Malaysia Corporate Tax Rate Ya 2020

International tax malaysia highlights 2020 updated january 2020.

Malaysia corporate tax rate ya 2020. The standard malaysia corporate tax rate is of 24 for the financial year of 2019 2020 this rate being applied to both resident companies and to non resident companies. Rates corporate income tax rate 24 in general branch tax rate 24. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Which has a paid up capital of ordinary shares of rm2 5 million or less at the beginning of the basis period of a ya provided.

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Malaysia corporate income tax rate for a company whether resident or not. Ya 2020 are taxed at the following scale rates. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less and with annual sales of not more than rm50 million w e f.

Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. These proposals will not become law until their enactment and may be amended in the course of their passage through. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

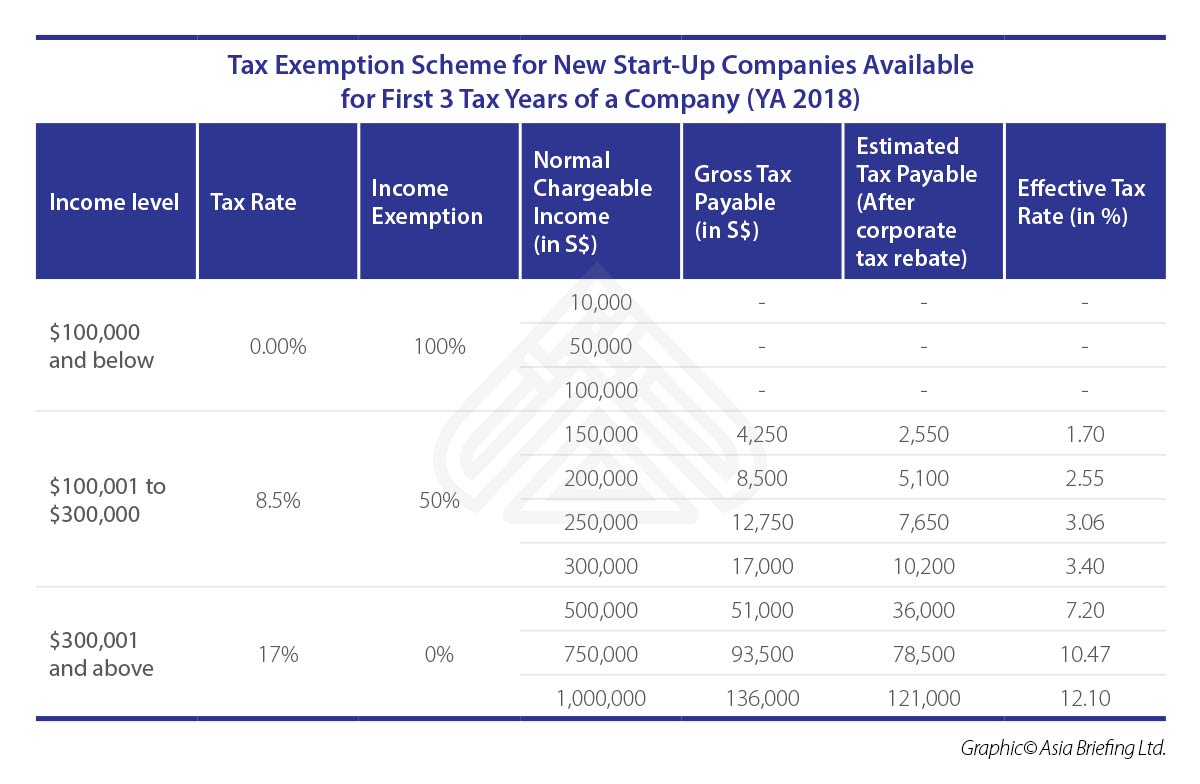

However in the case of a resident company the malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non resident entities. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Increased from myr 500 000 as from ya 2020 with the balance being taxed at the 24 rate.