Eis Contribution Rate Malaysia

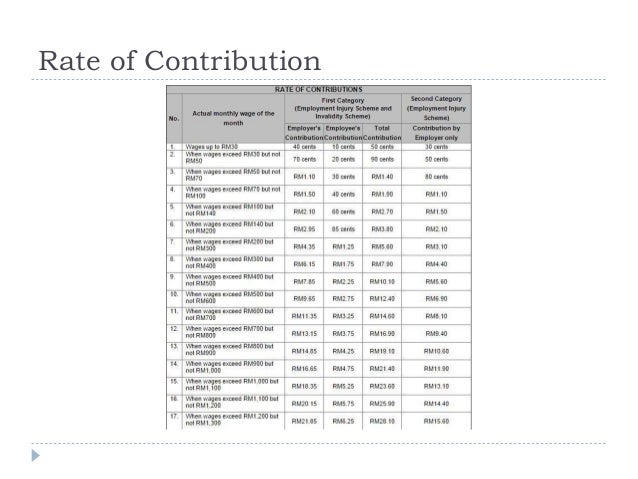

Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the third schedule of the epf act 1991 instead of using the exact percentage calculation except for salaries that are more than rm20 000 00.

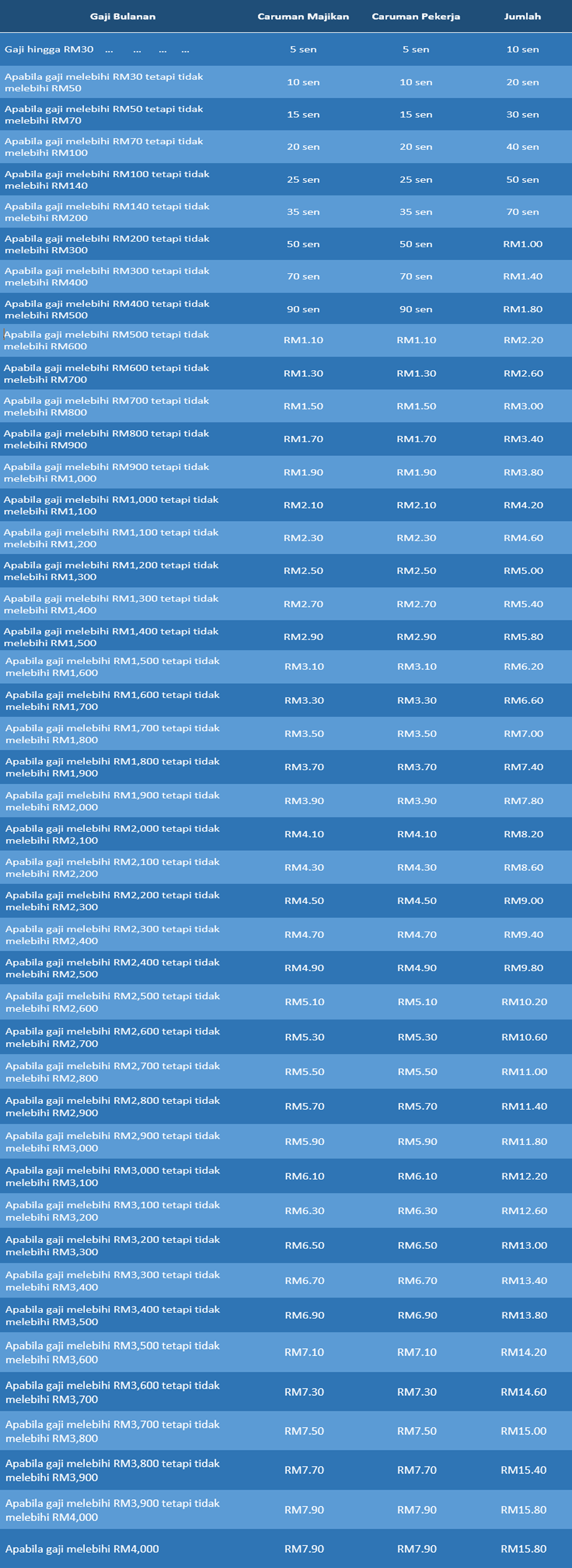

Eis contribution rate malaysia. Contribution rates are capped at insured salary of rm4000 00. Monthly eis deduction as seen in a malaysian employee s payslip. His eis contribution would be capped at a salary of rm4000. The contribution rate for eis is 0 2 of the employee s salary employer share and 0 2 of the employee s salary employee share.

However employees aged 57 and above who have no prior contributions before the age of 57 are exempted. The contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. The contribution rates stated in this table are not applicable to non malaysians registered as epf members before 1 august 1998. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent.

So even if you re earning more than rm4 000 a month the contribution from you and your employer is fixed at 0 4 of rm4 000 leading to the maximum amount of contribution capped at rm15 80 per month. Both the employer and employee make monthly contributions of 0 2 of employee s wage but restricted to a maximum of myr 7 90 for employer and employee respectively. Every month employees need to make a 0 2 contribution of their salary to eis. Here s how it works.

The maximum eligible monthly salary is capped at rm 4 000. The eis covers only malaysian citizens and permanent residents. On the other hand the maximum eligible monthly salary contribution is capped at rm4 000. Is there eis capping.

Yusri earns rm7000 per month. On top of 0 2 contribution from employees employers must also make another 0 2 contribution for their each of their employees into the accumulated fund managed by socso which is also known as perkeso pertubuhan keselamatan sosial in its malay abbreviation. This means the actual eis contribution amount is capped at rm7 90 from employers and rm7 90 from employees. Both your employer and yourself would contribute 0 2 of your salary to the scheme total 0 4 monthly.

The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. You may refer to the contribution table below for more information. Eis contributions are capped at a salary or gaji of rm4000 each month.