Islamic Credit Card Concept

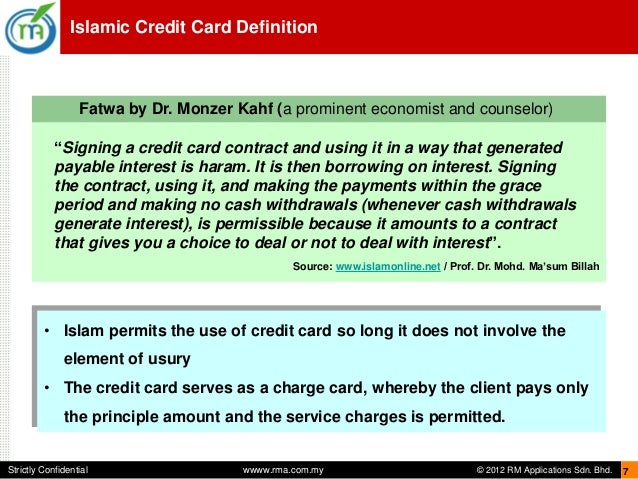

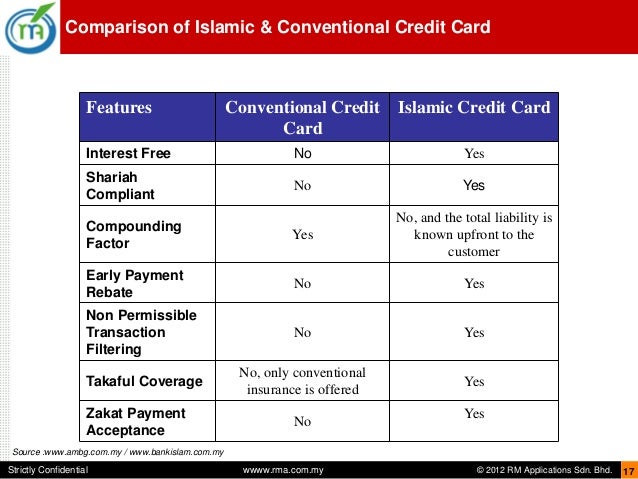

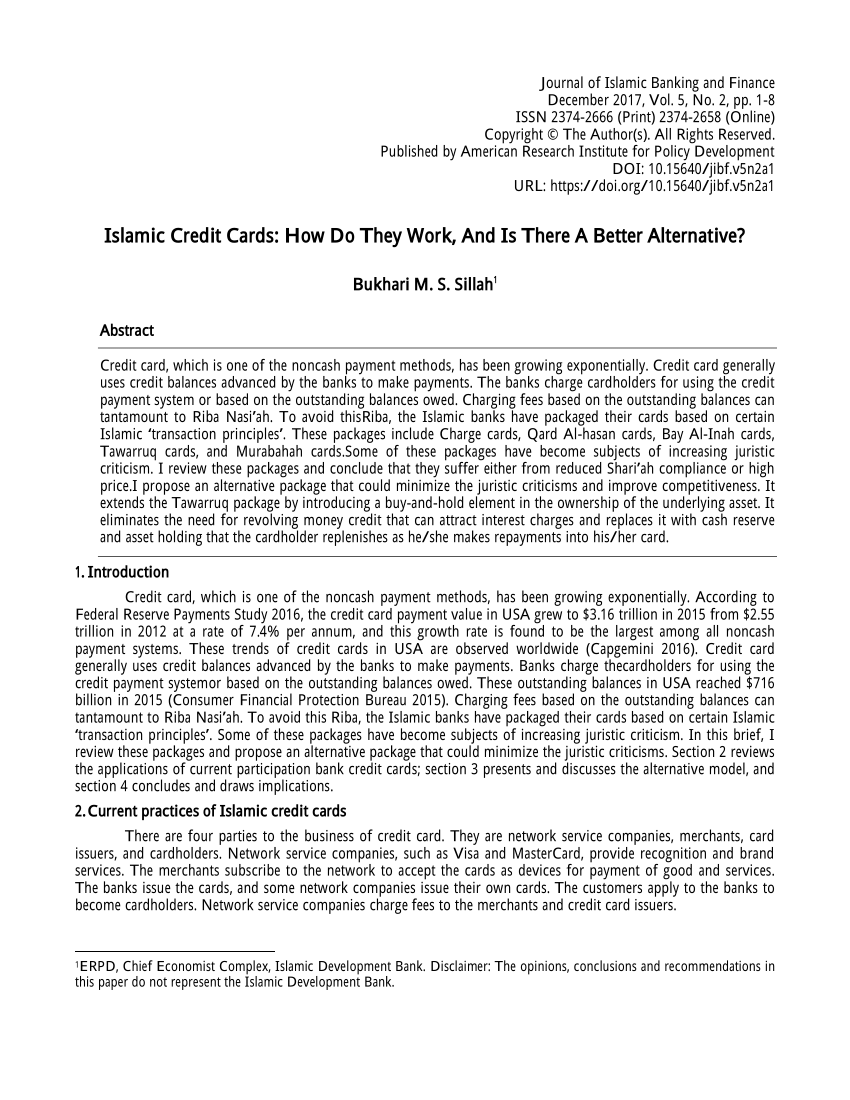

The islamic credit card is defined as a means of electronic payment including a deferred payment respecting the principles of islamic law and guided by the rules of islamic finance which bans any interest bearing revolving credit facility.

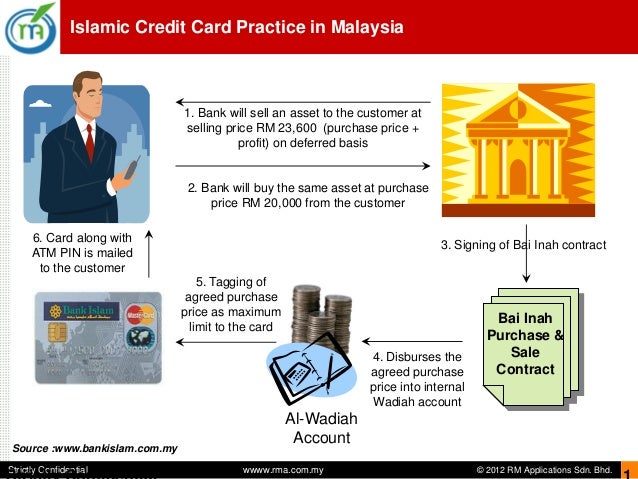

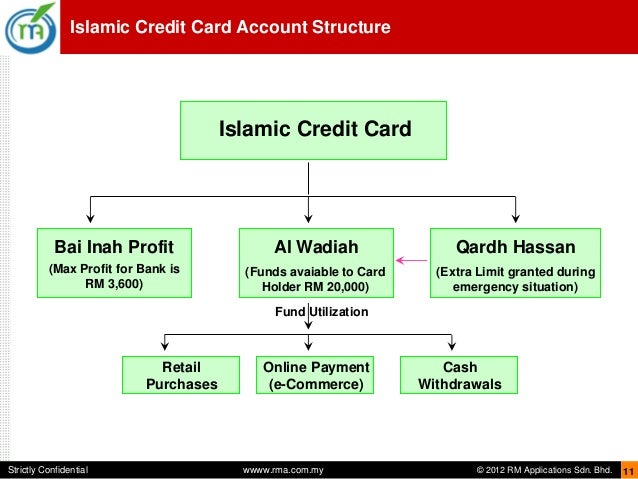

Islamic credit card concept. Overtly an icc is different than its conventional peer. This is an agreement between the financier and the recipient. An islamic credit card also known as credit card i in malaysia offers a viable option for muslims to have the convenience of a credit card while keeping true to their faith. Shari ah credit cards consist of three permissible contract structures that make it different from a conventional credit card namely kafalah wakalah and qard.

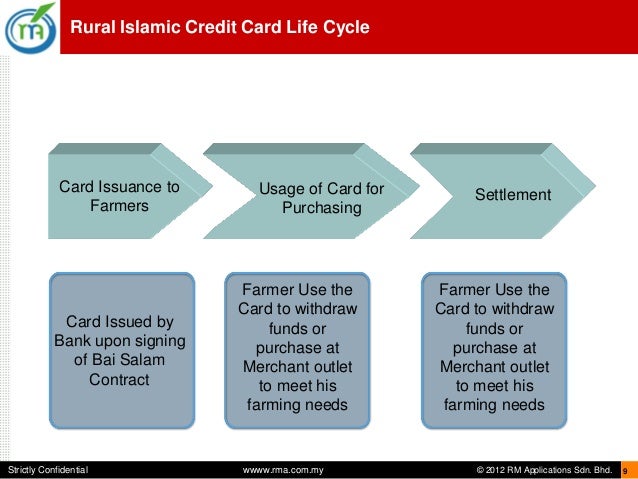

For many years an islamic credit card proposition has been a challenge to islamic banks to develop as a viable proposition. The bank acting as the financier is obliged to provide funding and the recipient is obliged to make payments in return for the financing he receives. Otherwise the payment to the card issuer can be made from cash funds obtained from an islamic bank through tawarruq murabaha with the cash funds repayable on a deferred payment basis. For muslims an islamic credit card is an assurance that the financial product is shariah compliant and adheres to islamic teachings.

As goods are purchased using this credit card the bank will render the transaction on your behalf and simultaneously. An islamic card uses the concept of ta widh for its transactions. The availability of islamic credit cards helps to increase the customer base of islamic banks. Islamic banking adheres to shariah which is the islamic religious law as defined in the quran hadith and sunnah.

The bank s source of financing is presently limited to deposit taking activities the islamic money market and sukuk. Using the principles of al bai bithaman ajil deferred payment sale the bank issues an interest free and penalty free credit card. It s also an alternative option for non muslims as you don t necessarily have to be muslim to have an islamic credit card. Hence it mends the banks sources of funding.