How To Submit Income Tax Challan Online

The online system is used to make the payment of tds challan at the convenience of the taxpayers.

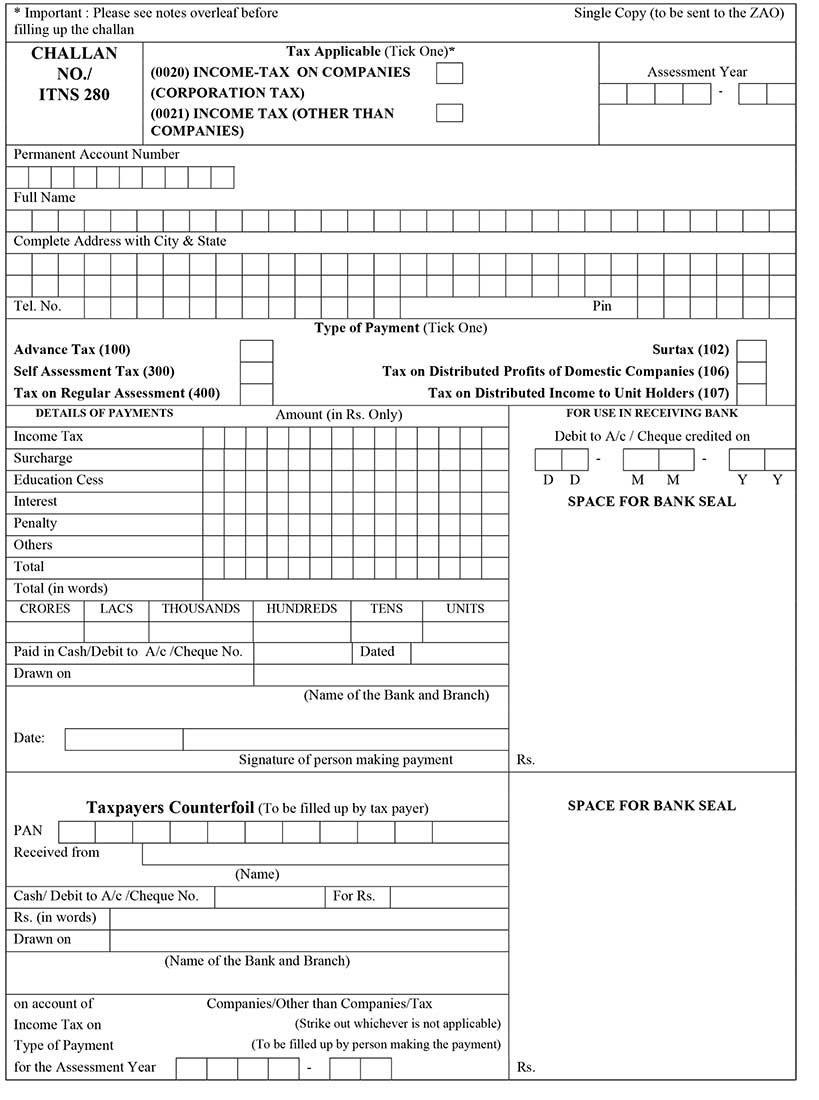

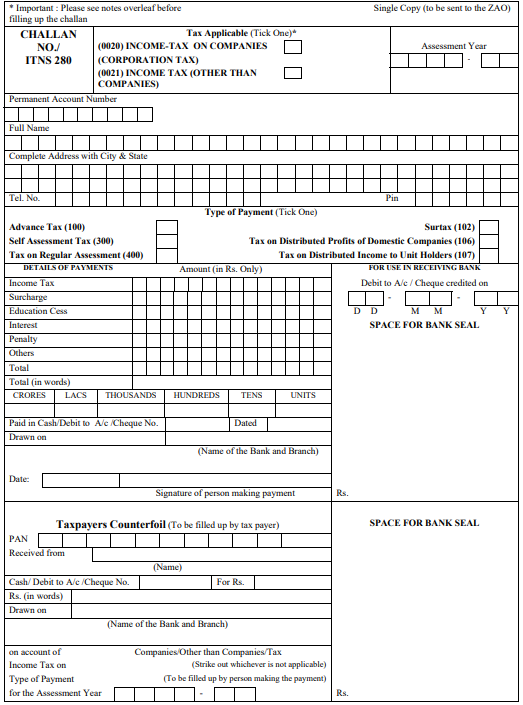

How to submit income tax challan online. Requirements for online tax payment. Visit the bank branch and ask for the applicable tax payment challan form in this case challan 280. Access to net banking or debit card payment to pay the tax you should have the online payment facility it can be either internet banking or debit card payment. Fill in the details as required in the form.

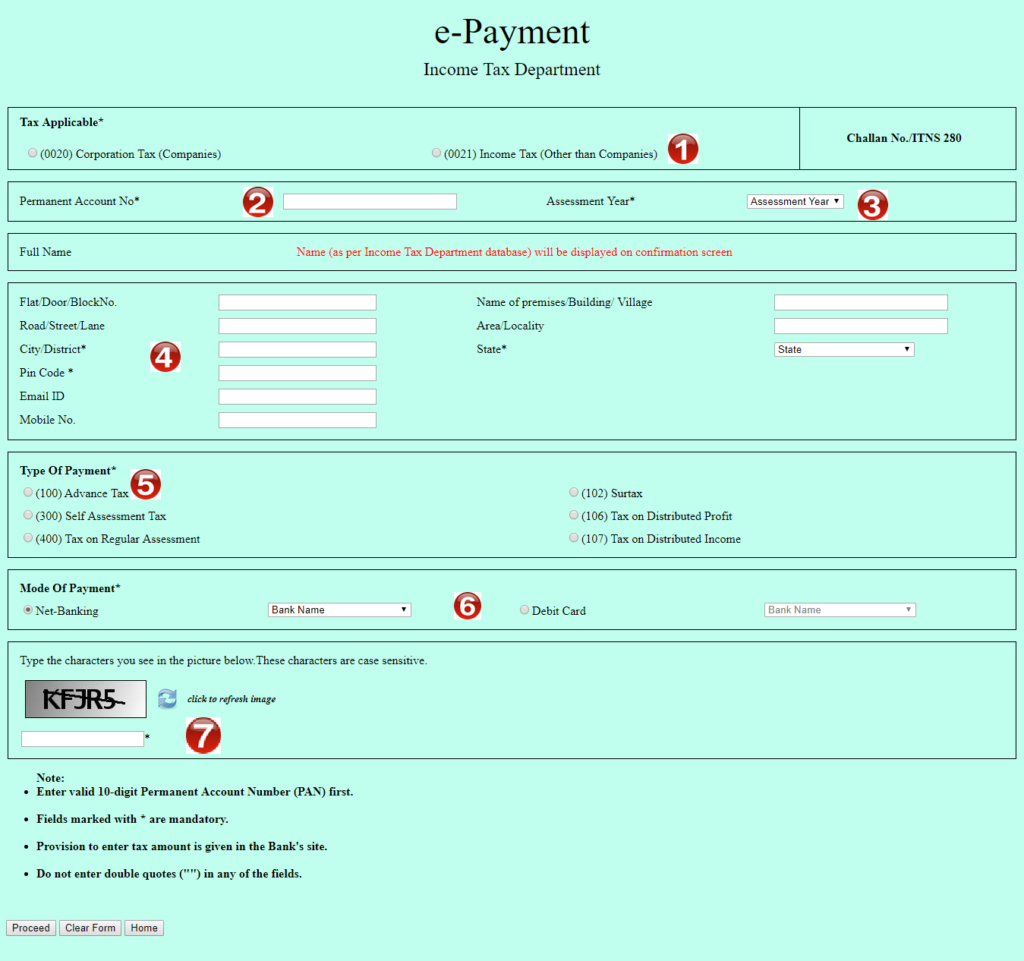

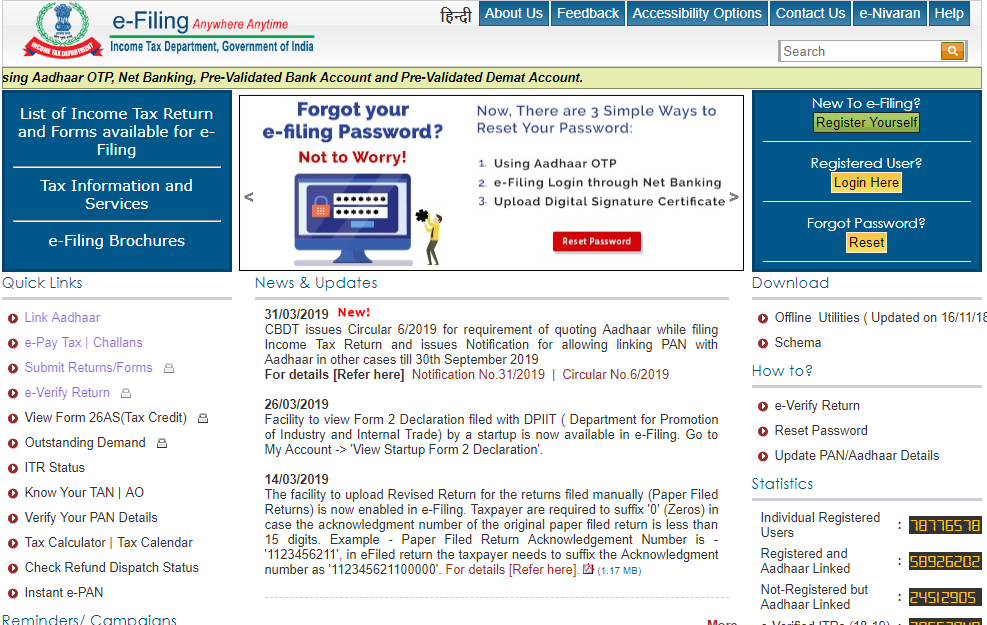

Log on to the online sbi website and click on e taxes on the top panel. Go to the income tax e filing portal www incometaxindiaefiling gov in login to e filing portal by entering user id pan password captcha code and click login. Itns 280 is used for. Click on direct taxes from the drop down or on the next page.

Enter the relevant data directly online at e filing portal and submit it. Pan your permanent account numberpayable tax you must know the tax amount which you have to pay note you must have the data of the tax and cess seprately. If you are unable to make tax payments online then you have the option to pay offline by visiting your bank branch. Https bit ly 2uctguu ph03417763776 hmkashif2010 technicalinformationportal follow me on other social accounts for regular updates.

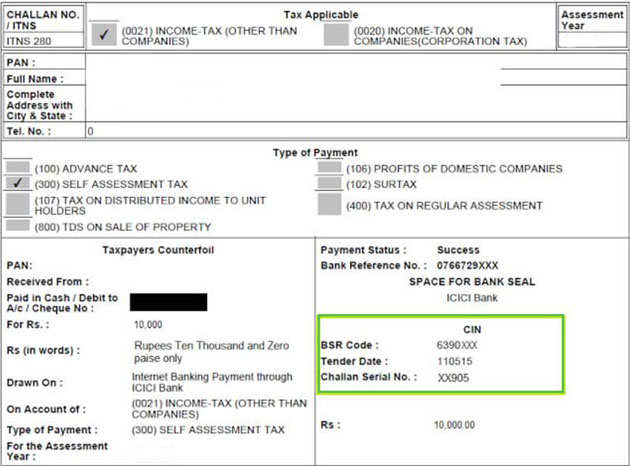

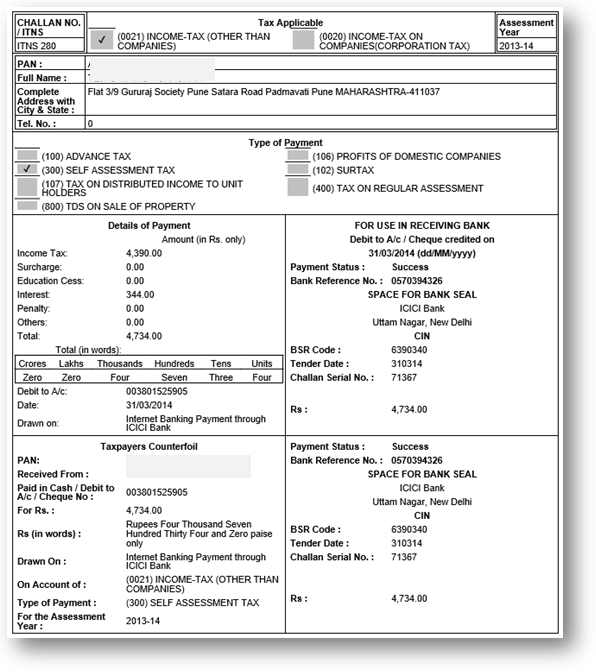

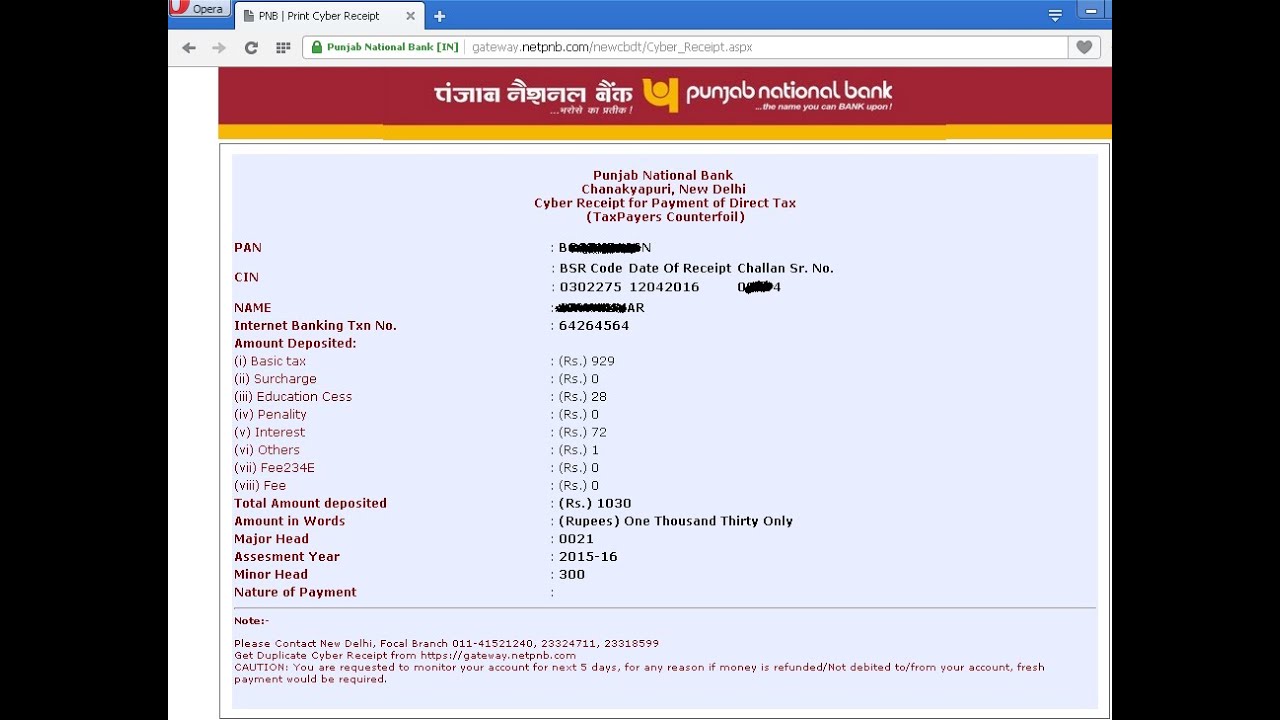

You can pay the tax by sitting anywhere on this earth. If you have paid self assessment tax through challan 280 fill in the details in tax paid and make sure that your tax liability is zero before submitting the return. Follow the steps below to make your payment offline. Advantages of pay income tax online in india using challan 280.

Provide proper link of e payment. Once you pay income tax online in india using challan 280 you have to show it in your itr. Taxpayer can file itr 1 and itr 4 online. The taxpayer can deposit income tax offline at designated branches of banks by filling up challan 280 or online through income tax department e filing website.

You will be asked to open a new browser window to enter. To know how to successfully submit challan 281 at the ease of your office or home read below the complete process.