Tax Rate 2019 Malaysia For Sdn Bhd

Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system.

Tax rate 2019 malaysia for sdn bhd. How to pay income. What is income tax return. 2019 2020 malaysian tax booklet. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

This means that if you are aware of a 2019 tax exemption or 2019 tax allowance in malaysia that you are entitled too but it isn t listed here that we don t allow for it in this version of the malaysia salary calculator. Malaysia adopts a territorial system of income taxation. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. In the section we publish all 2019 tax rates and thresholds used within the 2019 malaysia salary calculator.

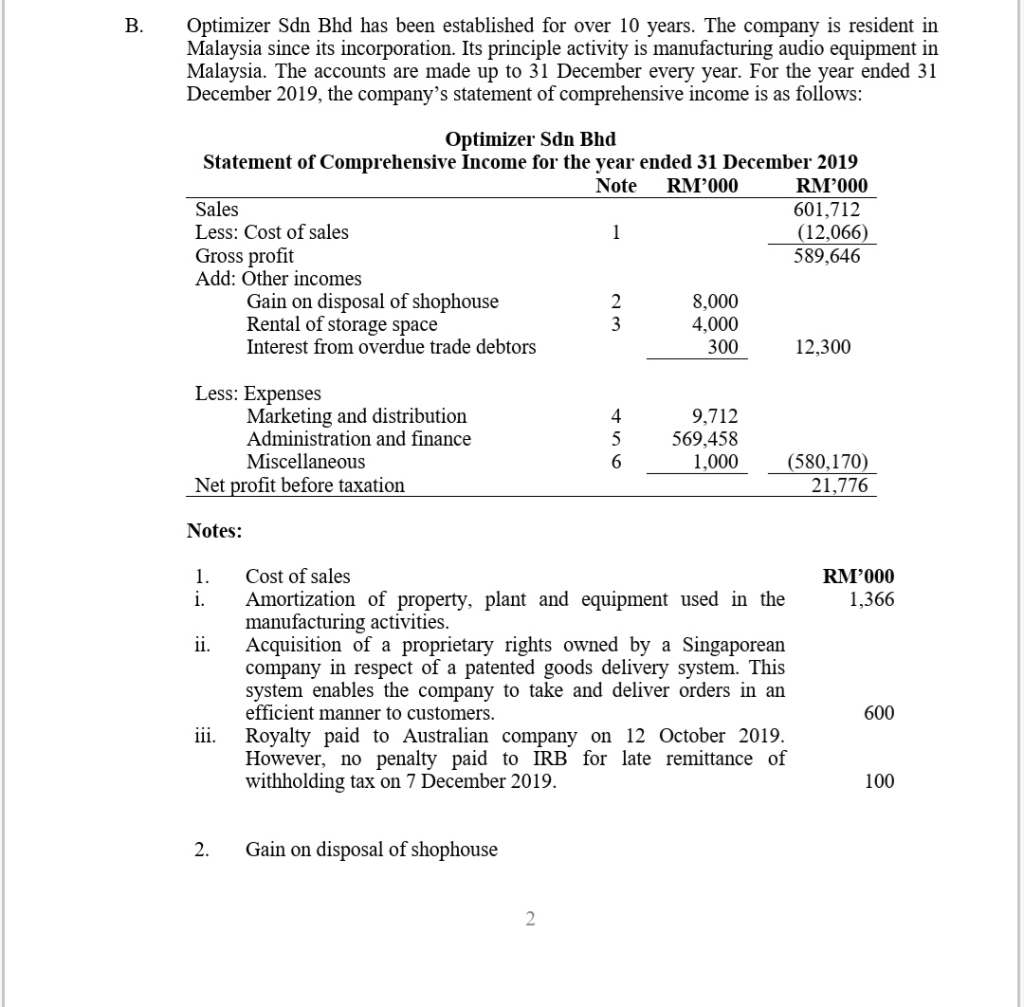

Above rm500 000 profit 25. What is tax rebate. Because sdn bhd company is taxed separately from their owners and the corporate tax rate is generally lower than the individual tax rate. Maximum tax rate for individual is 26.

The system is thus based on the taxpayer s ability to pay. Malaysia corporate income tax rate. How does monthly tax deduction mtd pcb work in malaysia. First rm500 000 profit 20.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Pricewaterhousecoopers taxation services sdn bhd 464731 m level 10 1 sentral jalan rakyat kuala lumpur sentral p o. Malaysia income tax e filing guide. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

This means that low income earners are imposed with a lower tax rate compared to those with a higher income.