Base Lending Rate Malaysia December 2019

This page keep track on the changed and movement of base rate for each bank in malaysia since it become effective on jan 2 2015 with latest update on 15 july 2020.

Base lending rate malaysia december 2019. Latest bank lending fixed deposit interest rates. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period. The effective lending rate for a 30 year loan of rm350 000 with no lock in period is br 0 75. Bank lending rate in malaysia remained unchanged at 3 64 percent in september from 3 64 percent in august of 2020.

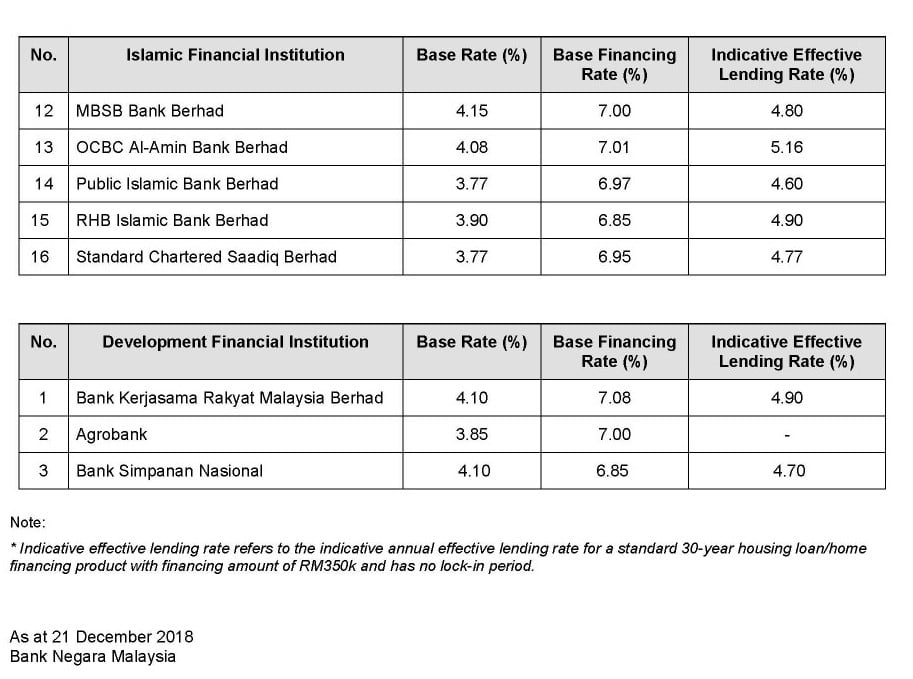

Opr reduced 0 25 on 7 may 2019. Base rates blr and indicative effective lending rates of financial institutions as at 6 august 2020 release date. Latest blr base rate fixed deposit interest rates from every bank in malaysia. From the record it shows that the highest blr malaysia ever has is 12 27 in year 1998 and the lowest blr is 5 55 in year 2009.

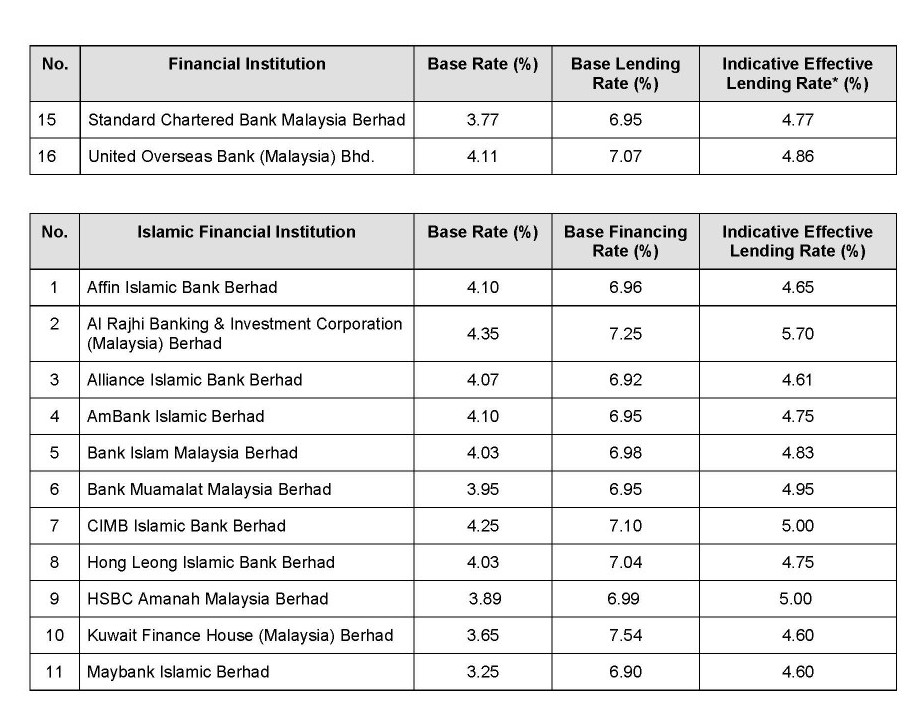

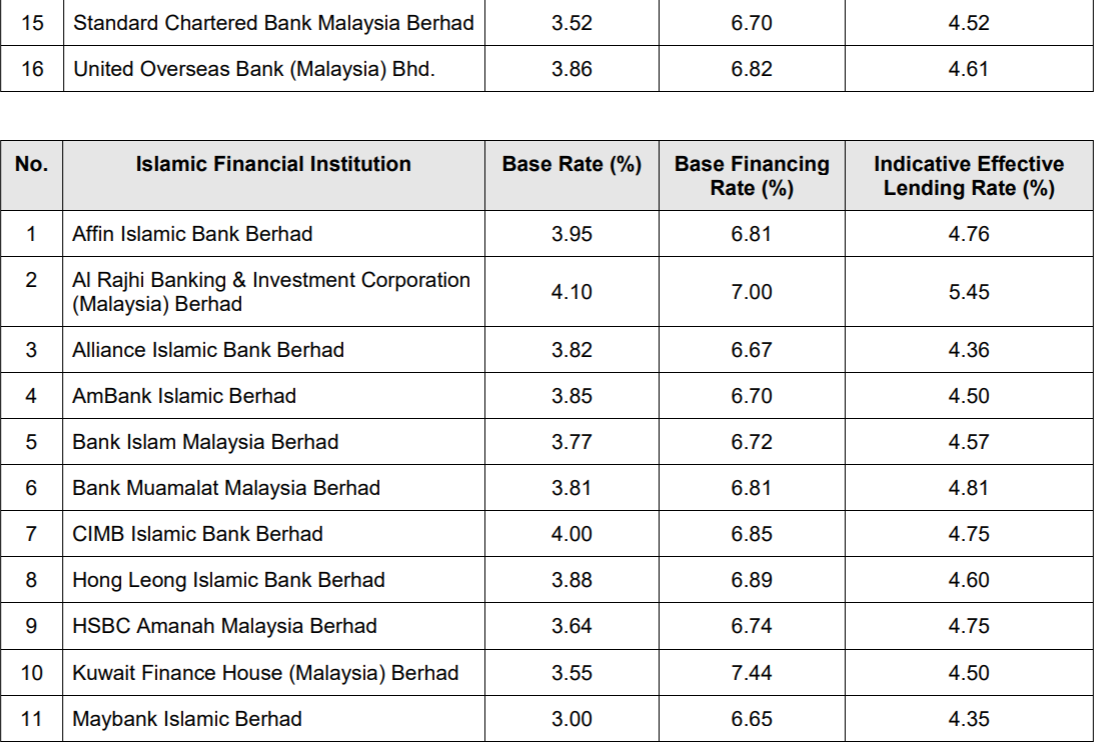

3 86 with effect from 15 05 2019 for illustration purpose. Bank lending rate in malaysia averaged 6 28 percent from 1996 until 2020 reaching an all time high of 13 53 percent in may of 1998 and a record low of 3 64 percent in august of 2020. As malaysia s central bank bank negara malaysia promotes monetary stability and financial stability conducive to the sustainable growth of the malaysian economy. The latest base rate br base lending rate blr and base financing rate bfr as at 21 december 2018 by bank negara malaysia.

Base lending rate blr. In january 2015 the base lending rate blr structure was replaced with a new base rate br system. Hey if you haven t noticed base rate br base lending rate blr and base financing rate bfr have increased. This page provides malaysia bank lending rate actual values historical data forecast chart.

You might want to know.