What Is Authorised Share Capital And Paid Up Capital

Generally a company issues two main types of shares.

What is authorised share capital and paid up capital. The difference between authorized and issued paid up share capital has been explained in the following points. Difference between authorized capital paid up capital. Carry voting rights and entitle shareholders to variable rates of dividends i e. It is laid out in the company s charter documents.

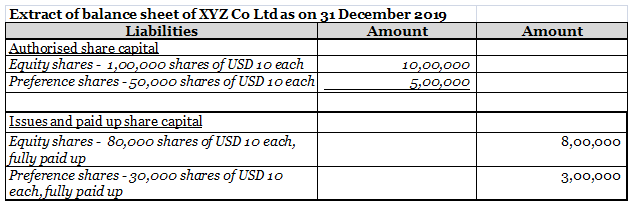

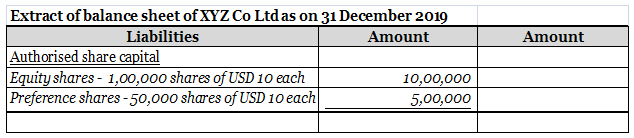

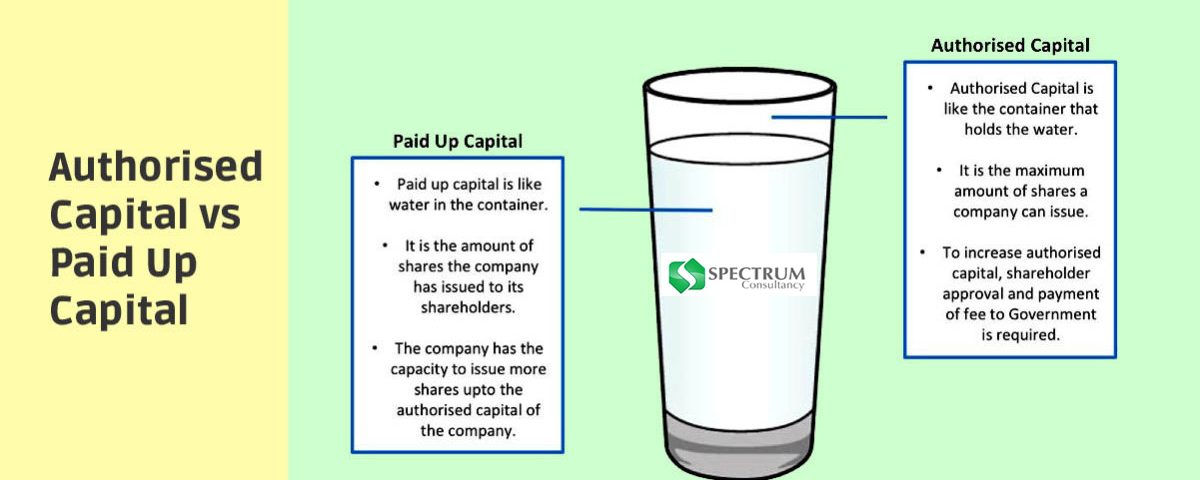

It is the maximum value of the shares issued to the shareholders. The authorised capital of a company sometimes referred to as the authorised share capital or the nominal capital is defined at times as registered capital of a company in malaysia. It is a amount of money for which shares of the company were issued to the shareholders and payment was made by the shareholders. A company may issue different types of shares with different conditions.

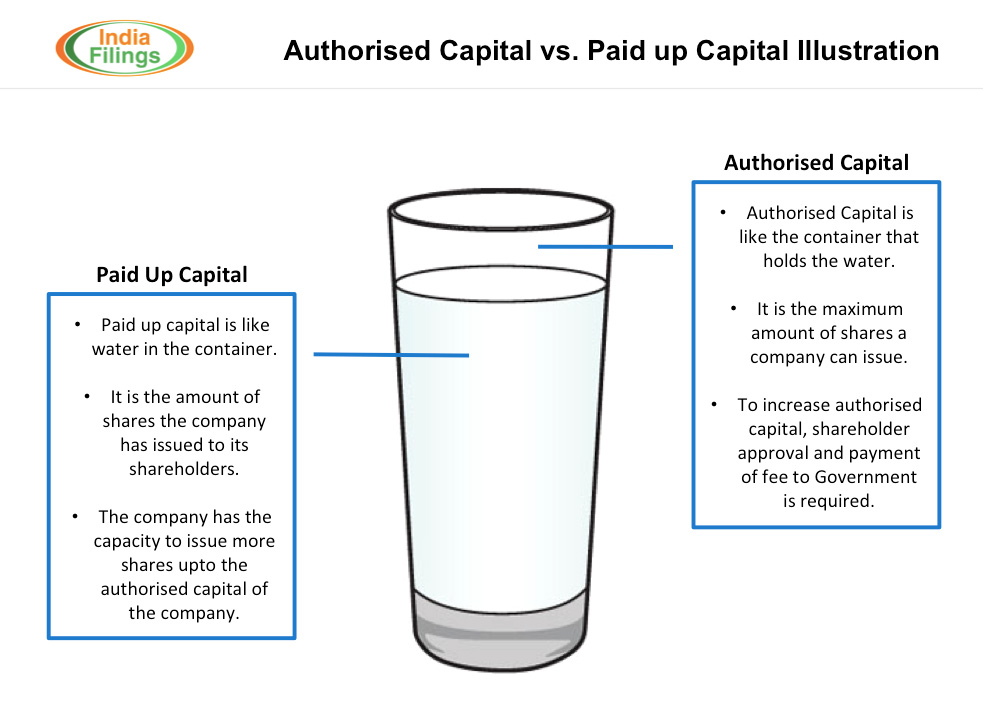

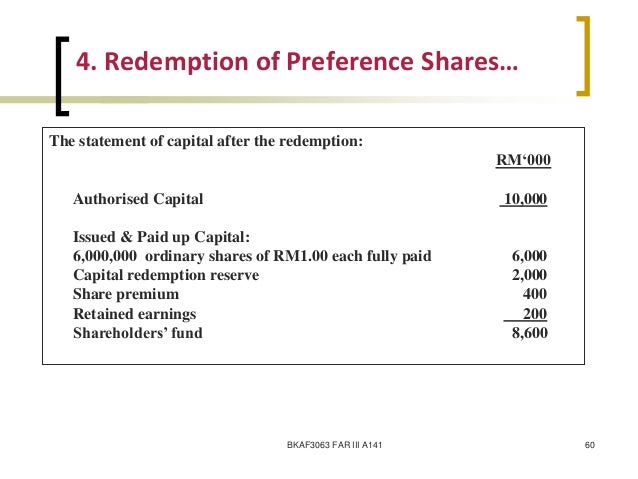

A paid up share capital is the amount of money received from the shareholders for the shares allotted to them. What is paid up capital. At any point of time paid up capital will be less than or equal to authorised share capital and the company cannot issue shares beyond the authorised share capital of the company. However there is no minimum paid up capital required.

Authorised capital vs paid up capital illustration authorised capital of a company. Upon the company s incorporation paid up capital must be paid immediately and deposited into the company s bank account. Payments to shareholders from profits of the company preference. The amount paid by the shareholders to the company for the company s financing.

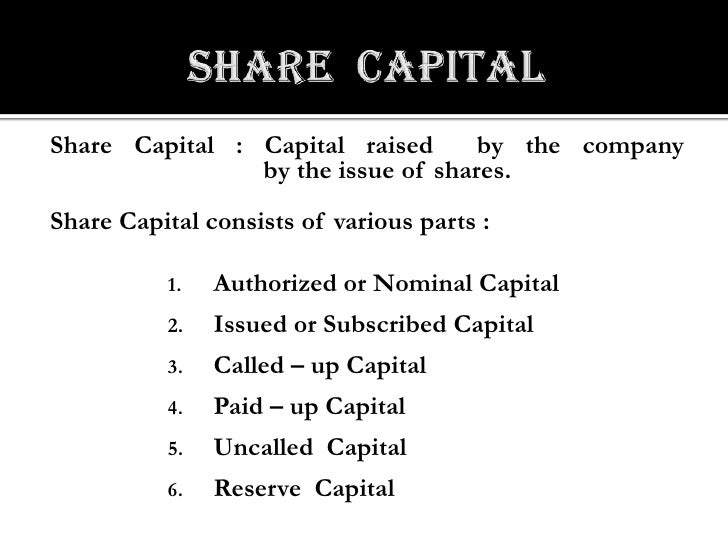

Authorise share capital is the amount for which a company can issue shares to the shareholders whereas. This is the maximum amount of the share capital in which a sdn bhd company is allowed to issue to its shareholders. Any time the authorized share capital changes these changes. These shares may be ordinary shares preference shares or some other class of shares.

Finding authorized versus paid up capital. Issued capital comprises of paid up share capital the amount of share capital already paid to the company by the company s shareholders and unpaid share capital. Difference between authorized and issued paid up share capital. Issued share capital is the total amount of consideration i e.

The authorised capital of a company is the maximum amount of share capital for which shares can be issued by a company. Paid up capital refers to the amount that has been paid up on shares that have been issued by the company. The initial authorised capital of the company is mentioned in the memorandum of association of the company and is usually rs. A paid up share capital should always be less than the authorized share.

Authorized share capital is the maximum extent of funding that can be raised through issue of shares. The capital clause of moa mentions it. The capital clause of moa mentions it. Money and other assets that shareholders have contributed to.

How is paid up capital different from share capital.