How To Calculate Balancing Charge Lhdn

This guidelines is to determine the timing for calculation of balancing charge bc and balancing allowance ba for non current asset which is classified as hfs under mfrs 5.

How to calculate balancing charge lhdn. First of all you need to know what is considered income by lembaga hasil dalam negeri lhdn. Ba is tax deductible whereas bc is taxable income. Balancing charge 106 000 balancing charge is restricted to 96 000 total capital allowances have been allowed rm 68 000 28 000 96 000 computation of chargeable income adjusted income current year loss rm160 000 nil add. When a fixed asset is sold or written off you need to calculate balancing allowance ba or balancing charge bc if capital allowance has been claimed for the asset previously.

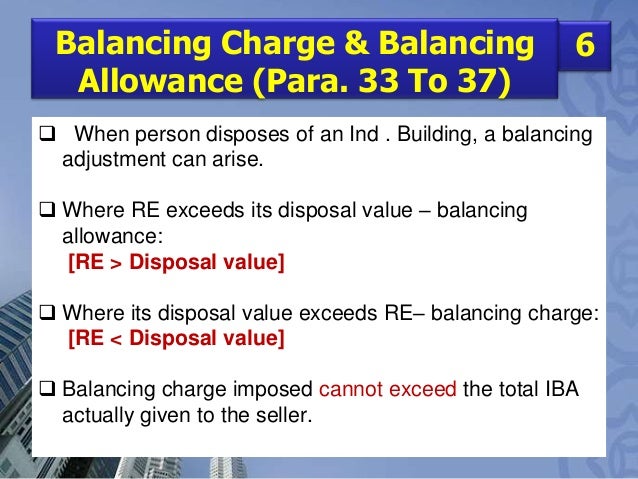

According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Example of a balancing charge. Understanding tax rates and chargeable income. 3 7 balancing charge is the excess that arises where the sale price of a plant machinery or industrial building which is purchased constructed and used in for the purposes of the business exceeds the residual expenditure of that asset.

However the amount of the balancing charge should not exceed the total capital allowances allowed. When a fixed asset is sold or written off you need to calculate balancing allowance ba or balancing charge bc if capital allowance has been claimed for the asset previously. Ba is tax deductible whereas bc is taxable income. The tax written down value is the amount you bought the item for minus any capital allowances you claimed.

This guidelines is effective from ya2013 in line with the changes in certain provisions of schedule 3 of ita 1967 announced during budget 2013. Transferring fixed assets to related companies section 24 election. Here are the income tax rates for personal income tax in malaysia for ya 2019. With effect from the year 2015 an individual who earns an annual employment income of rm34 000 after epf deduction has to register a tax file.

6 2015 date of publication.