Malaysia Income Tax 2016

The amount of monthly tax deduction of additional remuneration before the year 2016 which is received in the current year shall be calculated in accordance with the method and table of monthly tax deduction applicable for the year it is.

Malaysia income tax 2016. Tax relief for children who provide for their parents is given total tax. The fixed income tax rate for non resident individuals be increased by 3 from 25 to 28 from ya 2016. Amendment at income tax deduction from remuneration determination of amount of monthly tax deduction for additional remuneration of previous years. Most malaysians are unaware of the differences between tax exemptions tax reliefs tax rebates and tax deductibles.

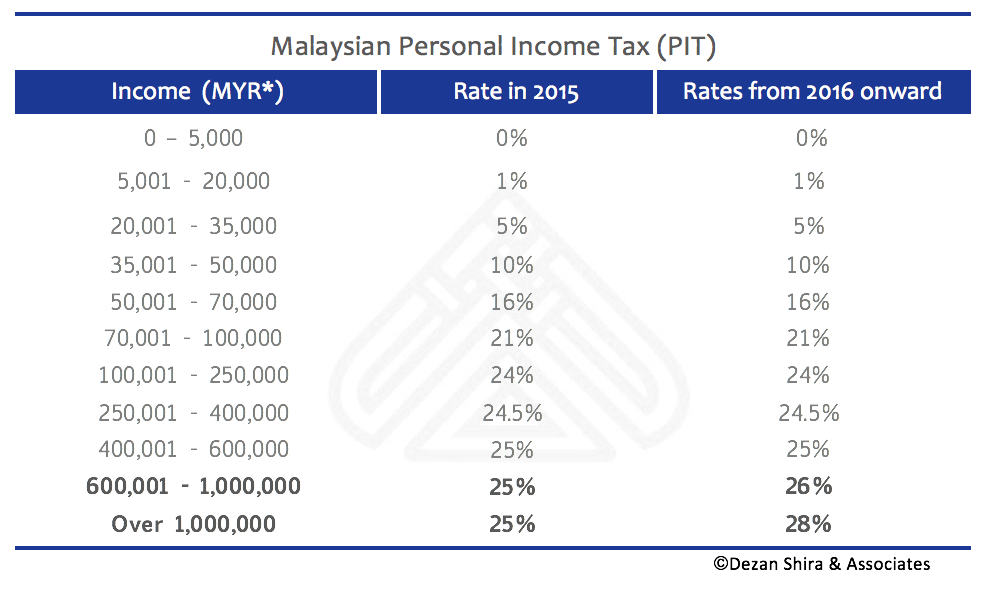

Ya 2015 ya 2016 chargeable income rm rate tax payable rm rate tax payable rm on the first on the next 5 000 15 000 1 0 150 1 0 150 on the first on the next 20 000 15 000 5 150 750 5 150 750. You will never have less net income after tax by earning more. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.

150 tarikh kemaskini. However there is real property gains tax rpgt. Calculations rm rate tax rm 0 5 000. Contents 1 corporate income tax 1 2 income tax treaties for the avoidance of double taxation 5 3 indirect tax 7 4 personal taxation 8 5 other taxes 9 6 free trade agreements 10.

Tax relief for each child below 18 years of age is increased from rm1 000 to rm2 000 from year of assessment 2016. There is no capital gains tax in malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information.

Kuala lumpur 30 march 2016 preparing and filing your income tax in malaysia can be a challenging and anxiety inducing experience every year for most people. Tax rates are on chargeable income not salary or total income chargeable income is calculated after tax exemptions and tax reliefs more below. Tax relief for individual taxpayer whose spouse has no income is increased from rm3 000 to rm4 000. Calculations rm rate tax rm 0 5 000.

Following the tabling of budget 2016 it was announced that high income earners who are earning more than rm1 million per annum will be charged 28 income tax which is an increase of 3 from the previous year. Malaysia has a progressive income tax system which means the more you earn the more you will need to pay. Income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from. Tax rates are progressive so you only pay the higher rate on the amount above the rate i e.

Assessment year 2016 2017.