What Is Authorised Capital And Paid Up Capital

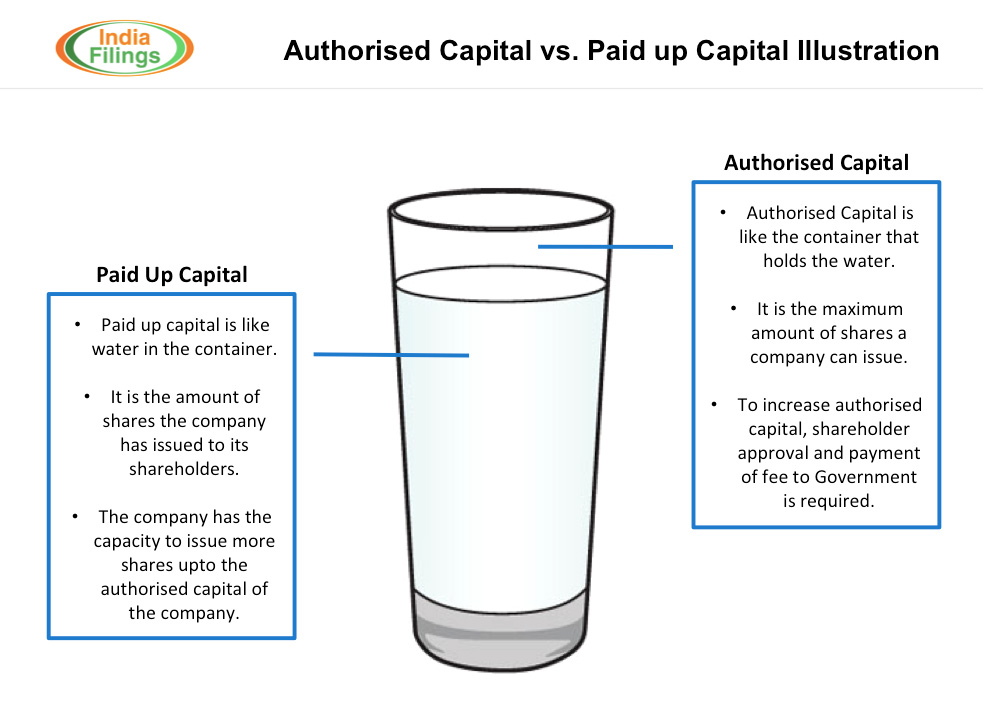

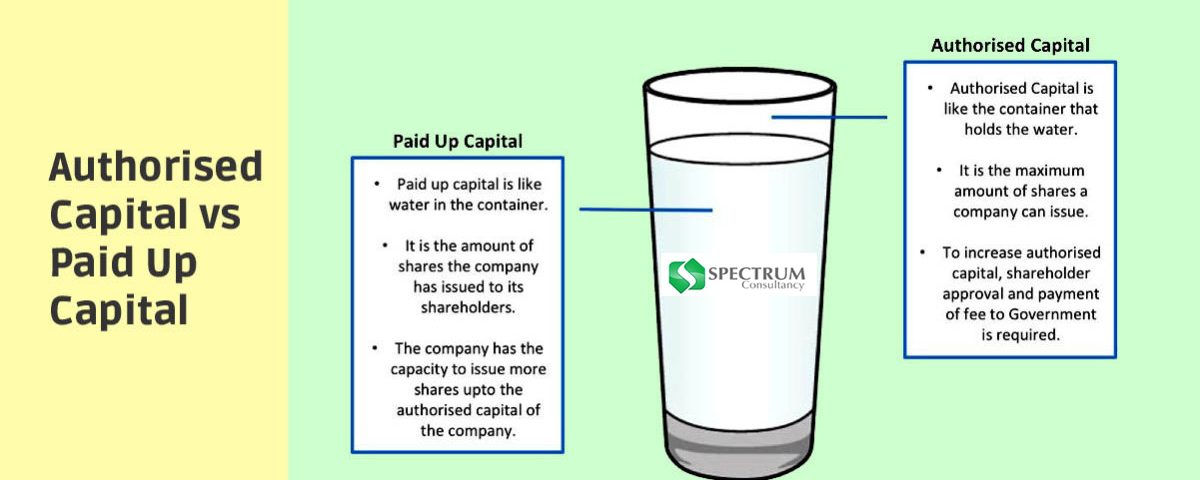

In other words the authorized share capital represents the upward bound on possible paid up capital.

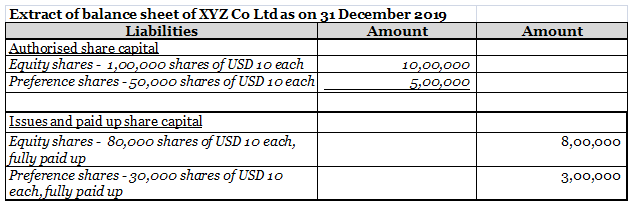

What is authorised capital and paid up capital. The authorized capital of the yes bank will be at rs 5 000 and the paid up capital will be rs 4 800. The amount of capital with which a company is registered with the registrar of companies body responsible for registration of companies it is the maximum amount of capital which a company can raise through shares i e. Paid up capital can never exceed authorized share capital. This article explains the difference between authorized and paid up capital of a private limited company in india.

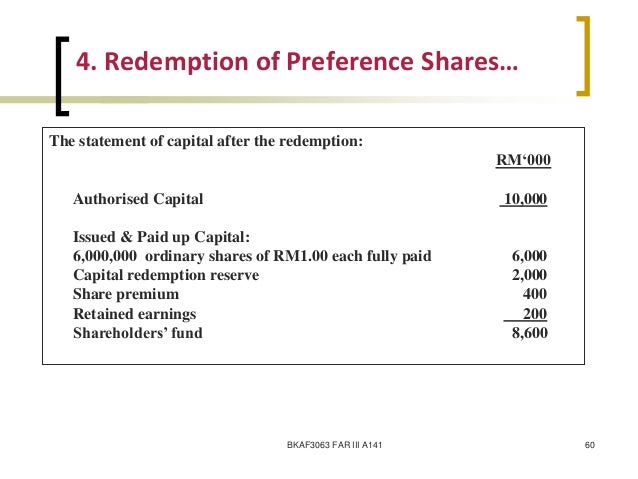

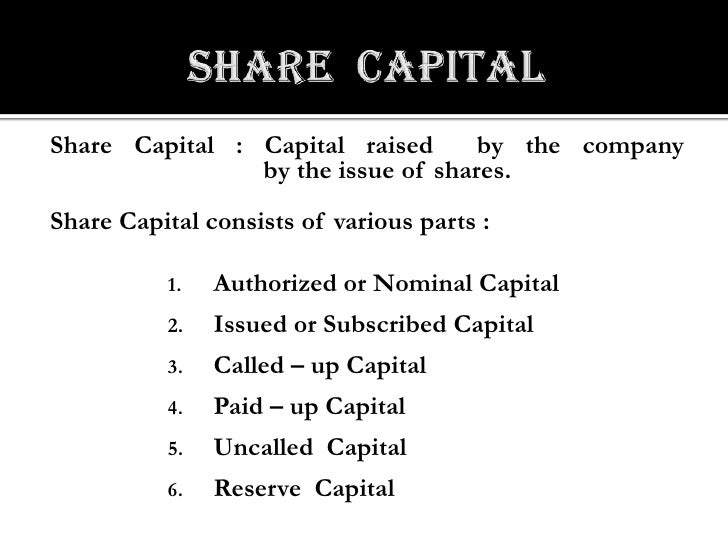

It referred to the maximum amount of share capital inclusive of paid up capital that a company was authorised to allot. Authorised capital vs paid up capital a private limited company or one person company or limited company will have its share capital classified under various types in the financial statements. It is a amount of money for which shares of the company were issued to the shareholders and payment was made by the shareholders. The authorised capital of 1 million could seem impressive to the misinformed and be misleading.

This capital is a reflection of how an equity funding is needed for a company to grow in the market. As part of a revitalisation scheme announced on friday by the reserve bank of india rbi the state bank of india sbi will take up 49 stakes in distressed private lenders yes bank. A paid up capital can never be more than the authorized capital of the company. Paid up share capital.

M v can help with capitalization needs. How is paid up capital different from authorised capital. At any point of time paid up capital will be less than or equal to authorised share capital and the company cannot issue shares beyond the authorised share capital of the company. A company can raise its finances with the help of the paid up capital which can either be in the form of initial public offering ipo or an additional issue.

Authorised capital is a concept that used to exist but abolished on 30th january 2006. Recently vide the companies amendment act 2015 the requirement for paid up capital for the company has been removed.