How To Submit Income Tax

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

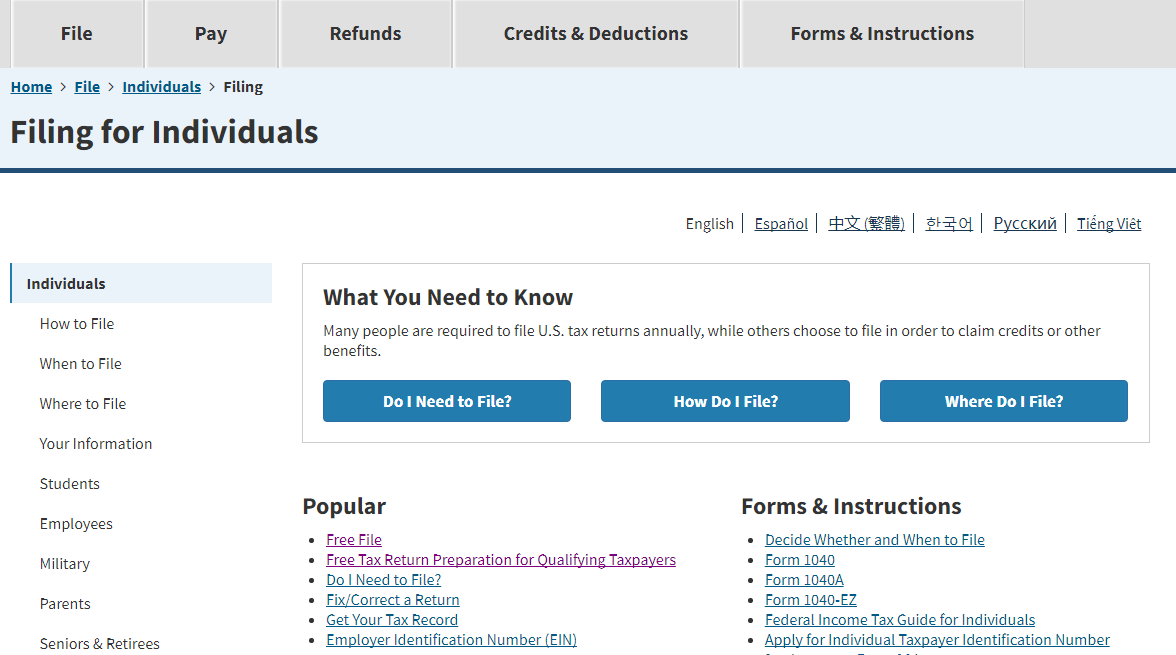

Through mytax portal for dbs posb and ocbc account holders applying for individual income tax and property tax only through dbs posb ocbc or uob internet banking websites for individual income tax and property tax only at axs stations if you are a dbs posb customer for individual income tax and property tax only.

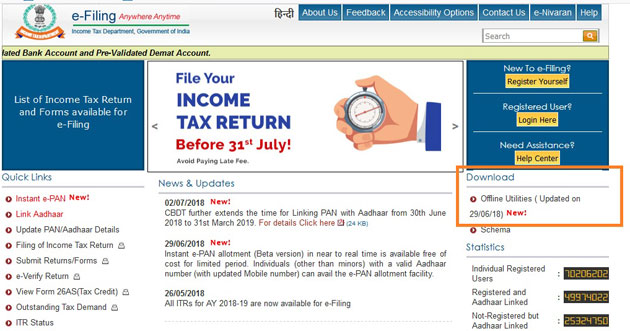

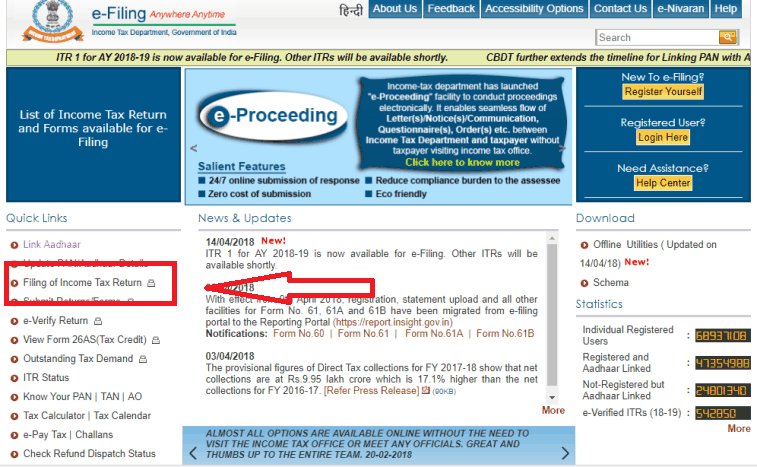

How to submit income tax. You did not have any income in the preceding year. To file your tax return please log into mytax portal using your singpass. It does not matter how much you earned in the previous year or whether your employer is participating in the auto inclusion scheme ais for employment income. This method of e filing is becoming popular among taxpayers for its simplicity and user friendliness.

You must file an income tax return if you receive a letter form or an sms from iras informing you to do so. Taxpayers who does not derive an income from any business using the e filing system has been given until 30 april 2016 to submit their income tax returns. Notification to file income tax return. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

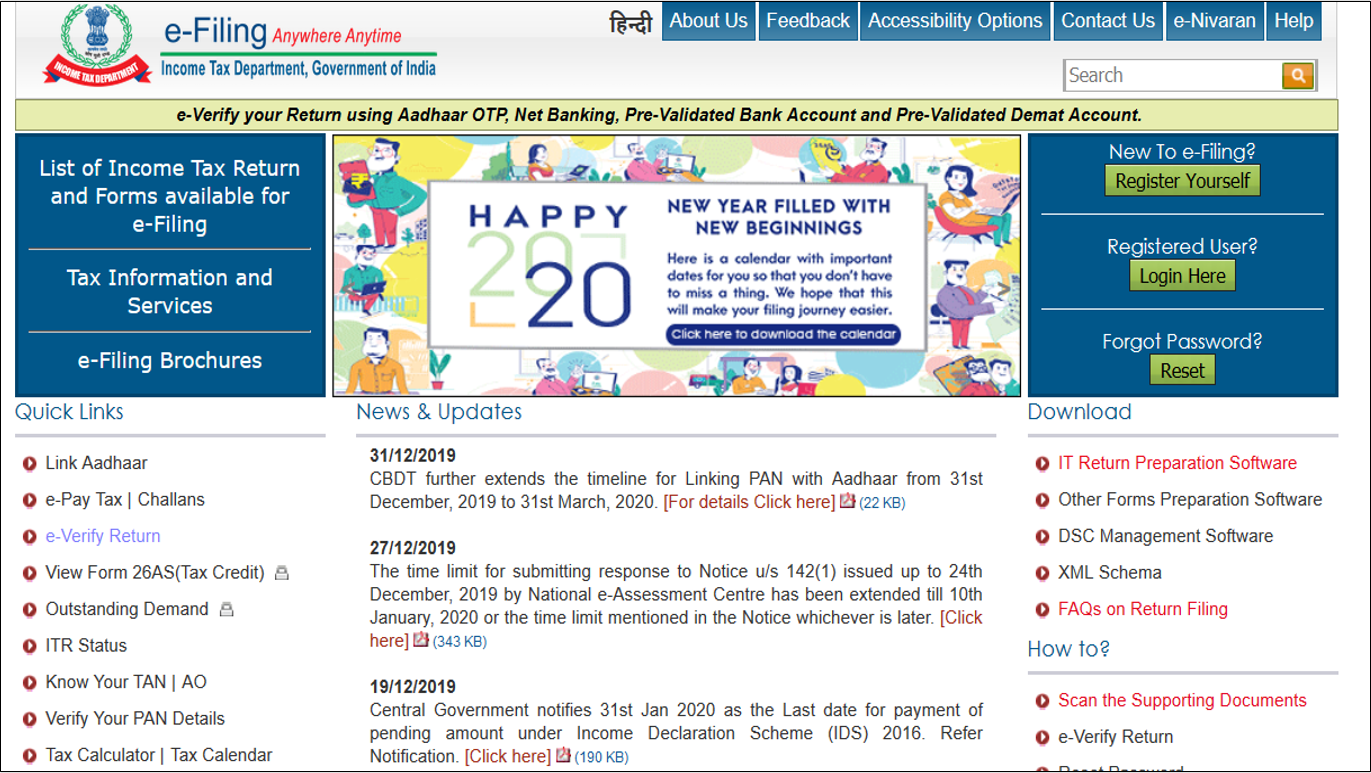

It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Ezhasil e filing is a most convenient way to submit income tax return form itrf. Or you have only employment income and your employer is participating in the auto inclusion scheme ais and will e submit your employment income details to iras. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Taxpayers can start submitting their income tax return forms through the e filing system starting from march 1 of every year unless otherwise announced by lhdn.