Malaysia Corporate Tax Rate 2019 Table

This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Malaysia corporate tax rate 2019 table. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Malaysia adopts a territorial system of income taxation. Malaysia corporate income tax rate.

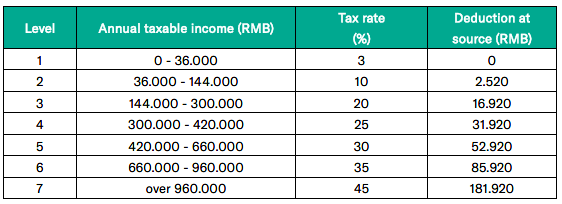

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Resident company with paid up capital of rm2 5 million and below at the beginning of the basis period sme note 1 on first rm500 000 chargeable income 17.

The corporate tax rate in malaysia stands at 24 percent. There are no other local state or provincial. List of countries by corporate tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. No other taxes are imposed on income from petroleum operations.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Malaysia income tax e filing guide. Income attributable to a labuan business. These proposals will not become law until their enactment and may be amended in the course of their passage through.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. What is tax rebate.

How to pay income. How does monthly tax deduction mtd pcb work in malaysia.