Personal Tax Rate 2017 Malaysia

Corporate tax rates in malaysia.

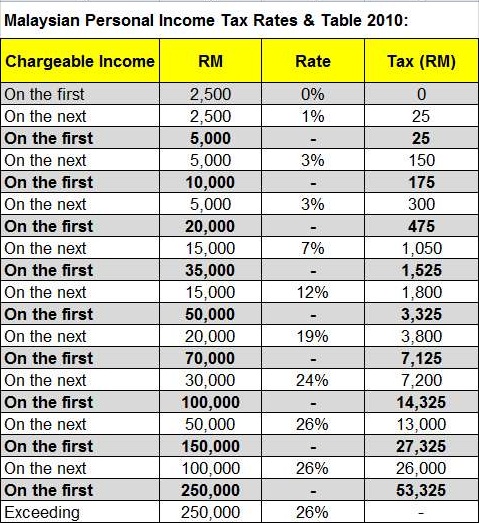

Personal tax rate 2017 malaysia. This means that low income earners are imposed with a lower tax rate compared to those with a higher income. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Green technology educational services healthcare services creative industries financial advisory and consulting. On the first 2 500.

On the first 10 000 next 10 000. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Resident companies with a paid up capital of myr 2 5 million and below as defined at the beginning of the basis period for a year of assessment ya are subject to a corporate income tax rate of 20 on the first myr 500 000 of chargeable income. On the first 35 000 next 15 000.

Rm 770 if the above is still not paid after 60 days you will be charged another 5 on the rm770 making your total tax payable come up to rm 808 50. In malaysia for at least 182 days in a calendar year. The corporate tax rate is 25. On the first 5 000 next 5 000.

Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28 a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. No guide to income tax will be complete without a list of tax reliefs.

Know the taxpayer s responsibilities. Tax relief and deductions. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. The applicable tax rates are the following.

On the first 20 000 next 15 000. On the first 50 000 next 20 000. Rate tax rm 0 2500. Technical or management service fees are only liable to tax if the services are rendered in malaysia.

For expatriates that qualify for tax residency malaysia has a progressive personal income tax system in which the tax rate increases as an individual s income increases starting at 0 percent and capped at 30 percent.