company after its incorporation decides the amount of authorized capital for the company and the value of shares that they will receive in return for their investment in the company.

What is authorised share capital in private limited company. So these are called the share capital of the company. For example a company with 1000 shares of 1 has an issued share capital of 1000. Money and other assets that shareholders have contributed to the company in exchange for their shares. In this guide you learn about minimum share capital required to setup a private limited company in india.

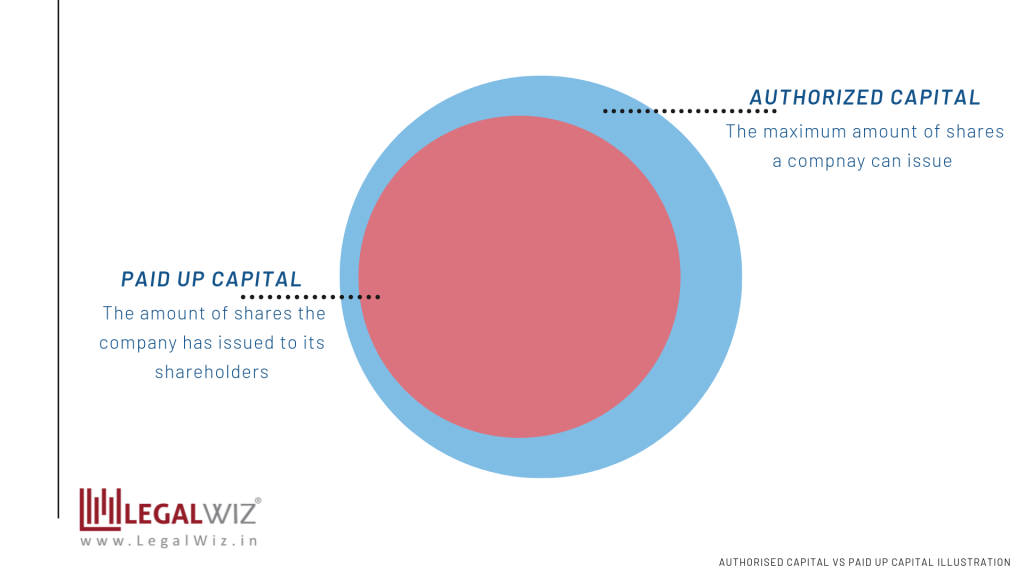

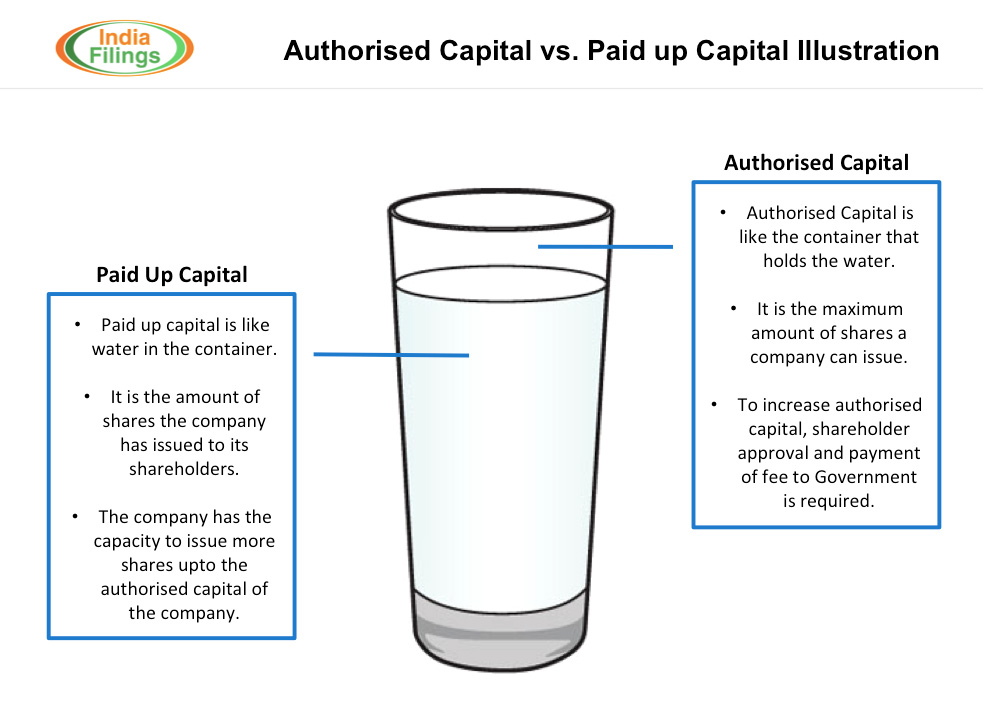

Authorised capital of a private limited company is the maximum value of shares a company can allot to its shareholders. As a result shareholders of a singapore private limited company are not liable for its debts and losses beyond their amount of share capital. The issued share capital of a limited company is the total value of shares in issue. In this article we will discuss about minimum authorised share capital for private limited company when you register a private limited company in india you always check about the money or investment to start business.

It is the maximum value of shares that a company can allot to its shareholders. I will tell you in details how to increase paid up share capital of private limited company or resolution for an increase in authorized share capital of the private limited company. Shares are allotted to members shareholders upon incorporation and the company may allot shares to new members further down the line subject to the terms of the articles of association and agreement of the. In most cases a portion of the company s authorised share capital will remain unissued.

It is recognised as a taxable entity in its own right. Issued shares or outstanding shares on the other hand is the amount of shares issued by the private limited company to its shareholders. The key requirements to register a private. Issued share capital is the total amount of consideration i e.

The authorised share capital often referred to as the nominal share capital is the maximum amount of share capital a company can issue to its shareholders according to the company s constitution. A private limited company is limited by shares and is a separate legal entity from its shareholders. Unlike paid up capital these shares may or may have not been fully paid up yet though it is nowadays uncommon for shares to be issued without being fully paid up. And for anything above that you will be paying a stamp duty of inr 400 and as per the amendment in companies act 2015 there is no minimum requirement of paid up capital to start a private limited company.