Calculation Of Salary For Incomplete Month Of Work Malaysia

Calculate your pay for an incomplete month of work.

Calculation of salary for incomplete month of work malaysia. Salary calculation for incomplete month. For calculating salary a month or complete month refers to any one of the months in the calendar year. Under the minimum wages order 2016 effective 1 july 2016 the minimum wage is rm1 000 a month peninsular malaysia and rm920 a month east malaysia and labuan. When an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly.

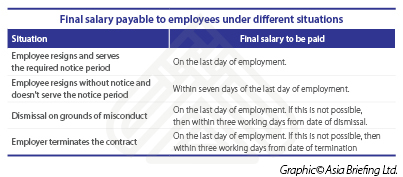

Payment must be made within 14 days after the last day of the salary period. If you are a monthly rated full time employee use this calculator to calculate your salary for an incomplete month of work. To calculate unpaid leave. Find the number of working days in the current month.

What are the required statutory deductions from an employee s salary. I am a permanent staff due to my unforseen circumstances i only work for about 10 to 12 days per month so my salary will be count like. If monthly salary is rm 5 000 with a yearly bonus of rm 5 000 then for an employee who is not married the combined tax for both salary and bonus is rm 650. However the method of this method remains the same in hiring workers.

This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax. There are salary definition several types of pay salary calculator malaysia periods such as pay for the end month bonus month mid month advance and other pay in payroll system. For monthly paid is it. Use this figure to calculate how much the employee is paid daily monthly salary working days in month.

How an incomplete month pay is calculated. This calculator is for months worked in 2019 and 2020. The overtime calculator rate payable for non workmen is capped at the salary level of myr1250 00 and have work of 44 hours a week for overtime calculator for payroll software malaysia work your employer must pay you at least 1 5 times the hourly basic rate of pay. Basic 26 12 days working or basic 30 12 days working which formula is the right one.

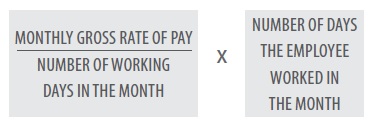

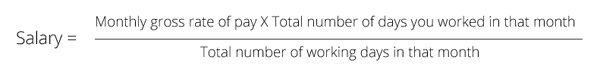

Salary for an incomplete month of work is calculated as follows. Download the table of working days per month for 2019 and 2020. The salary of a monthly rated employee is apportioned base on the number of days in the respective calendar month. And how about daily paid.