What Is Authorised Capital

Authorised capital is indicated in moa.

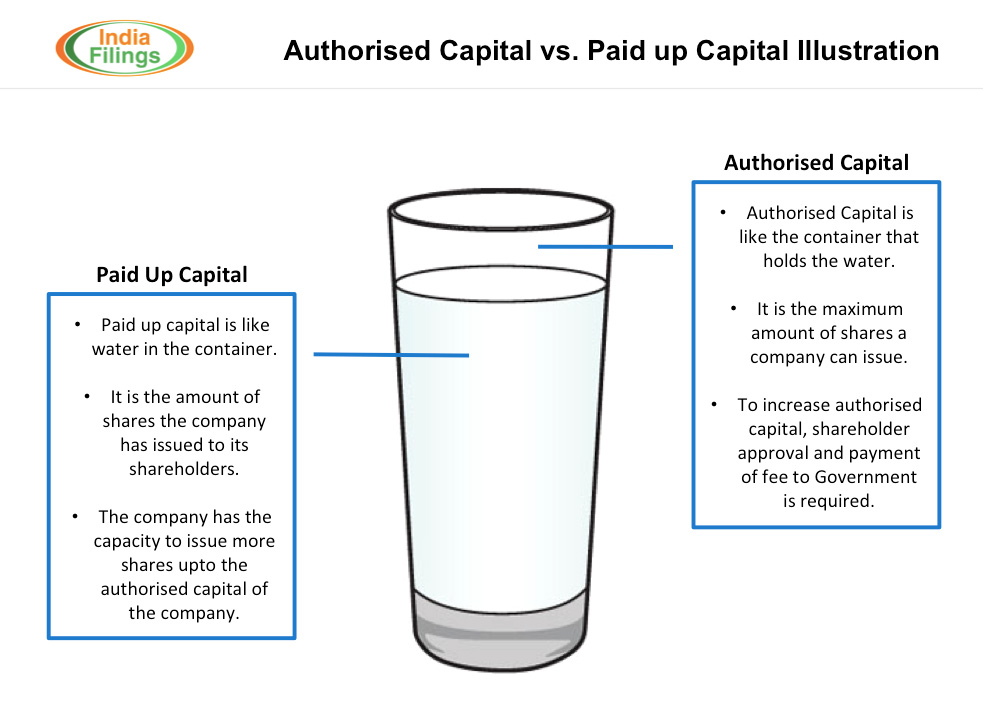

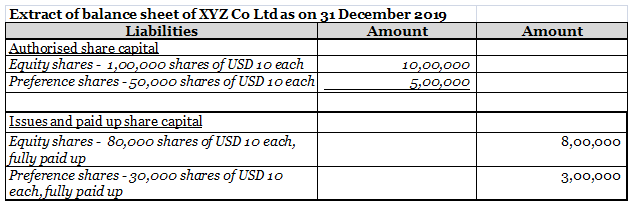

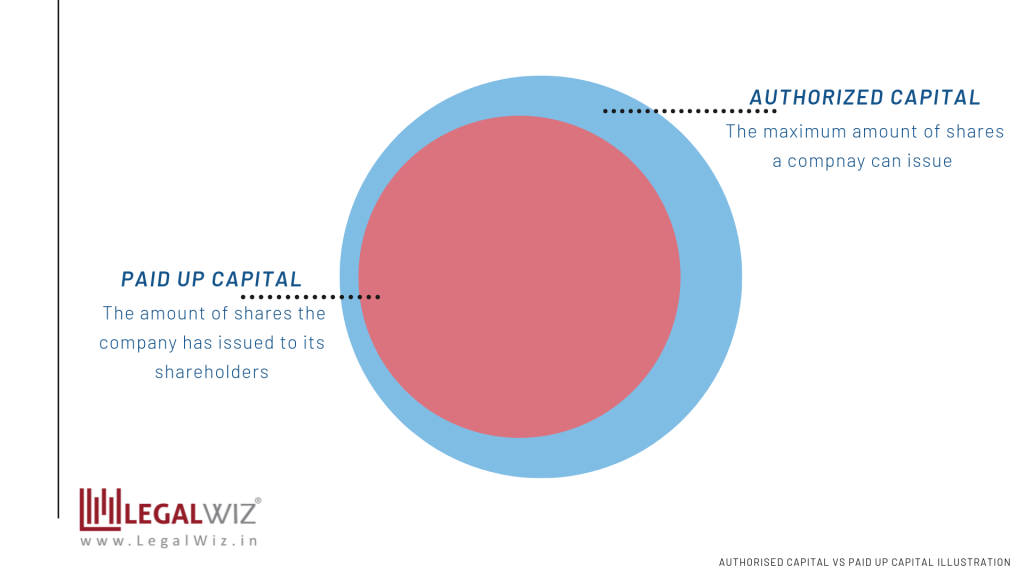

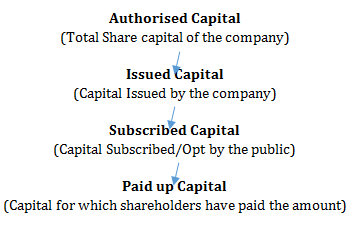

What is authorised capital. As per moa the maximum capital a company can raise by issuing shares to public is capped as authorised capital. This means that if a company decides that it can issue up to a maximum of 100 million shares with a par value of 1 the authorised capital of the company would be 100 million. The company s charter documents include its memorandum and articles of association. The authorised capital of a company is the maximum amount of share capital for which shares can be issued by a company.

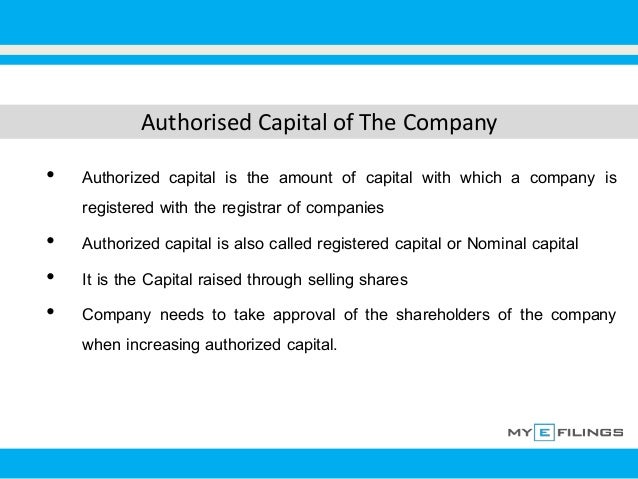

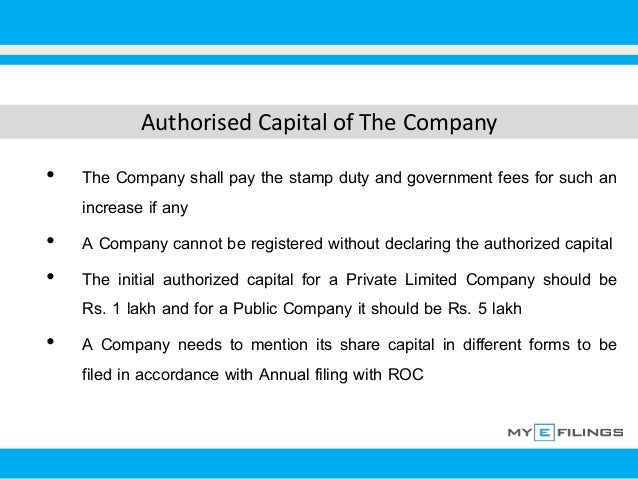

The maximum equity capital a company can raise which is mentioned in the memorandum of association and articles of association of the company. The initial authorised capital of the company is mentioned in the memorandum of association of the company and is usually rs. Authorized share capital is the maximum value of share capital face value that can be raised by a company by issue of shares as specified by the its charter documents. The authorised capital of a company sometimes referred to as the authorised share capital registered capital or nominal capital particularly in the united states is the maximum amount of share capital that the company is authorised by its constitutional documents to issue allocate to shareholders.

Maximum value and amount of total shares that a company is authorized to issue legally is termed as authorized capital or authorized share capital. Authorized share capital is. The authorized capital is the maximum amount of capital that a company can raise through the issue of shares to the shareholders. However share premium is excluded from the.

In other words the capital amount with which a company is registered with the registrar of the company as stated in the article of incorporation is called the authorized capital. It is the maximum amount a company can raise as capital in the form of both equity shares and preference shares during its lifetime.