Income Tax Rate 2019 Malaysia Pdf

From year of assessment 2019 2.

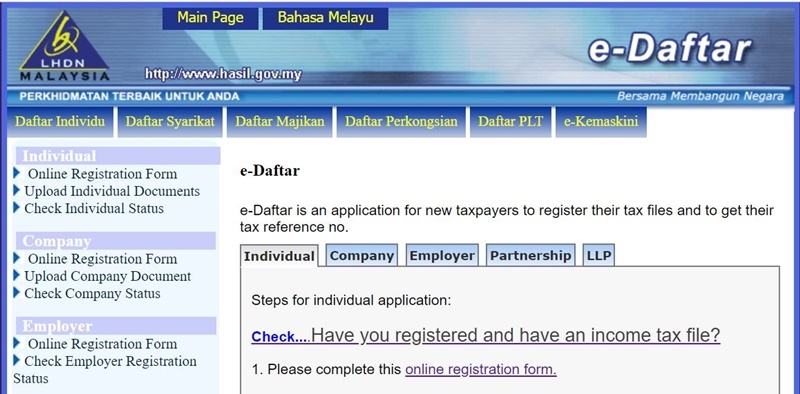

Income tax rate 2019 malaysia pdf. Malaysia income tax e filing guide. It is deductible from income tax before calculating education cess. Income tax 40 3 other direct tax 2 6 non tax revenue 27 2 indirect tax 13 1 borrowings and use of government s assets 16 8 security 2 3 emoluments 26 1 debt service charges 10 5 supplies and services 9 2 retirement charges 8 4 economic 9 3 other expenditure 18 9 subsidies and social assistance 7 1 grants and transfers to state. Income tax return for 2 yas or more rm1 000 to rm20 000 or imprisonment or both and 300 of tax liability on conviction.

The survey was discussed at a meeting of the economic and development review committee on 24 april 2019 and is. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Non resident individual huf net income range income tax rates health and education cess up to rs. 2 tax rate for companies.

Individual income tax relief on net annual savings in the national education savings scheme current position individual income tax relief of. How does monthly tax deduction mtd pcb work in malaysia. The amount of rebate is 100 per cent of income tax or rs. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

12 500 whichever is less. 6 december 2019 page 1 of 19. For public servants under the pension scheme the income tax relief on takaful contributions or payment for life insurance premiums is given up to rm7 000. Green technology educational services.

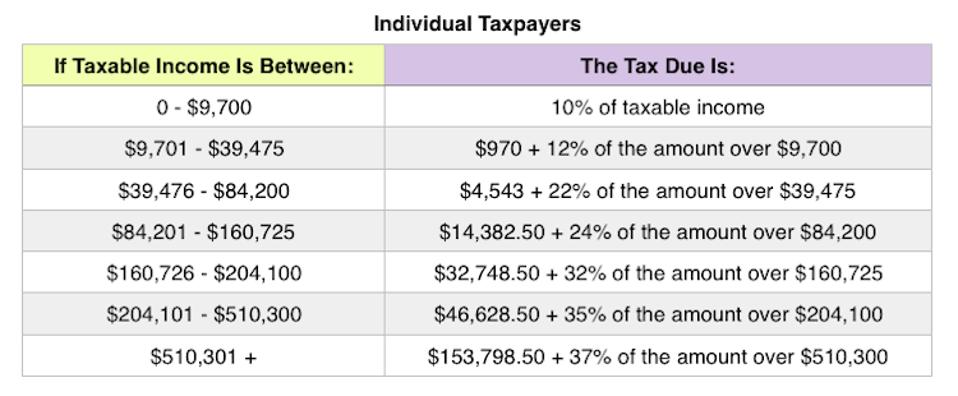

Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5 400 000 83 650 25 600 000 133 650 26 1 000 000 237 650 28 a qualified person defined who is a. 9 2019 inland revenue board of malaysia date of publication. Section 138a of the income tax act 1967 ita. Or 300 of tax payable in lieu of prosecution 2018 2019 malaysian tax booklet income tax.

How to pay income. 2018 2019 malaysian tax booklet 22 rates of tax 1. What is income tax return. This overview is extracted from the 2019 economic survey of malaysia.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. What is tax rebate.