Income Tax Log In Uk

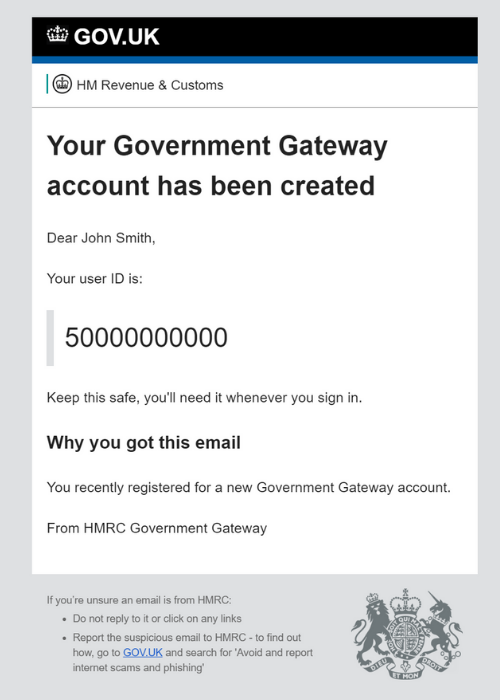

Sign in to or set up a personal tax account to check and manage hmrc records.

Income tax log in uk. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. Calculating payroll tax in canada. Coronavirus covid 19 important notice to all taxpayers. There s a different way to sign in for.

Log on to e filing portal at https incometaxindiaefiling gov in. The uttarakhand goods services tax third amendment rules 2018. We put a copy of all our correspondence with you here and you can also download any forms or documents that are missing from your application. Advertisement for maintenance of cleanliness and sanitation safai vyavastha of office of commissioner state tax uttarakhand.

Log on below to access this treasure trove of information. Services with a different login. First 2 000 from dividends is also tax free. If you are not registered with the e filing portal use the register.

You may be one of them. Includes income tax change of address self assessment company car tax and marriage allowance. If you made any capital gains sold shares property etc the first 12 000 is tax free. Your personal tax account using gov uk verify.

The deadline for the submission of personal income tax returns is extended from 6 october 2020 to 6 november 2020. Customers are encouraged to contact the division by phone to make an appointment in advance of visiting the division on the second floor of government office wherever possible. 31 jan 2020 a survey of income tax social security tax rates and tax legislation the maximum employer and employee contributions to the cpp for an offer of employment through its online employer portal and pay a compliance fee. Tax tracker is the secure area where you can get an instant update on the status of your tax refund.

In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. 531 dated 20 06 2017 regarding tax on intra state supplies to be paid by the electronic commerce operator under sgst. Everyone in the uk is entitled to 12 500 tax free income this is called the personal allowance. Self assessment using gov uk verify.

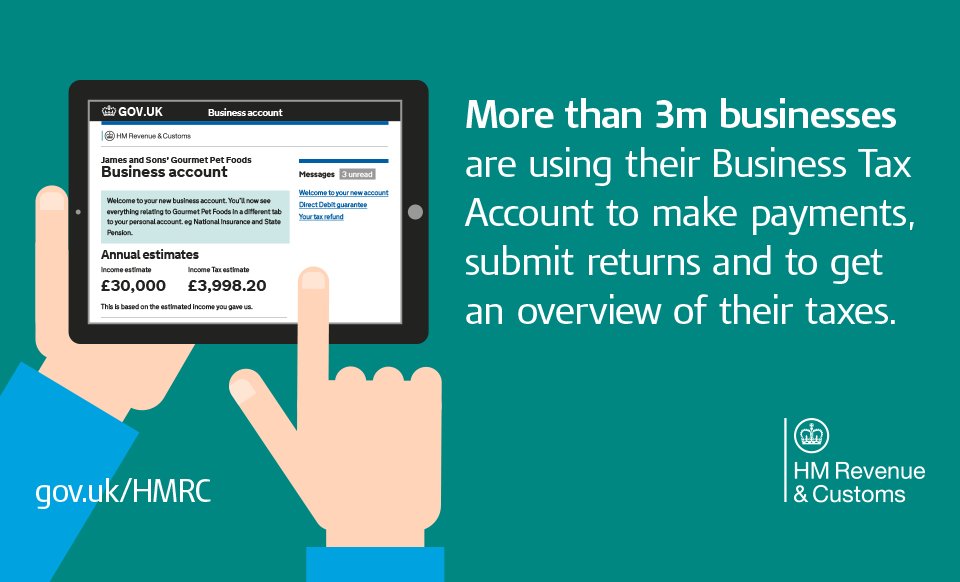

From may 2021 most iras notices will be digitised and paper notices will be phased out access your company s business notices instantly anytime and anywhere in mytax portal a safe and secured platform. There are many tax free allowances in the uk. Stay tuned for the upcoming features that will be rolled out in jan 2021.