How To Submit Income Tax Return In Bangladesh

It aims at ensuring equity and social justice.

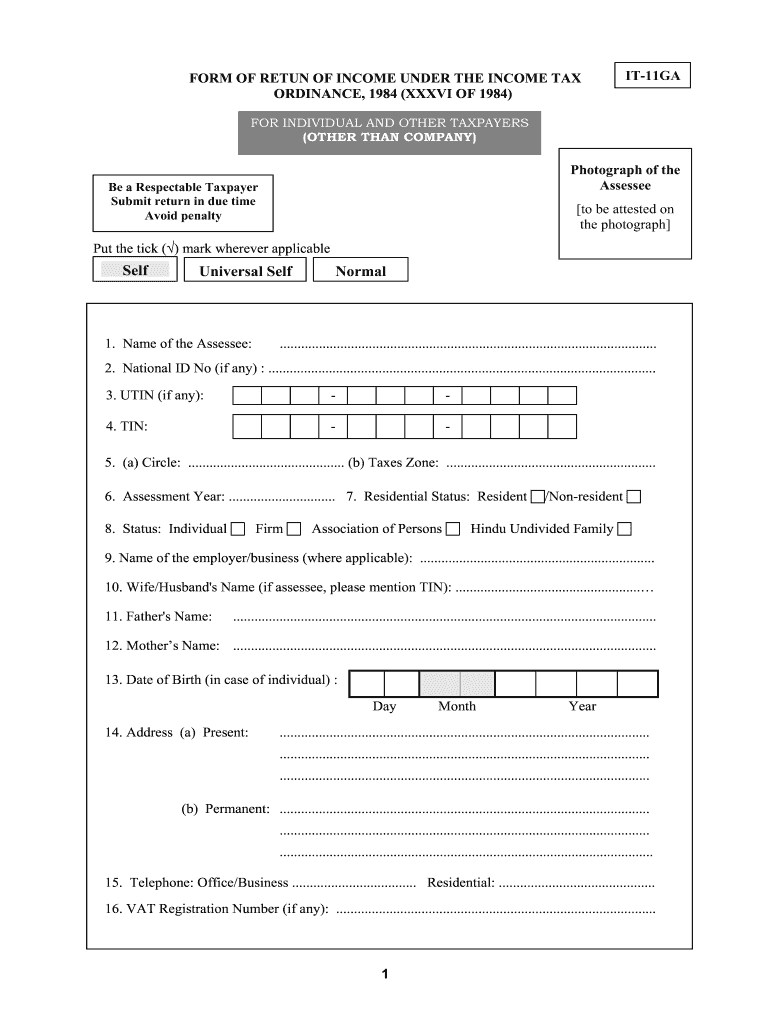

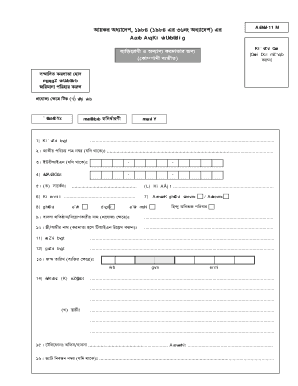

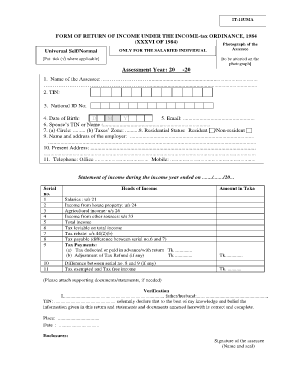

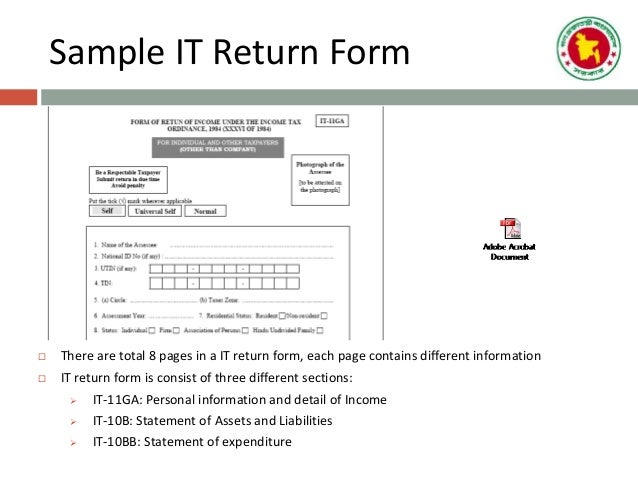

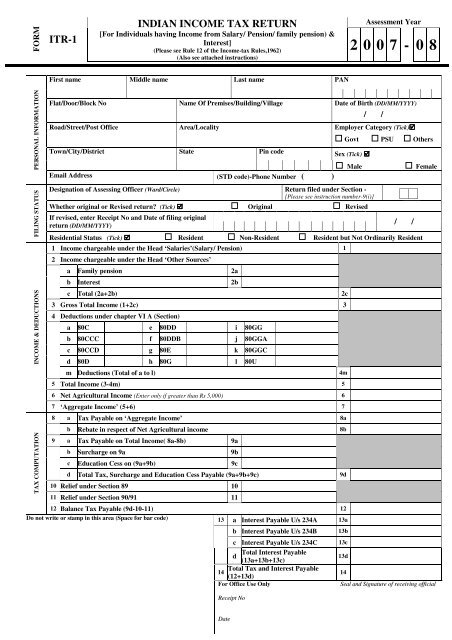

How to submit income tax return in bangladesh. And by that time you will have to update your employment property and income tax data through a form. The website is the government s attempt to create a friendly and automated tax environment for the citizens and other stakeholders in calculating and submitting tax returns. Other than company return it 11ga company returns it 11gha. The first thing a person filing tax returns needs to knowis if his or her margin of income falls within a certain tax bracket.

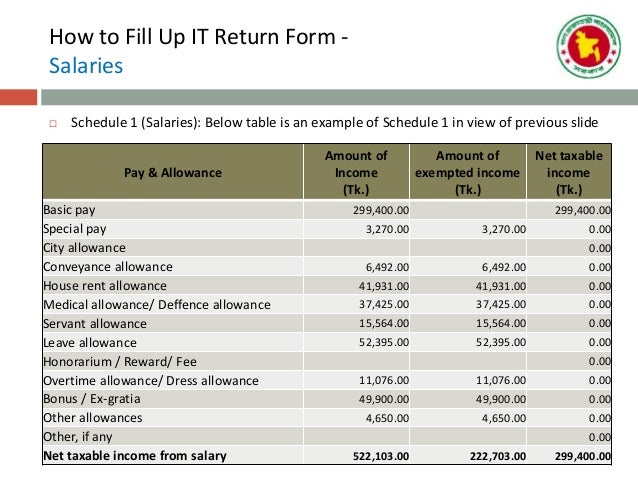

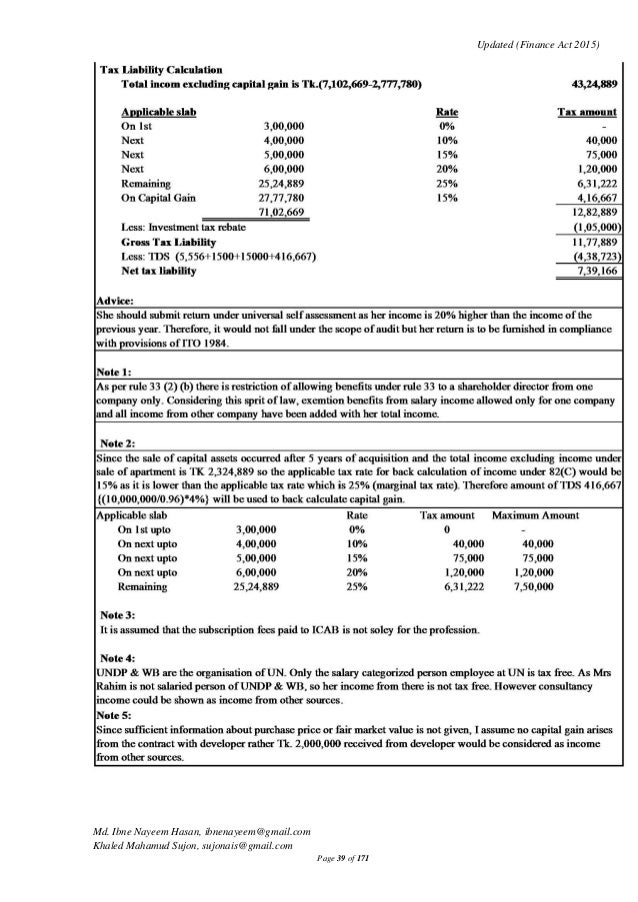

In bangladesh tax is paid in different ways like advance income tax tax deducted at source tds and tax payment during the submission of return under section 74 of ito 1984. People under income tax coverage. The income tax return is something that people are required to submit each year by november 30. Introduction about income tax online filing system.

Income tax is imposed on the basis of ability to pay. You can submit your income tax online easily in bangladesh. It is a progressive tax system. E filing website is the official portal of the income tax department national board of revenue bangladesh.

For the salaried person whose only income is salary can file the return in the form of it 11 uma with the supporting of salary certificate tin tds documents and bank statements. The income tax return itr filing deadline for the financial year 2019 20 has been extended to november 30 2020 from july 31 2020 as announced in a press conference on may 13 2020. According to the current income tax act there are seven categories of incomes that are taxable in bangladesh. Advance tax is payable through treasury challan or pay order.

The more a taxpayer earns the more he should pay is the basic principle of charging income tax. The due date for all income tax return for the financial year 2019 20 will be extended from july 31 and october 31 to november 30 2020. Tax file return submit bangladesh the system displays online account registration application and taxpayer saves application form to his computer by clicking save image from top bar then choose a folder to save file after that taxpayer can open the saved file anytime to print it and fill it up to submit. In bangladesh income tax is.

Any non resident bangladeshi may file his return of income along with bank draft equivalent to the tax liability to the nearest bangladesh mission and the mission will issue a receipt of such return with official seal and send the return to the national board of revenue nbr. You can submit the following tax applications as well as attach all related documents.