Personal Income Tax Rate 2016 Malaysia

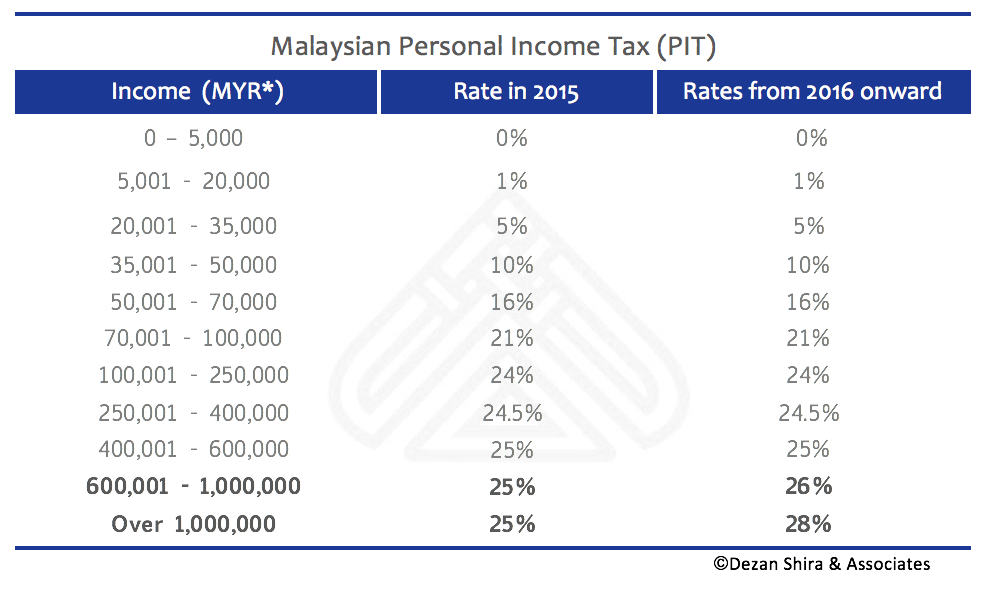

Budget 2016 introduces two new rates as follows.

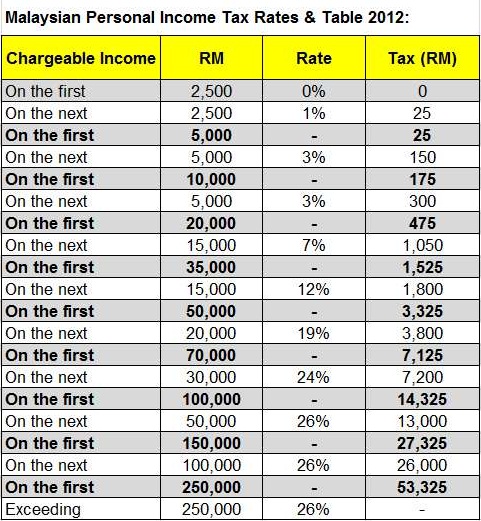

Personal income tax rate 2016 malaysia. What is tax rebate. Tax rates are on chargeable income not salary or total income. Malaysia personal income tax rate. First off we start with the table for personal income tax rates in malaysia for the assessment year 2015 so everyone would be able to cross check the tax bracket and the amount of tax needed to pay.

Personal income tax 3 rates of tax resident individuals ya 2015 ya 2016 chargeable income rm rate tax payable rm rate tax payable rm on the first on the next 5 000 15 000 1 0 150 1 0 150 on the first on the next 20 000 15 000 5 150 750 5 150 750 on the first on the next 35 000 15 000 10 900 1 500 10 900 1 500 on the first on the next. The corporate tax rate is 25. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Tax relief for each child below 18 years of age is increased from rm1 000 to rm2 000 from year of assessment 2016.

Tax relief for children who provide for their parents is given total tax. Under existing tax rules resident taxpayers in malaysia are taxed on a sliding scale from 0 percent on the first myr5 000 usd1 170 of taxable income up to 25 percent for income exceeding myr400 000. Non resident individuals pay tax at a flat rate of 30 with. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. And 28 for income exceeding myr1m. Chargeable income is calculated after tax exemptions and tax reliefs more below. What is a tax exemption.

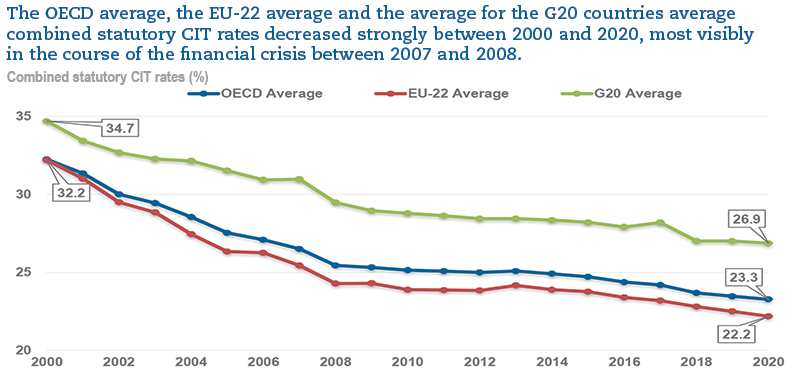

26 percent for income between myr600 001 to myr1m. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Corporate tax rates in malaysia. Malaysia personal income tax guide for 2020.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Green technology educational services. Tax relief for individual taxpayer whose spouse has no income is increased from rm3 000 to rm4 000.

Other income is taxed at a rate of 26 for 2014 and 25 for 2015. The fixed income tax rate for non resident individuals be increased by 3 from 25 to 28 from ya 2016. Non residents are subject to withholding taxes on certain types of income.