What Is Authorised Capital Of A Company In India

When you look at the minimum amount of authorized capital for private limited companies and opcs is inr 1 lakh.

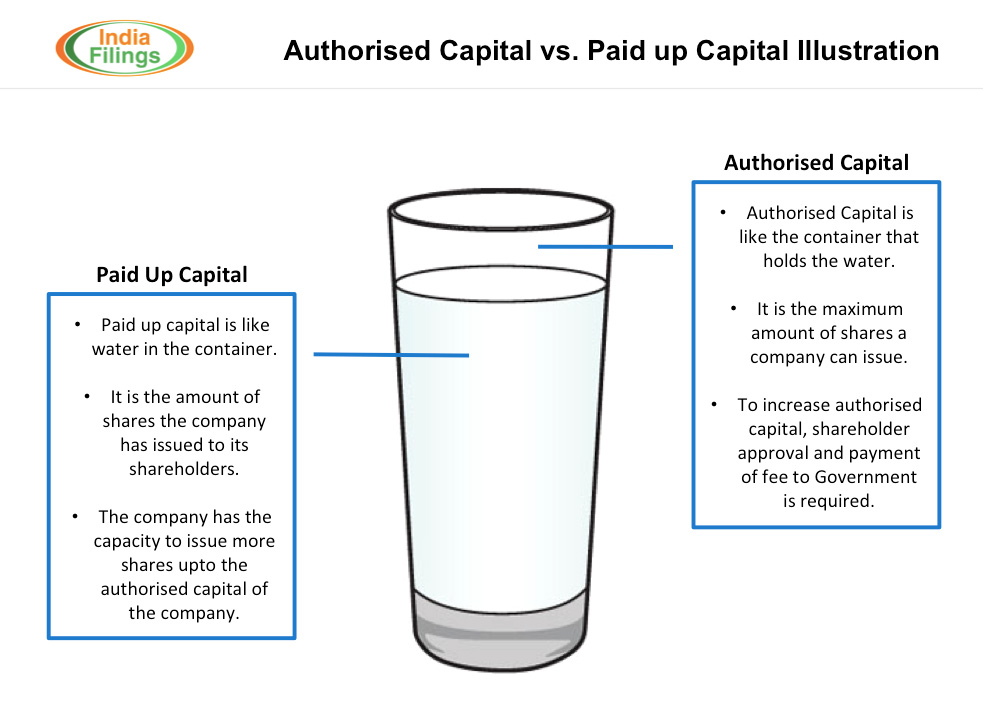

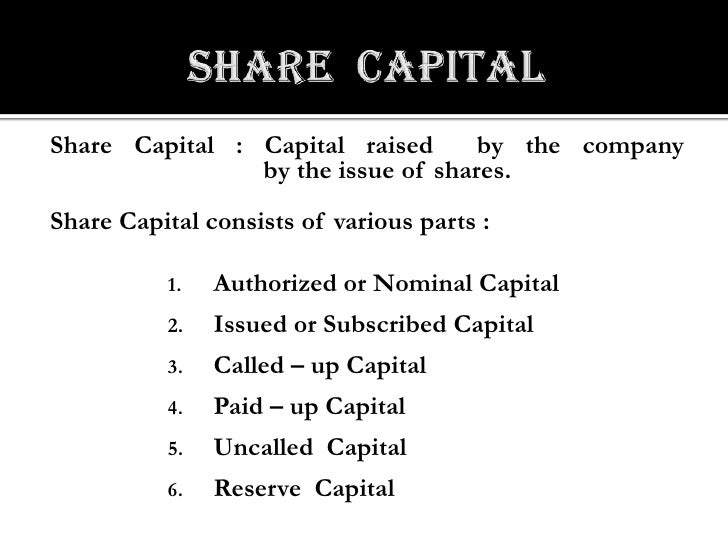

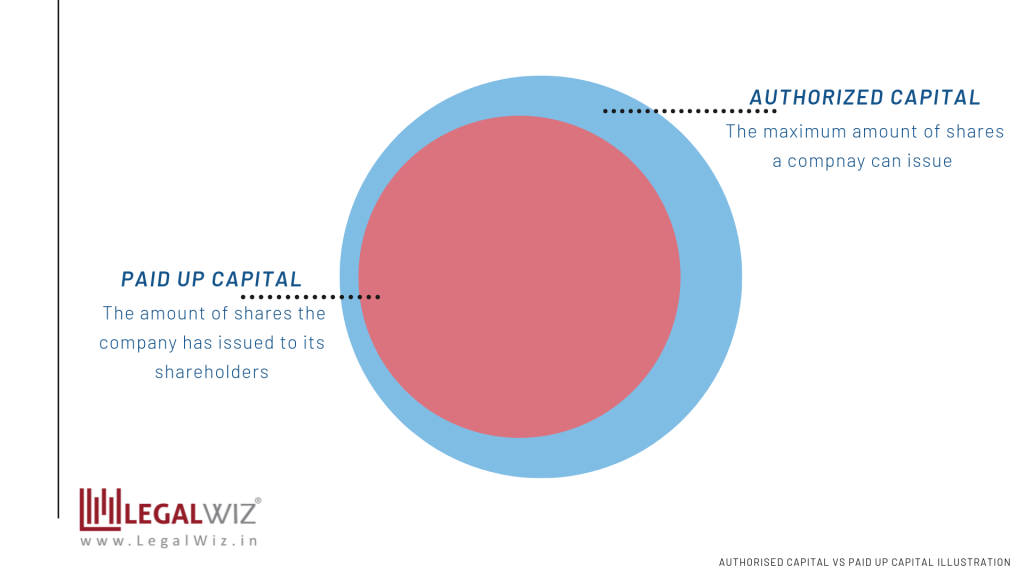

What is authorised capital of a company in india. Authorized share capital is. The device of the authorised capital is used to limit or control the ability of the directors to issue or allot new shares which may have consequences in the control of a company or otherwise alter the balance of control between shareholders. Authorised share capital it is the maximum amount of the capital for which shares can be issued by the company to shareholders. Authorised capital of a private limited company is the maximum value of shares a company can allot to its shareholders.

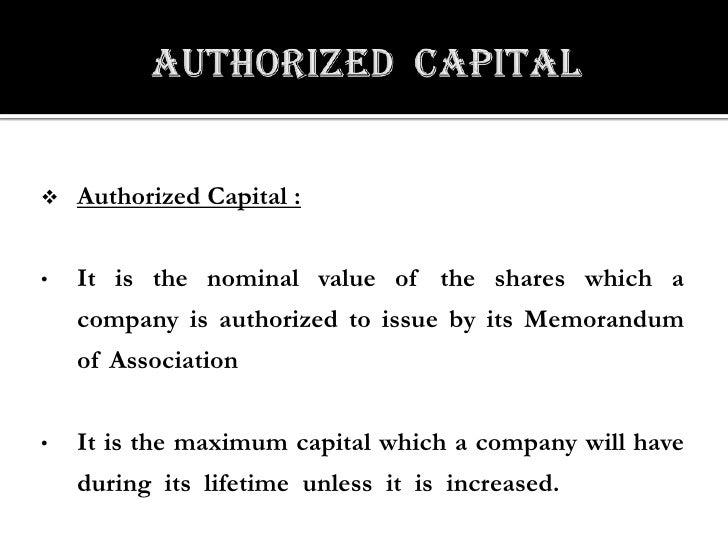

Issued shares or outstanding shares on the other hand is the amount of shares issued by the private limited company to its shareholders. This sets a limit on the capacity of the company to raise its equity capital. The initial authorised capital of the company is mentioned in the memorandum of association of the company and is usually rs. Authorised capital of a company the authorised capital of a company is the maximum amount of share capital for which shares can be issued by a company.

This means that if a company decides that it can issue up to a maximum of 100 million shares with a par value of 1 the authorised capital of the company would be 100 million. Authorised capital is the maximum number of shares a company can issue multiplied by its par value or the nominal value of one share in the company. Authorized share capital is the number of stock units shares that a company can issue as stated in its memorandum of association or its articles of incorporation. The authorized capital of 1 lakh is alloted by the ministry of corporate affairs mca for private limited company after its incorporation it helps to decide value of shares that they will receive in return to their investment in the company.

The government fee of company registration also depends on the authorised capital of the company. The part of the authorised capital which has been issued to shareholders is referred to as the issued share capital of the company. Authorized capital of a company during incorporation is the maximum amount of share capital that a company can issue to shareholders and this is the money founders or co founders during the registration of the startup must authorize.