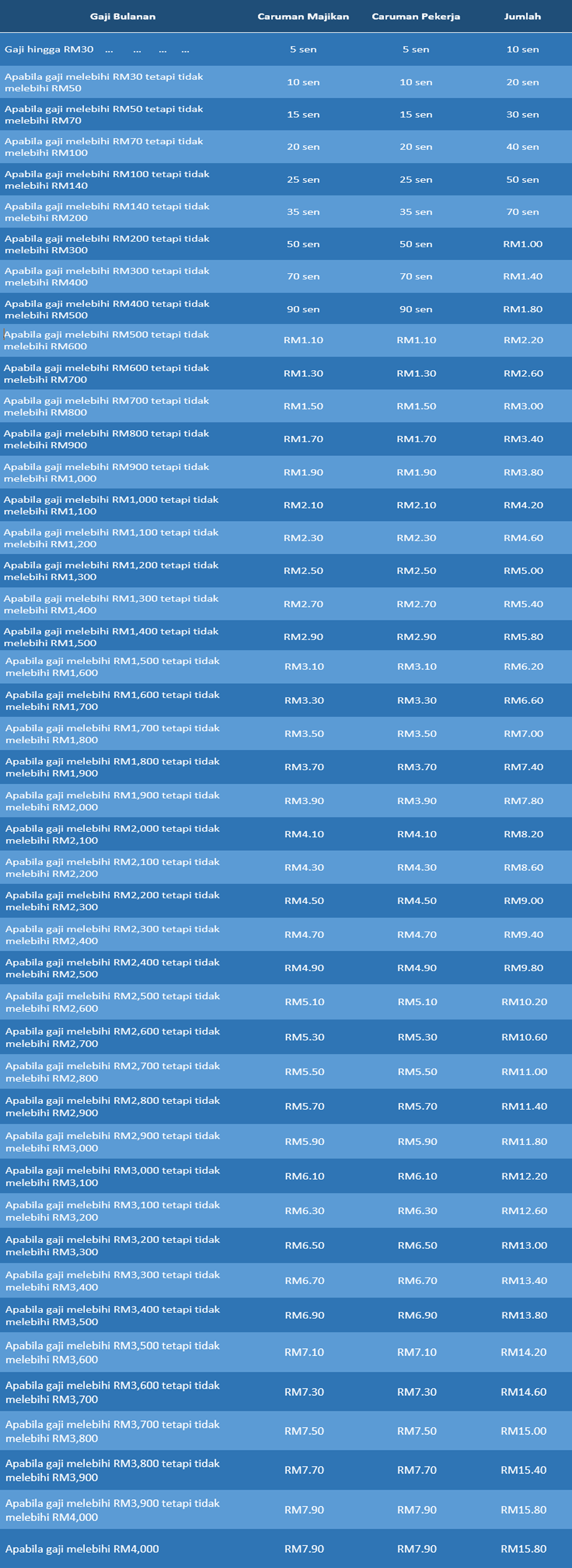

Eis Contribution Rate Table 2018

Both employers and employees are required to contribution 0 2 of their monthly wages.

Eis contribution rate table 2018. Government employees domestic workers and the self employed are exempt. Contribution rates are set out in the second schedule and subject to the rules in section 18 of the employment insurance system act 2017. The contribution rate for eis is 0 2 of the employee s salary employer share and 0 2 of the employee s salary employee share. You may refer to the contribution table below for more information.

The contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f. Relief is available at the taxpayer s marginal rate of income tax for charitable donations via the gift aid and payroll giving schemes and for charitable gifts of quoted shares and securities and real property. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

Kajian ilo tabung bantuan kehilangan pekerjaan tbkp. Januari 2018 yab pm mengumumkan peruntukan tambahan rm 70 juta untuk bayaran bantuan interim 2018 5. Looking at the table above why is my eis contribution not exactly 0 2 of my wages salary gaji. Employer are required to manage and submit eis contributions to socso.

For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Insurance system registration and contribution regulations 2017 hereinafter referred to as the regulations including its application contribution rates and registration rules as well as payment of contribution. 22 09 1997 onwards 10 enhanced rate 12 a establishment paying contribution 8 33 to 10 b establishment paying contribution 10 to 12. 4 the budget in full tax rates 2018 19.

Employers in the private sector are required to pay monthly contributions on behalf of each employee. The table of contribution rate can be refer here. Eis will start to implement from 1st january 2018. The maximum eligible monthly salary is capped at rm 4 000.

The eis is intended to assist those employees who have lost their employment. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. Acknowlegdement contribution received pengesahan terimaan caruman 21 kaedah pembayaran caruman. Therefore the amount reflected on your payslip will not be exactly 0 2 percent of your salary wages gaji.