Cara Kira Income Tax Individu

Ini yang dinyatakan dalam seksyen 127 akta cukai pendapatan 1967.

Cara kira income tax individu. 5 000 pertama 15 000 berikutnya. Setiap individu dan perniagaan yang memenuhi syarat perlu menyerahkan borang taksiran secara atas talian menerusi sistem e filing kepada lhdn. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. It may go to your income tax report as an income or may go to the company income tax report as an expense.

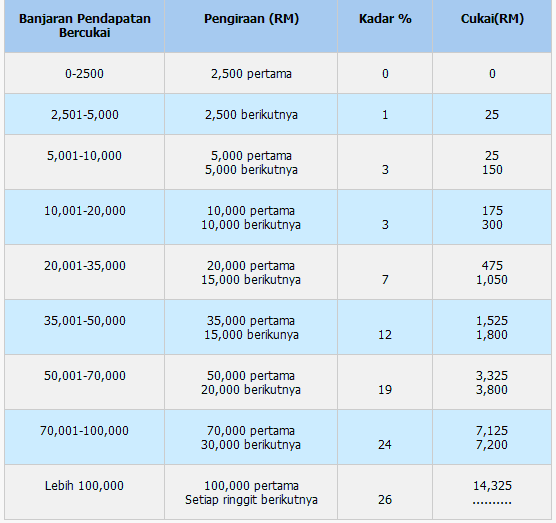

Kadar cukai pendapatan individu 2020 bagi tahun taksiran 2019. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Paling sesuai menggunakan ie. Berikut adalah kadar cukai bagi individu yang bermastautin di malaysia untuk tahun taksiran 2019 sepertimana dinyatakan oleh lembaga hasil dalam negeri lhdn malaysia.

Pengiraan rm kadar cukai rm 0 5 000. About simple pcb calculator pcb calculator made easy. Calculation of yearly income tax for 2019. Kadar cukai tahun 2018 2019 berubah berbanding kadar cukai bagi tahun taksiran 2017.

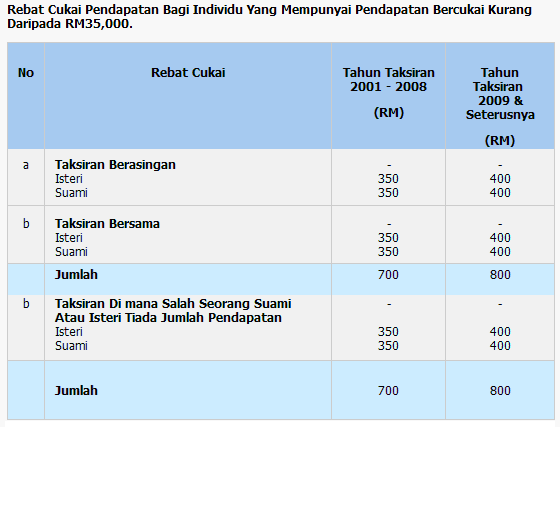

Any exemption from any previous tax or from any provision of a repealed law shall if it was made under a repealed law and was effective on 31 december 1967 be deemed to have been made by an order under section 127 in relation to tax imposed by this act or in relation to the corresponding provision of this act as. The acronym is popularly known for monthly tax deduction among many malaysians. However an extra 20 is levied on people who do not have a tax number npwp on top of progressive income tax rates mentioned above. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

Deductions for an individual are rp 2 880 000 wife 2 880 000 and up to three children rp 1 440 000. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. Pcb stands for potongan cukai bulanan in malaysia national language.