How To Submit Income Tax Return Fbr

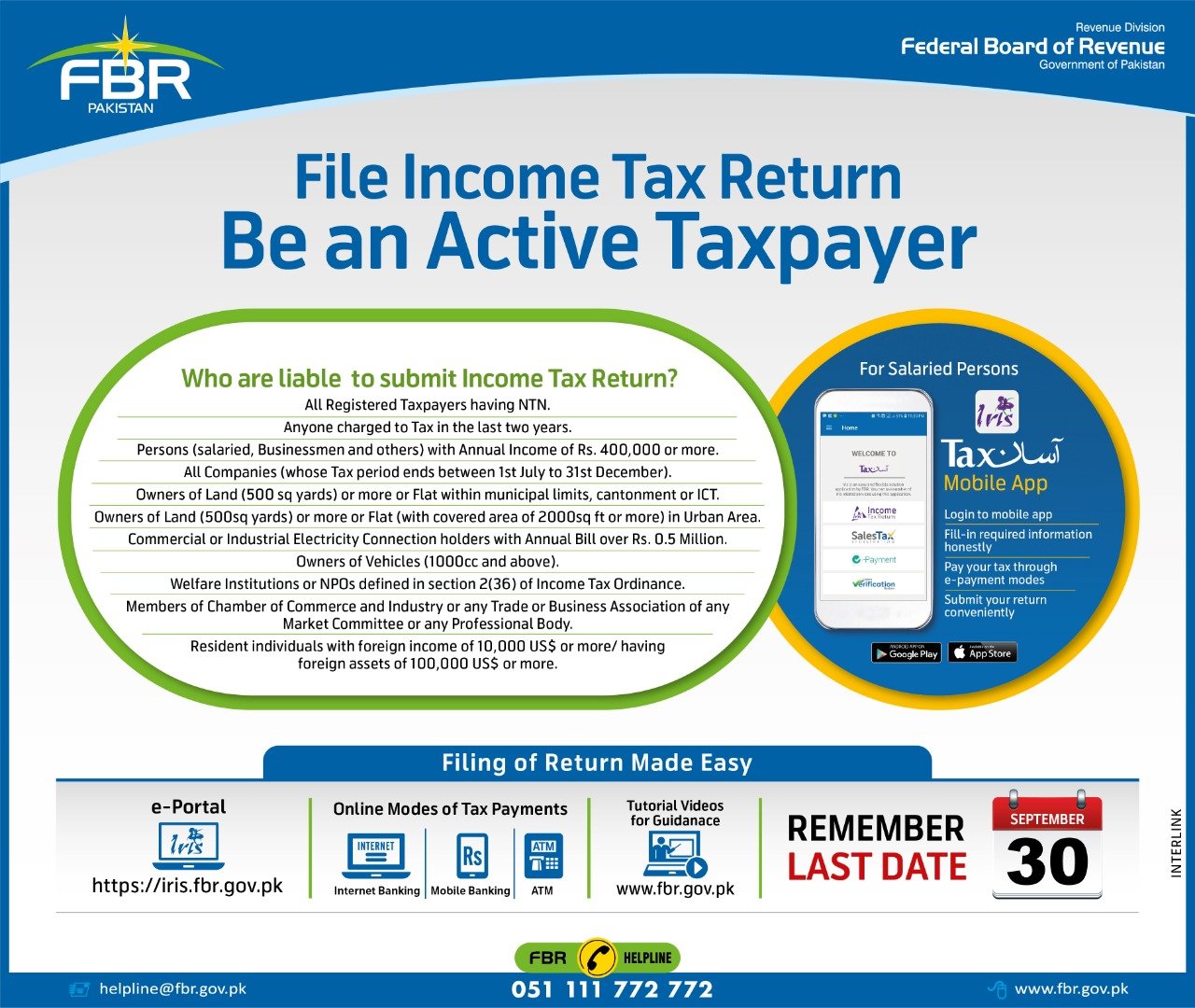

For filing your income tax return the first step is to register yourself with the federal board of revenue fbr.

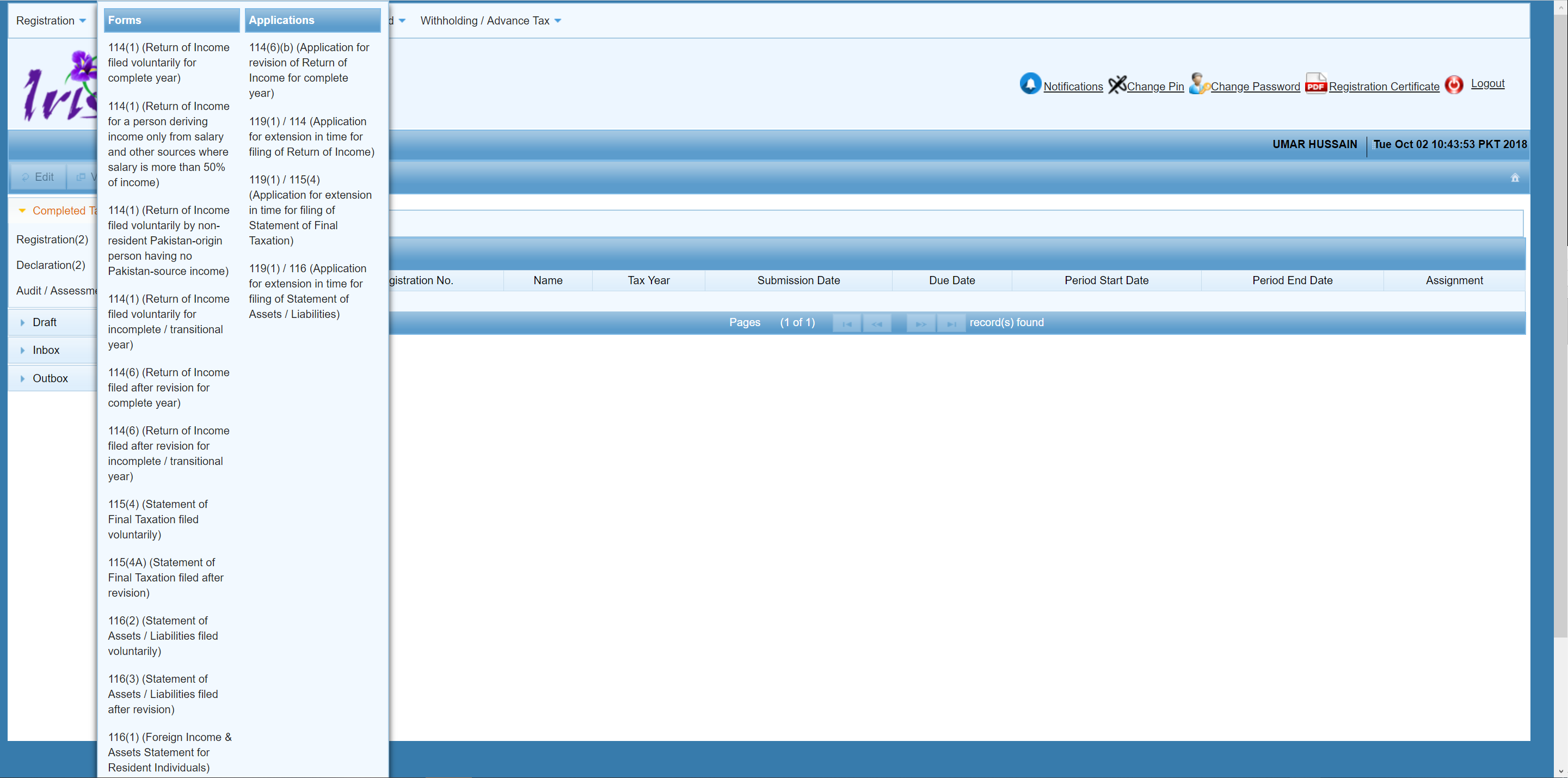

How to submit income tax return fbr. If you can feel any problem then contact me and i will make you filer in rs. 0308 4121499 for help and further details. To facilitate taxpayers fbr has introduced a simplified wizard based income tax return filing mechanism as a new feature of tax asaan mobile application. After registration you can log into iris and file your income tax return.

This video shows how to submit fbr income tax returns in pakistan. Iris is online portal where income tax return is filed. Print income tax return you may print your income tax return form by clicking on the print button at any stage. First step to file income tax return if your income is more than rs 400 000 and you have decided to submit the return you first have to register with fbr.

Once you are satisfied with your provided details you can now file your income tax return by clicking on the submit button on the top left corner of the page. This video shows the complete procedure to file and submit forms 116 2 and 114 1 for salaries person in pakistan. If you are a first time income tax filer registration will be required before you can file your income tax return. For registration with fbr you may visit the following address and state your particulars correct.

The fbr has taken a number of steps to facilitate taxpayers to facilitate the submission of income tax returns. File online income tax return by logging into iris. How to get ntn number and fbr filer registration. Taxpayers can submit annual returns with guidance through the new wizard based simple web interface.

Persons who are deriving income only from salary and other sources where salary is more than 50 of income can avail this form. 1000 only please contact us. For income tax registration an individual can register online through iris. You may also have to attach the following scanned documents.

A new simple return form for tax year 2020 has been introduced. Now final you can submit all the forms then fill it completely and get your ntn number after making filer in fbr for income tax returns easily.