How To Submit Income Tax Form 10e

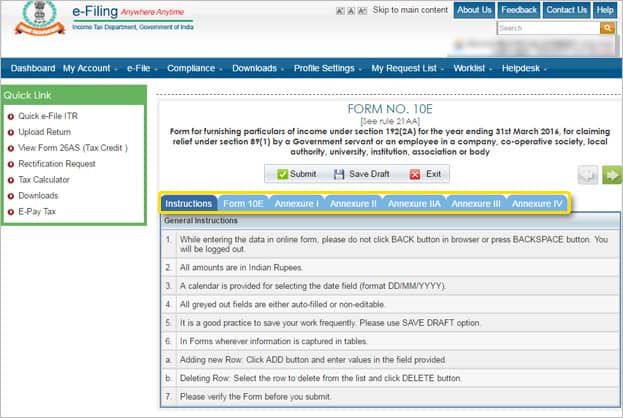

Once you fill up your name pan and other details the instructions to fill form 10e will be displayed on the screen.

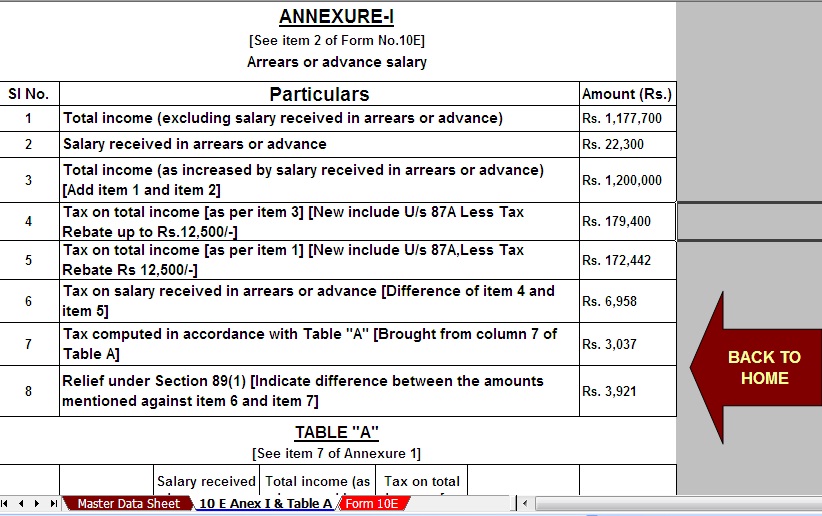

How to submit income tax form 10e. You did not have any income in the preceding year. Select form 10e from it. For claiming relief on arrears under section 89 1 about fillable forms compiled by us. The persons who has received any salary arrears in the financial year 2011 12 and want to save income tax while claiming relief under section 89 1.

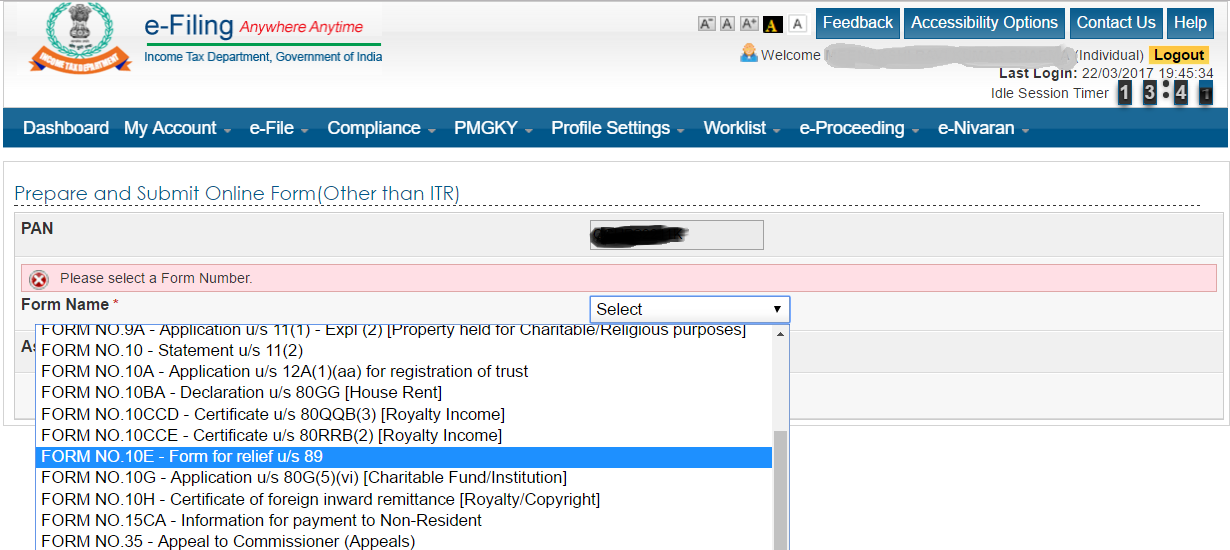

This is actually a kind of a lacuna because of mistakes can be made in the returns then mistakes can b. Step 6 income tax form 10e. You have only employment income and your employer is participating in the auto inclusion scheme ais and will e submit your employment income details to iras. How to file form 10e.

Unlike the income tax return you cannot revise a form that has been filed. Income tax form 10e in excel fillable pdf for furnishing particulars of income under section 192 2a for the year ending 31st march. You can e file your tax return via mytax portal from 1 mar 2020 to 18 apr 2020 extended to 31 may 2020 new. As income tax returns forms are already ready to upload salary returns in form itr 1 sahaj form.

Submitting the form to your employer is not mandatory but submitting it to the income tax department is. Name and address of the employee 2. Click on the submit icon once all the relevant details have been filled and completed appropriately. If the whole process cannot be completed at one go the user may choose to save the information already filled by clicking on the save draft icon at the bottom of the page and may continue to complete the same at their own time.

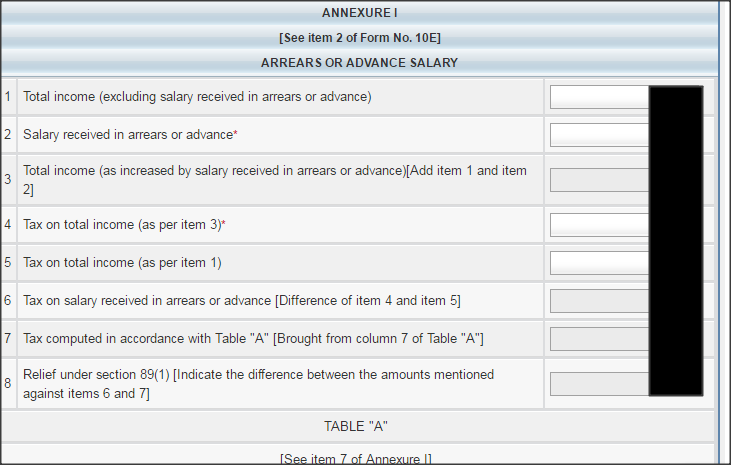

Your employer might ask you to furnish form 10e to calculate the appropriate tds on your salary. Those who missed to file form 10e were not allowed the relief while processing their tax returns and might get the notice for non filing of form 10e. Form 10e can be filed online. 10e see rule 21aa form for furnishing particulars of income under section 192 2a for the year ending 31st march for claiming relief under section 89 1 by a government servant or an employee in a company co operative society local authority university institution association or body 1.

The relief u s 89 has not been allowed in your case as the online form 10e has not been filed by you. You need to enter the assessment year the year in which the arrears on salary or pension were received. A drop down list will appear on the screen. The furnishing of online form 10e is required as per sec 89 of the income tax act.

Now select the option of income tax forms. You should therefore submit form 10e to claim tax relief available under section 89 1. From ay 2015 16 fy 2014 15 the income tax department has made it mandatory for the person claiming the relief u s 89 to file an online form 10e on the tax department s e filing website.